The IRS Form 8944 is a crucial document that plays a significant role in the tax preparation process. As a tax preparer, it's essential to understand the intricacies of this form to ensure accuracy and compliance with the IRS regulations. In this article, we'll delve into the details of the IRS Form 8944, its purpose, and the step-by-step process of completing it.

What is IRS Form 8944?

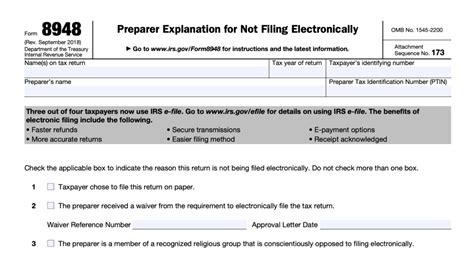

IRS Form 8944, also known as the "Preparer Explanation for Not Filing Electronic Return," is a document that tax preparers use to explain why they cannot file a client's tax return electronically. This form is typically used when a client's tax situation is complex, or there are issues with the client's identification or authorization.

Purpose of IRS Form 8944

The primary purpose of IRS Form 8944 is to provide a valid explanation for not filing a client's tax return electronically. The IRS requires tax preparers to file tax returns electronically, but there may be situations where this is not possible. The form serves as a documentation of the preparer's efforts to file the return electronically and provides an explanation for not doing so.

When to Use IRS Form 8944

Tax preparers should use IRS Form 8944 in the following situations:

- The client's tax return is too complex to be filed electronically.

- The client's identification or authorization is incomplete or incorrect.

- The client's tax return requires additional documentation or attachments that cannot be submitted electronically.

- The client's tax return is being filed under a special program or provision that does not allow electronic filing.

Step-by-Step Process of Completing IRS Form 8944

Completing IRS Form 8944 involves providing detailed information about the client's tax return and the reasons for not filing it electronically. Here's a step-by-step guide to completing the form:

- Client Information: Enter the client's name, address, and taxpayer identification number (TIN) in the designated fields.

- Tax Return Information: Provide the tax return year, type of tax return (e.g., Form 1040, Form 1120), and the reason for not filing the return electronically.

- Preparer Information: Enter the preparer's name, address, and Preparer Tax Identification Number (PTIN).

- Explanation: Provide a detailed explanation for not filing the client's tax return electronically. This should include the specific reasons, such as complexity or missing documentation.

- Certification: Sign and date the form, certifying that the explanation provided is accurate and complete.

Benefits of Using IRS Form 8944

Using IRS Form 8944 provides several benefits, including:

- Avoiding Penalties: Failing to file a client's tax return electronically can result in penalties. Using Form 8944 can help avoid these penalties by providing a valid explanation.

- Documentation: The form serves as documentation of the preparer's efforts to file the return electronically and provides a clear explanation for not doing so.

- Compliance: Using Form 8944 ensures compliance with IRS regulations and demonstrates the preparer's commitment to following procedures.

Common Errors to Avoid

When completing IRS Form 8944, tax preparers should avoid the following common errors:

- Inaccurate Information: Ensure that all information provided on the form is accurate and complete.

- Insufficient Explanation: Provide a detailed and clear explanation for not filing the client's tax return electronically.

- Unsigned or Undated Form: Sign and date the form to certify its accuracy and completeness.

Conclusion

IRS Form 8944 is a vital document that tax preparers use to explain why they cannot file a client's tax return electronically. By following the step-by-step process outlined in this article, tax preparers can ensure accuracy and compliance with IRS regulations. Remember to avoid common errors and provide a clear and detailed explanation for not filing the client's tax return electronically.

Call to Action

If you're a tax preparer looking to improve your knowledge of IRS Form 8944, we encourage you to share your experiences and tips in the comments section below. Additionally, if you have any questions or need further clarification on any of the points discussed in this article, please don't hesitate to ask.

What is the purpose of IRS Form 8944?

+The primary purpose of IRS Form 8944 is to provide a valid explanation for not filing a client's tax return electronically.

When should I use IRS Form 8944?

+You should use IRS Form 8944 when a client's tax return is too complex to be filed electronically, or when there are issues with the client's identification or authorization.

What are the benefits of using IRS Form 8944?

+Using IRS Form 8944 can help avoid penalties, provides documentation of the preparer's efforts to file the return electronically, and ensures compliance with IRS regulations.