As a U.S. taxpayer with international income, navigating the complex world of foreign tax credits can be overwhelming. The Form 1116 is a crucial document for claiming foreign tax credits, and understanding its intricacies is essential to avoid missing out on potential credits or facing penalties. In this article, we will delve into the world of Form 1116, exploring its purpose, benefits, and providing a step-by-step guide to help you navigate this complex tax landscape.

Understanding the Purpose of Form 1116

The Form 1116, also known as the Foreign Tax Credit (Individual, Estate, or Trust), is a tax form used by individuals, estates, and trusts to claim foreign tax credits. The primary purpose of this form is to allow taxpayers to claim a credit against their U.S. tax liability for taxes paid to a foreign government. This credit helps to prevent double taxation, ensuring that taxpayers are not taxed twice on the same income.

Benefits of Claiming Foreign Tax Credits

Claiming foreign tax credits can provide significant benefits to taxpayers, including:

- Reduced U.S. tax liability: By claiming foreign tax credits, taxpayers can reduce their U.S. tax liability, resulting in a lower tax bill.

- Prevention of double taxation: Foreign tax credits help to prevent double taxation, ensuring that taxpayers are not taxed twice on the same income.

- Increased refund: In some cases, claiming foreign tax credits can result in a refund, especially if the foreign tax credit exceeds the U.S. tax liability.

Step-by-Step Guide to Form 1116

To accurately complete Form 1116, follow these steps:

Step 1: Determine Eligibility

Before completing Form 1116, determine if you are eligible to claim foreign tax credits. You are eligible if:

- You have foreign source income that is subject to U.S. tax

- You have paid foreign taxes on that income

- You have not claimed a deduction for those foreign taxes

Step 2: Gather Required Documents

To complete Form 1116, you will need the following documents:

- Foreign tax return or equivalent document

- Proof of foreign tax payment (e.g., receipt or bank statement)

- W-2 or 1099 forms showing foreign income

- Form 8938, Statement of Specified Foreign Financial Assets (if required)

Step 3: Complete Part I - Foreign Tax Credit

Complete Part I of Form 1116, which includes:

- Line 1: Enter the total foreign tax credit

- Line 2: Enter the foreign tax credit limitation

- Line 3: Enter the net foreign tax credit

Step 4: Complete Part II - Foreign Source Income

Complete Part II of Form 1116, which includes:

- Line 1: Enter the foreign source income

- Line 2: Enter the foreign taxes paid on that income

- Line 3: Enter the foreign tax credit claimed

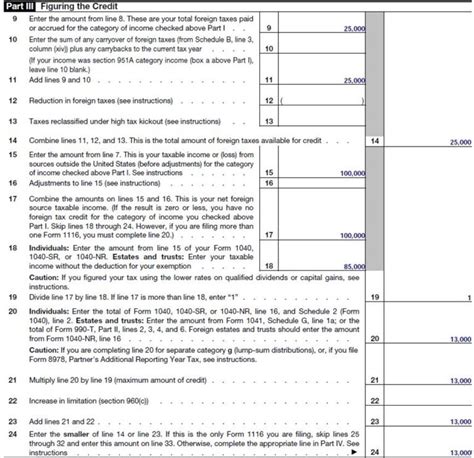

Step 5: Complete Part III - Foreign Tax Credit Limitation

Complete Part III of Form 1116, which includes:

- Line 1: Enter the foreign tax credit limitation

- Line 2: Enter the excess foreign tax credit

Step 6: Complete Part IV - Additional Information

Complete Part IV of Form 1116, which includes:

- Line 1: Enter any additional information or explanations

Step 7: Attach Supporting Documents

Attach all supporting documents, including:

- Foreign tax return or equivalent document

- Proof of foreign tax payment (e.g., receipt or bank statement)

- W-2 or 1099 forms showing foreign income

- Form 8938, Statement of Specified Foreign Financial Assets (if required)

Step 8: Submit Form 1116

Submit Form 1116 with your U.S. tax return (Form 1040).

Common Mistakes to Avoid

To avoid common mistakes, keep the following in mind:

- Ensure accurate reporting of foreign income and taxes paid

- Properly calculate the foreign tax credit limitation

- Attach all supporting documents

- File Form 1116 with your U.S. tax return (Form 1040)

Conclusion

Navigating the complex world of foreign tax credits can be overwhelming, but with this step-by-step guide to Form 1116, you can ensure accurate reporting and claim the credits you deserve. Remember to attach all supporting documents and submit Form 1116 with your U.S. tax return. By following these steps, you can reduce your U.S. tax liability, prevent double taxation, and potentially increase your refund.

Take Action

If you have foreign income and are unsure about claiming foreign tax credits, consult with a tax professional or the IRS to ensure accurate reporting. Share your experiences with claiming foreign tax credits in the comments below.

What is Form 1116?

+Form 1116 is a tax form used by individuals, estates, and trusts to claim foreign tax credits.

Who is eligible to claim foreign tax credits?

+Taxpayers with foreign source income that is subject to U.S. tax, who have paid foreign taxes on that income, and have not claimed a deduction for those foreign taxes.

What documents are required to complete Form 1116?

+Foreign tax return or equivalent document, proof of foreign tax payment, W-2 or 1099 forms showing foreign income, and Form 8938 (if required).