Mastering form RI 7004 is a crucial step for individuals and businesses looking to navigate the complexities of the Rhode Island tax system. The RI 7004 form is used to request an automatic six-month extension of time to file the Rhode Island business tax return, and it's essential to understand the process to avoid penalties and fines. In this article, we'll break down the process into five easy steps, providing you with a comprehensive guide to mastering form RI 7004.

Understanding the Importance of Form RI 7004

Before we dive into the steps, it's essential to understand the significance of form RI 7004. The Rhode Island Division of Taxation requires businesses to file their tax returns by a specific deadline. However, in some cases, businesses may need more time to gather necessary documents or resolve complex tax issues. That's where form RI 7004 comes in – it allows businesses to request an automatic six-month extension of time to file their tax return.

Benefits of Filing Form RI 7004

Filing form RI 7004 provides several benefits, including:

- Avoiding penalties and fines for late filing

- Giving businesses more time to gather necessary documents and resolve complex tax issues

- Reducing stress and anxiety associated with meeting tight deadlines

- Allowing businesses to focus on core operations rather than rushing to meet tax deadlines

Step 1: Determine Eligibility and Requirements

To file form RI 7004, businesses must meet specific eligibility requirements. These requirements include:

- The business must be a Rhode Island-based entity, such as a corporation, partnership, or sole proprietorship.

- The business must have a valid Rhode Island tax ID number.

- The business must be filing a Rhode Island business tax return.

In addition to these eligibility requirements, businesses must also meet specific filing requirements, including:

- Filing the form electronically or by mail.

- Paying any estimated taxes due by the original deadline.

- Attaching supporting documentation, such as a copy of the federal extension (Form 7004).

Supporting Documentation

Businesses must attach supporting documentation to their form RI 7004, including:

- A copy of the federal extension (Form 7004).

- A statement explaining the reason for the extension request.

- Any additional documentation required by the Rhode Island Division of Taxation.

Step 2: Gather Necessary Documents and Information

To file form RI 7004, businesses must gather necessary documents and information, including:

- Business tax ID number.

- Federal tax ID number.

- Business name and address.

- Tax year and period.

- Estimated tax liability.

- Supporting documentation (e.g., federal extension, financial statements).

Estimated Tax Liability

Businesses must estimate their tax liability for the tax year. This can be done by:

- Reviewing financial statements.

- Consulting with a tax professional.

- Using tax estimation software.

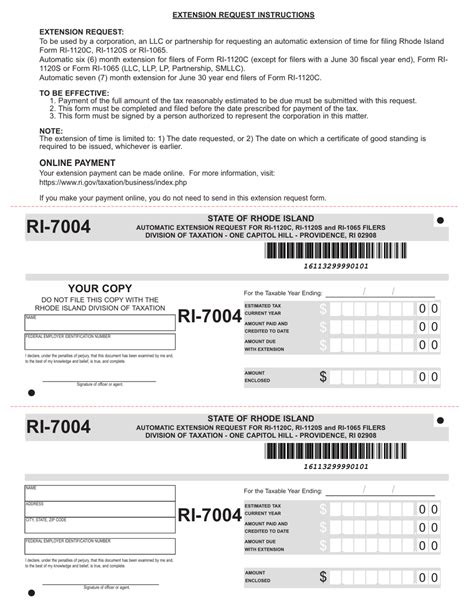

Step 3: Complete and File Form RI 7004

Once businesses have gathered necessary documents and information, they can complete and file form RI 7004. The form must be filed electronically or by mail, and businesses must pay any estimated taxes due by the original deadline.

Filing Options

Businesses can file form RI 7004 electronically or by mail. Electronic filing is recommended, as it provides faster processing and reduces the risk of errors.

Step 4: Pay Estimated Taxes and Interest

Businesses must pay estimated taxes and interest by the original deadline to avoid penalties and fines. Estimated taxes can be paid online, by phone, or by mail.

Interest and Penalties

Businesses may be subject to interest and penalties if they fail to pay estimated taxes or file form RI 7004 by the deadline. Interest and penalties can be avoided by:

- Filing form RI 7004 on time.

- Paying estimated taxes by the original deadline.

- Seeking assistance from a tax professional.

Step 5: Follow Up and File the Tax Return

After filing form RI 7004, businesses must follow up and file their tax return by the extended deadline. The tax return must be filed electronically or by mail, and businesses must pay any remaining taxes due.

Final Reminders

Businesses must:

- File their tax return by the extended deadline.

- Pay any remaining taxes due.

- Keep accurate records and supporting documentation.

By following these five easy steps, businesses can master form RI 7004 and avoid penalties and fines associated with late filing. Remember to determine eligibility and requirements, gather necessary documents and information, complete and file form RI 7004, pay estimated taxes and interest, and follow up and file the tax return.

We hope this article has provided you with a comprehensive guide to mastering form RI 7004. If you have any questions or concerns, please don't hesitate to reach out. Share your thoughts and experiences in the comments section below.

What is form RI 7004?

+Form RI 7004 is a request for an automatic six-month extension of time to file the Rhode Island business tax return.

Who is eligible to file form RI 7004?

+Rhode Island-based businesses, including corporations, partnerships, and sole proprietorships, are eligible to file form RI 7004.

What is the deadline for filing form RI 7004?

+The deadline for filing form RI 7004 is the same as the original deadline for filing the Rhode Island business tax return.