When filing tax returns or submitting various forms to the Internal Revenue Service (IRS), accuracy is crucial to avoid delays or even penalties. One of the often-overlooked yet critical pieces of information is the return address. In this article, we will delve into the specifics of IRS Form 3531, focusing on the correct return address information and its importance.

Why is Return Address Information Important?

Providing the correct return address on any IRS form, including Form 3531, is essential for several reasons. Firstly, it ensures that any correspondence or notifications from the IRS regarding your submission are sent to the right address. This includes any additional information requests or approval notices. Secondly, accurate return address information helps in maintaining the integrity of the tax filing process, reducing the likelihood of identity theft or misdirected mail.

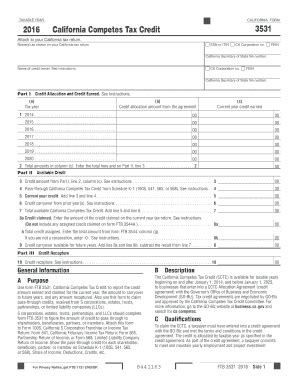

What is IRS Form 3531?

IRS Form 3531 is not a commonly discussed form, as it's mainly used by tax practitioners and not individual taxpayers. It's utilized for tax-related purposes that require a more detailed level of reporting than standard tax forms. Understanding the specifics of this form and its requirements is crucial for those who need to use it.

Correct Return Address Information for IRS Form 3531

When filling out IRS Form 3531, the return address section should be completed with precision. Here are the steps to ensure your return address information is correct:

-

Use Your Current Address: The address you provide should be where you currently reside or where your business is located, depending on the nature of the form's submission.

-

Complete All Fields: Ensure that you fill in all the required address fields, including street address, apartment or suite number, city, state, and ZIP code.

-

Use a Clear and Legible Handwriting: If you're filling out the form manually, use a pen with dark ink and write clearly. Avoid abbreviations unless they are commonly recognized by the IRS.

-

Double-Check for Accuracy: Before submitting the form, review the return address section to ensure there are no errors. A single mistake can lead to your form being returned or delayed.

Common Mistakes to Avoid

While filling out the return address on IRS Form 3531, there are several common mistakes to be aware of and avoid:

-

Incorrect ZIP Code: Double-check the ZIP code for your address. An incorrect ZIP code can significantly delay the processing of your form.

-

Missing Apartment or Suite Number: If your address includes an apartment or suite number, do not omit it. This can lead to your mail being undeliverable.

-

Using an Old Address: Ensure that the address you provide is current. Using an old address can lead to missed correspondence from the IRS.

Best Practices for Filing IRS Form 3531

When filing IRS Form 3531, consider the following best practices to ensure a smooth process:

-

Consult IRS Guidelines: Before filling out the form, consult the IRS guidelines and instructions. This will help you understand what information is required and how to accurately complete the form.

-

Use the Latest Version of the Form: Always use the most current version of IRS Form 3531. You can find the latest versions on the IRS website.

-

Seek Professional Help: If you're unsure about any aspect of the form, consider seeking help from a tax professional. They can guide you through the process and ensure accuracy.

Conclusion and Call to Action

Providing the correct return address information on IRS Form 3531 is vital for efficient and accurate processing of your submission. By understanding the importance of this information and following the steps outlined above, you can avoid common pitfalls and ensure that your form is processed without delay. If you have any specific questions about IRS Form 3531 or need further clarification on any aspect of the tax filing process, please leave a comment below or share this article with others who may find it useful.

Why is it important to provide the correct return address on IRS Form 3531?

+Providing the correct return address ensures that any correspondence from the IRS regarding your submission is sent to the right address, reducing the likelihood of delays or misdirected mail.

What are some common mistakes to avoid when filling out the return address on IRS Form 3531?

+Common mistakes include using an incorrect ZIP code, omitting the apartment or suite number, and providing an old or outdated address.

Where can I find the latest version of IRS Form 3531?

+The latest versions of IRS forms, including Form 3531, can be found on the official IRS website.