For individuals residing in the state of Virginia, understanding and accurately completing the Virginia Form 760PY, also known as the Individual Income Tax Return, is crucial for tax compliance and potential refunds. This comprehensive guide is designed to walk you through the process, highlighting key aspects, benefits, and steps involved in filing this form.

Why is the Virginia Form 760PY Important?

The Virginia Form 760PY is the primary document used by the Virginia Department of Taxation to assess the income tax liabilities of its residents. This form is a critical component of the state's tax system, ensuring that individuals contribute their fair share towards the state's infrastructure and public services. By accurately completing and submitting this form, individuals can avoid penalties and interest charges associated with late or incorrect filings.

Key Components of the Virginia Form 760PY

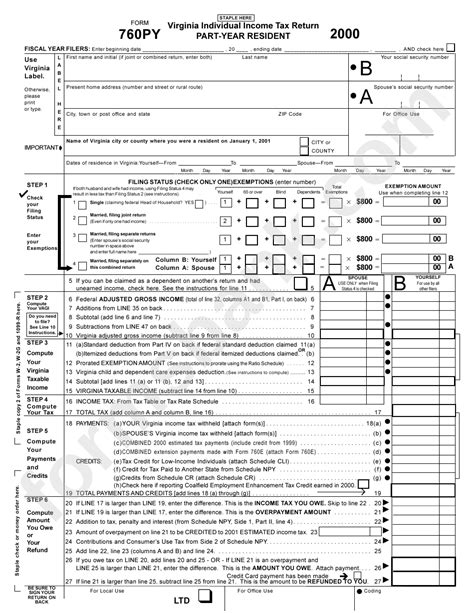

The Virginia Form 760PY is composed of several sections, each designed to capture specific information regarding an individual's income, deductions, and credits. Key components include:

- Personal Information: This section requires basic information such as name, social security number, and address.

- Income: Detailed information about all sources of income, including wages, salaries, interest, dividends, and capital gains.

- Deductions and Credits: This includes standard deductions, itemized deductions, and various tax credits that can reduce tax liability.

How to Complete the Virginia Form 760PY

Completing the Virginia Form 760PY involves several steps:

- Gather Required Documents: Collect all relevant documents, including W-2 forms, 1099 forms, interest statements, and any other paperwork that supports your income and deductions.

- Choose a Filing Status: Determine your filing status, which could be single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Report All Income: Accurately report all sources of income, ensuring you include every dollar earned.

- Calculate Deductions and Credits: Determine whether you qualify for the standard deduction or if itemizing deductions would be more beneficial. Also, identify any tax credits you are eligible for.

- Complete the Return: Fill out the form with the information gathered, ensuring accuracy and completeness.

- Submit the Return: The form can be submitted electronically or by mail, adhering to the specified deadline to avoid penalties.

Benefits of Accurate Completion

Accurately completing the Virginia Form 760PY offers several benefits, including:

- Avoid Penalties and Interest: Submitting an accurate return on time helps avoid unnecessary penalties and interest charges.

- Potential Refund: If you've overpaid your taxes, completing the form accurately can result in a refund.

- Compliance with State Law: Filing the return demonstrates compliance with Virginia's tax laws, avoiding legal complications.

Tips for a Smooth Filing Process

To ensure a smooth filing process:

- Consult Tax Professionals: If you're unsure about any aspect of the form, consider consulting a tax professional.

- Use Tax Preparation Software: Utilize tax preparation software that guides you through the filing process, reducing errors and stress.

- File Electronically: Electronic filing is generally faster and more accurate than paper filing.

Common Mistakes to Avoid

- Inaccurate Information: Ensure all information is accurate and complete to avoid delays or penalties.

- Missing Documents: Always attach required documents, such as W-2s and 1099s.

- Late Submission: Submit the form by the deadline to avoid penalties and interest.

Virginia Form 760PY and Tax Planning

The Virginia Form 760PY plays a crucial role in tax planning. By understanding the tax implications of your income and deductions, you can make informed decisions about your financial strategies. This includes maximizing deductions, optimizing investment income, and planning for tax credits.

Maximizing Deductions

- Itemize Deductions: Consider itemizing deductions if they exceed the standard deduction, potentially reducing your tax liability.

- Charitable Contributions: Donations to charitable organizations can provide tax benefits.

- Home Office Deduction: If you work from home, you may be eligible for a home office deduction.

Conclusion and Next Steps

Completing the Virginia Form 760PY is a critical step in fulfilling your tax obligations as a resident of Virginia. By understanding the importance of this form, accurately completing it, and avoiding common mistakes, you can ensure compliance with state tax laws and potentially claim a refund. Remember, tax planning and professional advice can further optimize your tax situation.

Share Your Thoughts and Experiences

Have you encountered any challenges while filing the Virginia Form 760PY? Share your thoughts and experiences in the comments below. Your insights can help others navigate the process more smoothly.

Additional Resources

For more detailed information and the latest updates on the Virginia Form 760PY, visit the official Virginia Department of Taxation website. Utilize the resources provided to ensure you are well-prepared for the filing process.

What is the deadline for filing the Virginia Form 760PY?

+The deadline for filing the Virginia Form 760PY is typically May 1st of each year. However, if you need an extension, you can file Form 760EXT by the original deadline to receive an automatic six-month extension.

Can I file the Virginia Form 760PY electronically?

+Yes, you can file the Virginia Form 760PY electronically through the Virginia Department of Taxation's website. Electronic filing is generally faster and more accurate than paper filing.

What if I need help completing the Virginia Form 760PY?

+If you need help completing the Virginia Form 760PY, consider consulting a tax professional or using tax preparation software. These resources can guide you through the filing process, reducing errors and stress.