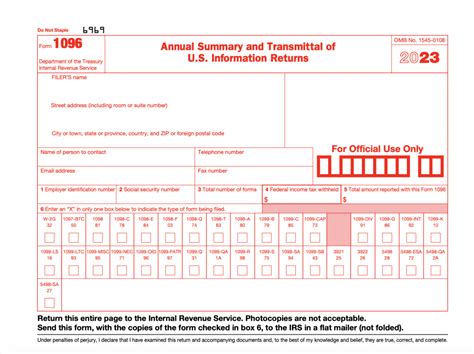

As the tax season approaches, many businesses and individuals are scrambling to complete their tax forms, including the often-overlooked Form 1096. This form is used to summarize information returns, such as 1099s, that are filed with the IRS. While it may seem daunting, filling out Form 1096 can be a straightforward process with the right guidance. In this article, we'll explore five easy ways to fill out Form 1096 in Word.

Why is Form 1096 Important?

Before we dive into the nitty-gritty of filling out Form 1096, let's quickly discuss why this form is so important. Form 1096 is used to transmit information returns, such as 1099-MISC, 1099-INT, and 1099-DIV, to the IRS. These forms report various types of income, such as freelance work, interest, and dividends, that are required to be reported to the IRS.

Who Needs to File Form 1096?

If you're a business or individual who needs to file information returns with the IRS, you'll need to complete Form 1096. This includes:

- Businesses that pay freelance workers or independent contractors

- Financial institutions that pay interest or dividends

- Businesses that pay rents or royalties

- Individuals who receive income from these sources

5 Easy Ways to Fill Out Form 1096 in Word

Now that we've covered the basics, let's move on to the five easy ways to fill out Form 1096 in Word.

1. Use the IRS Website

The IRS provides a fillable Form 1096 on their website. You can download the form and fill it out electronically using Word. Simply visit the IRS website, search for Form 1096, and click on the "Fillable Form" link.

2. Use a Template

Microsoft Word offers a range of templates that can help you create a Form 1096. To access these templates, open Word and click on the "File" tab. Then, click on "New" and search for "Form 1096."

3. Create Your Own Form

If you're comfortable creating your own forms in Word, you can create a Form 1096 from scratch. Simply open a new document and set up the form with the required fields, including the payer's name, address, and TIN, as well as the type of return and the number of returns.

4. Use a Third-Party Software

There are several third-party software programs available that can help you create and file Form 1096. These programs often include templates and guides to ensure you're filling out the form correctly.

5. Consult with a Tax Professional

If you're unsure about how to fill out Form 1096 or need guidance on specific tax-related issues, consider consulting with a tax professional. They can provide personalized advice and help you ensure you're meeting all the necessary tax requirements.

Tips and Reminders

When filling out Form 1096, be sure to keep the following tips and reminders in mind:

- Use black ink and a font size of 12 points or larger

- Make sure to sign and date the form

- Use a separate form for each type of return (e.g., 1099-MISC, 1099-INT, etc.)

- Keep a copy of the form for your records

Wrapping Up

Filling out Form 1096 can seem like a daunting task, but with the right guidance, it can be a straightforward process. By following these five easy ways to fill out Form 1096 in Word, you'll be well on your way to meeting your tax obligations. Remember to take your time, use the resources available to you, and don't hesitate to seek help if you need it.

What is Form 1096 used for?

+Form 1096 is used to summarize information returns, such as 1099s, that are filed with the IRS.

Who needs to file Form 1096?

+Businesses and individuals who need to file information returns with the IRS, including those who pay freelance workers or independent contractors, financial institutions that pay interest or dividends, and businesses that pay rents or royalties.

How do I file Form 1096?

+You can file Form 1096 electronically or by mail. If you're filing electronically, you'll need to use the IRS's Electronic Federal Tax Payment System (EFTPS). If you're filing by mail, you'll need to send the form to the IRS address listed on the form.