Filing taxes as a multinational corporation can be a daunting task, especially when it comes to reporting foreign tax credits. One of the most critical forms for corporations with foreign-sourced income is Form 1118, Schedule H. In this article, we will provide you with 5 valuable tips for filing Form 1118 Schedule H accurately and efficiently.

Understanding Form 1118 Schedule H

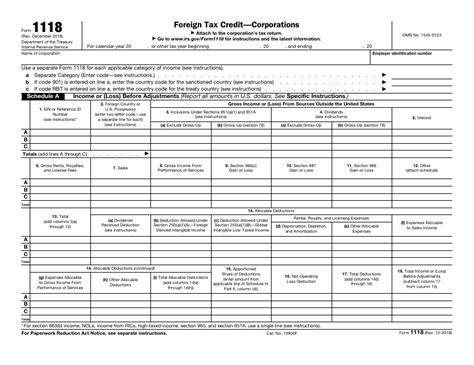

Before we dive into the tips, let's quickly review what Form 1118 Schedule H is all about. Form 1118 is the Foreign Tax Credit (Corporate) form, and Schedule H is specifically used to report the limitation on the foreign tax credit under Section 904. This form is used by corporations that have foreign-sourced income and want to claim a foreign tax credit against their U.S. tax liability.

Tips for Filing Form 1118 Schedule H

Tip 1: Understand the Purpose of Schedule H

Schedule H is used to calculate the limitation on the foreign tax credit under Section 904. This section requires corporations to separate their foreign-sourced income into different baskets, such as passive income, general category income, and income subject to a high tax exception. Understanding the purpose of Schedule H will help you navigate the form more efficiently.

Tip 2: Identify the Correct Baskets

To complete Schedule H, you need to identify the correct baskets for your corporation's foreign-sourced income. The baskets are:

- Passive income

- General category income

- Income subject to a high tax exception

- Income re-sourced by treaty

Identifying the correct baskets is crucial to calculating the limitation on the foreign tax credit.

Tip 3: Calculate the Limitation on the Foreign Tax Credit

Once you have identified the correct baskets, you need to calculate the limitation on the foreign tax credit. This involves calculating the foreign tax credit for each basket and then applying the limitation. The limitation is calculated by multiplying the foreign tax credit by the ratio of the corporation's U.S. tax liability to its total tax liability.

Tip 4: Complete the Schedule H Worksheet

The Schedule H worksheet is a critical component of the form. The worksheet helps you calculate the limitation on the foreign tax credit and ensures that you are applying the correct limitation to each basket. Make sure to complete the worksheet accurately and thoroughly.

Tip 5: Review and Reconcile the Form

Finally, review and reconcile the form to ensure that all the calculations are accurate and complete. This includes reviewing the baskets, the limitation on the foreign tax credit, and the worksheet. Reconciling the form will help you identify any errors or discrepancies and ensure that you are taking advantage of the foreign tax credit.

Common Errors to Avoid

When filing Form 1118 Schedule H, there are several common errors to avoid:

- Incorrectly identifying the baskets

- Failing to calculate the limitation on the foreign tax credit

- Not completing the Schedule H worksheet

- Not reviewing and reconciling the form

Avoiding these common errors will help you ensure that your corporation is taking advantage of the foreign tax credit and avoiding any potential penalties or fines.

Best Practices for Filing Form 1118 Schedule H

To ensure that you are filing Form 1118 Schedule H accurately and efficiently, follow these best practices:

- Consult with a tax professional or accountant who has experience with international taxation

- Review and understand the instructions for the form

- Use tax software or a spreadsheet to help with calculations and completion of the form

- Review and reconcile the form thoroughly before submitting it to the IRS

By following these best practices, you can ensure that your corporation is taking advantage of the foreign tax credit and avoiding any potential penalties or fines.

Conclusion

Filing Form 1118 Schedule H can be a complex and daunting task, but by following these 5 tips and best practices, you can ensure that your corporation is taking advantage of the foreign tax credit and avoiding any potential penalties or fines. Remember to understand the purpose of Schedule H, identify the correct baskets, calculate the limitation on the foreign tax credit, complete the Schedule H worksheet, and review and reconcile the form. By doing so, you can ensure that your corporation is in compliance with the IRS regulations and taking advantage of the foreign tax credit.

We hope this article has been informative and helpful in providing you with valuable tips and best practices for filing Form 1118 Schedule H. If you have any questions or comments, please feel free to share them below.

What is Form 1118 Schedule H used for?

+Form 1118 Schedule H is used to report the limitation on the foreign tax credit under Section 904.

What are the different baskets for foreign-sourced income?

+The baskets are: passive income, general category income, income subject to a high tax exception, and income re-sourced by treaty.

How do I calculate the limitation on the foreign tax credit?

+The limitation on the foreign tax credit is calculated by multiplying the foreign tax credit by the ratio of the corporation's U.S. tax liability to its total tax liability.