Are you ready to streamline your business operations and reduce administrative burdens? One crucial step towards achieving this goal is understanding how to file Form 3115 with ease. Form 3115, also known as Application for Change in Accounting Method, is a critical document that allows businesses to make changes to their accounting methods. In this article, we will guide you through the step-by-step process of filing Form 3115, ensuring a smooth and hassle-free experience.

The Importance of Accurate Accounting Methods

Accurate accounting methods are essential for any business, as they provide a clear picture of the company's financial health. However, as businesses evolve, their accounting methods may need to change to reflect new circumstances. This is where Form 3115 comes in – allowing businesses to make necessary changes to their accounting methods, ensuring compliance with tax laws and regulations.

Understanding the Benefits of Filing Form 3115

Filing Form 3115 offers numerous benefits, including:

- Reduced administrative burdens

- Improved financial reporting

- Enhanced compliance with tax laws and regulations

- Increased accuracy in financial statements

Who Needs to File Form 3115?

Businesses that need to make changes to their accounting methods must file Form 3115. This includes:

- Businesses that are changing their accounting method for the first time

- Businesses that are changing their accounting method due to a change in business operations

- Businesses that are changing their accounting method to comply with tax laws and regulations

Step-By-Step Instructions for Filing Form 3115

Step 1: Determine the Type of Change

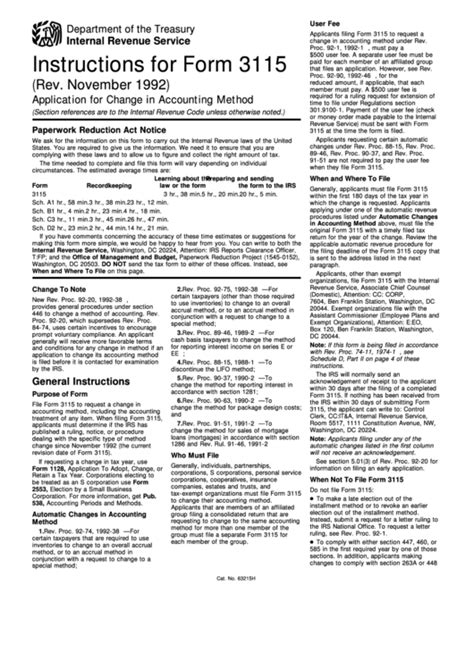

The first step in filing Form 3115 is to determine the type of change you need to make. This includes:

- Automatic changes: These are changes that are automatically approved by the IRS, such as changes to the accounting method for depreciation or amortization.

- Non-automatic changes: These are changes that require IRS approval, such as changes to the accounting method for inventory or revenue recognition.

Step 2: Gather Required Documents

Once you have determined the type of change, you need to gather the required documents. These include:

- Form 3115: The application for change in accounting method

- Statement of income: A statement of income that reflects the new accounting method

- Statement of financial position: A statement of financial position that reflects the new accounting method

- Schedule of adjustments: A schedule of adjustments that reflects the changes made to the accounting method

Step 3: Complete Form 3115

The next step is to complete Form 3115. This includes:

- Section 1: Identifying information, such as the business name and taxpayer identification number

- Section 2: Description of the change, including the reason for the change and the effective date

- Section 3: Financial statements, including the statement of income and statement of financial position

- Section 4: Schedule of adjustments, including the adjustments made to the accounting method

Step 4: Attach Supporting Documents

Once you have completed Form 3115, you need to attach supporting documents. These include:

- Financial statements: The financial statements that reflect the new accounting method

- Schedules of adjustments: The schedules of adjustments that reflect the changes made to the accounting method

Step 5: File Form 3115

The final step is to file Form 3115. This can be done electronically or by mail.

Common Mistakes to Avoid When Filing Form 3115

When filing Form 3115, there are several common mistakes to avoid. These include:

- Incomplete or inaccurate information: Make sure to provide complete and accurate information on Form 3115.

- Missing supporting documents: Make sure to attach all required supporting documents.

- Incorrect filing deadline: Make sure to file Form 3115 by the required deadline.

Tips for a Smooth Filing Process

To ensure a smooth filing process, follow these tips:

- Plan ahead: Make sure to plan ahead and allow sufficient time to complete and file Form 3115.

- Seek professional help: Consider seeking professional help from a tax accountant or attorney.

- Review and edit: Review and edit Form 3115 carefully to ensure accuracy and completeness.

Filing Form 3115 can seem daunting, but by following these step-by-step instructions, you can ensure a smooth and hassle-free experience. Remember to plan ahead, seek professional help, and review and edit Form 3115 carefully to ensure accuracy and completeness.

Wrapping Up

Filing Form 3115 is a critical step in ensuring compliance with tax laws and regulations. By understanding the benefits and process of filing Form 3115, businesses can reduce administrative burdens, improve financial reporting, and increase accuracy in financial statements. Follow these step-by-step instructions and tips to ensure a smooth filing process.

What is Form 3115?

+Form 3115 is an application for change in accounting method, which allows businesses to make changes to their accounting methods.

Who needs to file Form 3115?

+Businesses that need to make changes to their accounting methods must file Form 3115.

What is the filing deadline for Form 3115?

+The filing deadline for Form 3115 varies depending on the type of change. Automatic changes are due by the original due date of the tax return, while non-automatic changes are due by the 30th day after the IRS approves the change.