The LM-3 form is a crucial document for labor unions, and understanding its intricacies is vital for ensuring compliance with labor laws. In this article, we will delve into the world of LM-3 forms, exploring their significance, purpose, and essential facts that every labor union should know.

What is an LM-3 Form?

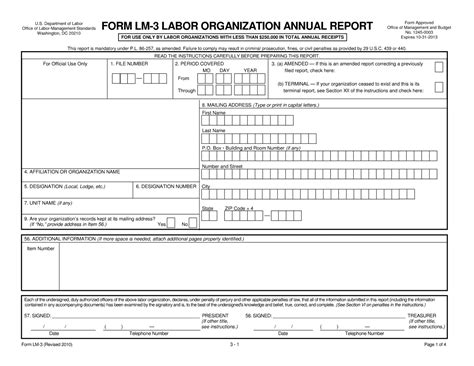

An LM-3 form, also known as the Labor Organization Annual Financial Report, is a document that labor unions with total annual receipts of $250,000 or more must file annually with the U.S. Department of Labor's Office of Labor-Management Standards (OLMS). The form provides a detailed breakdown of the union's financial activities, including income, expenses, and assets.

Why is the LM-3 Form Important?

The LM-3 form serves several purposes, including:

- Promoting transparency and accountability within labor unions

- Ensuring compliance with labor laws and regulations

- Providing valuable information to union members, the public, and regulatory agencies

- Helping to prevent union corruption and embezzlement

Fact #1: Filing Requirements

Labor unions with total annual receipts of $250,000 or more are required to file the LM-3 form annually. The form must be filed electronically through the OLMS Online Public Disclosure Room. Unions that fail to file the LM-3 form on time may be subject to fines and penalties.

Who Must File?

The following labor unions must file the LM-3 form:

- Labor organizations with total annual receipts of $250,000 or more

- Intermediate bodies, such as district councils and conferences of churches

- National or international unions that have affiliated local unions

Fact #2: Financial Disclosure

The LM-3 form requires labor unions to disclose detailed financial information, including:

- Total annual receipts

- Total annual disbursements

- Assets, liabilities, and fund balances

- Investments and transactions with affiliated organizations

What Information Must be Disclosed?

Labor unions must disclose the following financial information on the LM-3 form:

- All receipts, including dues, fees, and investments

- All disbursements, including salaries, benefits, and expenses

- All assets, liabilities, and fund balances

- All investments and transactions with affiliated organizations

Fact #3: Officer and Employee Compensation

The LM-3 form requires labor unions to disclose the compensation of officers and employees, including:

- Salaries and benefits

- Bonuses and other forms of compensation

- Expenses, including travel and entertainment expenses

What Information Must be Disclosed?

Labor unions must disclose the following information about officer and employee compensation:

- The name and title of each officer and employee

- The total compensation received by each officer and employee

- A breakdown of compensation, including salaries, benefits, and expenses

Fact #4: Lobbying and Political Activities

The LM-3 form requires labor unions to disclose information about lobbying and political activities, including:

- Lobbying expenditures

- Political contributions

- Grassroots lobbying expenses

What Information Must be Disclosed?

Labor unions must disclose the following information about lobbying and political activities:

- The total amount spent on lobbying activities

- The total amount contributed to political parties and candidates

- A breakdown of grassroots lobbying expenses

Fact #5: Public Disclosure

The LM-3 form is a public document, and labor unions must make it available to the public upon request. The OLMS also makes the LM-3 form available online through its website.

How Can the Public Access the LM-3 Form?

The public can access the LM-3 form in the following ways:

- By requesting a copy from the labor union

- By accessing the OLMS website and searching for the labor union's LM-3 form

- By visiting the labor union's website, if it has made the LM-3 form available online

As we conclude this article, we encourage labor unions to take the necessary steps to ensure compliance with the LM-3 form filing requirements. By doing so, they can promote transparency and accountability within their organizations and maintain the trust of their members and the public.

We invite you to share your thoughts and experiences with the LM-3 form in the comments section below. Have you had any challenges or successes with filing the LM-3 form? Do you have any questions or concerns about the process? We look forward to hearing from you.

What is the deadline for filing the LM-3 form?

+The deadline for filing the LM-3 form is 90 days after the end of the labor union's fiscal year.

Who is responsible for filing the LM-3 form?

+The labor union's president, treasurer, or other authorized officer is responsible for filing the LM-3 form.

What happens if a labor union fails to file the LM-3 form?

+If a labor union fails to file the LM-3 form, it may be subject to fines and penalties, including civil penalties of up to $10,000.