As the Grand Canyon State, Arizona is known for its stunning natural beauty and outdoor recreational opportunities. However, when it comes to taxes, the state has its own unique set of rules and regulations. If you're a non-resident of Arizona, you may need to file Form 140NR, also known as the Arizona Non-Resident Personal Income Tax Return. Here are five things you should know about Form 140NR Arizona:

Who Needs to File Form 140NR Arizona?

If you're a non-resident of Arizona, you may need to file Form 140NR if you have income from Arizona sources. This can include wages, salaries, tips, and commissions earned while working in Arizona, as well as income from Arizona-based businesses, investments, and rental properties. Even if you don't have a physical presence in Arizona, you may still be required to file Form 140NR if you have income from Arizona sources.

For example, let's say you're a resident of California but work remotely for an Arizona-based company. If you earn income from that job, you may need to file Form 140NR, even if you don't physically live in Arizona.

What is Considered Arizona Source Income?

Arizona source income can include a wide range of income types, including:

- Wages, salaries, tips, and commissions earned while working in Arizona

- Income from Arizona-based businesses, including self-employment income

- Income from Arizona-based investments, such as stocks, bonds, and mutual funds

- Income from Arizona-based rental properties

- Royalty income from Arizona-based intellectual property

It's worth noting that not all income is considered Arizona source income. For example, if you're a resident of another state and have income from a business or investment that's not based in Arizona, you may not need to file Form 140NR.

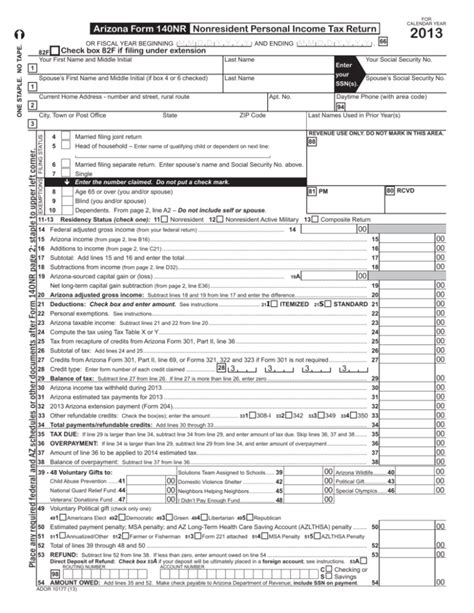

How to File Form 140NR Arizona

To file Form 140NR Arizona, you'll need to gather several pieces of information, including:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your Arizona source income

- Any applicable deductions and credits

- Any other tax-related information, such as your federal income tax return

Once you have all the necessary information, you can file Form 140NR Arizona either electronically or by mail. The Arizona Department of Revenue provides a variety of resources to help you file, including a downloadable version of the form and instructions.

Deadlines and Penalties for Form 140NR Arizona

The deadline for filing Form 140NR Arizona is typically April 15th of each year, although this deadline may be extended if you're serving in the military or have other extenuating circumstances.

If you fail to file Form 140NR Arizona or pay any required taxes, you may be subject to penalties and interest. The Arizona Department of Revenue may also assess additional fees for late filing or payment.

It's worth noting that even if you don't owe taxes, you may still need to file Form 140NR Arizona if you have Arizona source income. Failure to file can result in penalties and interest, even if you don't owe taxes.

Amending a Previously Filed Form 140NR Arizona

If you've already filed Form 140NR Arizona and need to make changes, you can file an amended return using Form 140NR-X. This form is used to correct errors or report changes to your Arizona source income.

To file an amended return, you'll need to gather the necessary information and documentation, including:

- A copy of your original Form 140NR Arizona

- Any additional documentation to support your changes

- A completed Form 140NR-X

Once you have all the necessary information, you can file Form 140NR-X either electronically or by mail.

Tips for Filing Form 140NR Arizona

Filing Form 140NR Arizona can be complex, especially if you're not familiar with Arizona's tax laws. Here are a few tips to help you navigate the process:

- Make sure to gather all the necessary information and documentation before filing.

- Use the Arizona Department of Revenue's resources, including the downloadable version of the form and instructions.

- Consider consulting a tax professional if you're unsure about any aspect of the filing process.

- Keep accurate records of your Arizona source income and any related documentation.

By following these tips and staying informed about Arizona's tax laws, you can ensure a smooth and successful filing process.

If you have any questions or concerns about Form 140NR Arizona, don't hesitate to reach out to the Arizona Department of Revenue or a qualified tax professional.

Who needs to file Form 140NR Arizona?

+If you're a non-resident of Arizona and have income from Arizona sources, you may need to file Form 140NR Arizona.

What is considered Arizona source income?

+Arizona source income can include wages, salaries, tips, and commissions earned while working in Arizona, as well as income from Arizona-based businesses, investments, and rental properties.

How do I file Form 140NR Arizona?

+You can file Form 140NR Arizona either electronically or by mail. The Arizona Department of Revenue provides a variety of resources to help you file.