As a partnership, accurate and timely tax reporting is crucial to avoid penalties and ensure compliance with the IRS. One of the most critical components of partnership tax reporting is Form 1065 Schedule D, which deals with capital gains and losses. In this article, we will delve into the world of Form 1065 Schedule D, exploring its purpose, key components, and step-by-step instructions for accurate reporting.

Understanding Form 1065 Schedule D

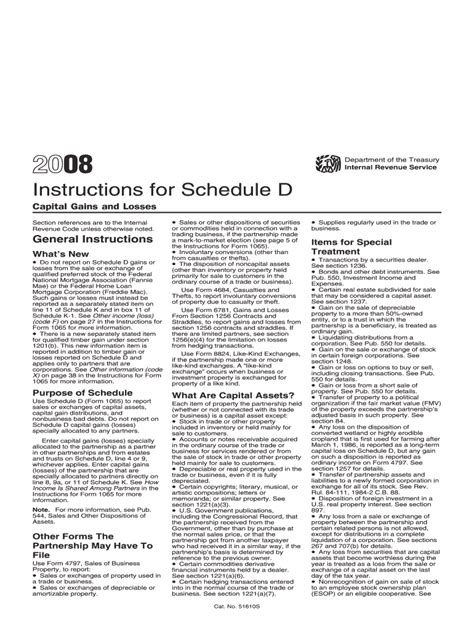

Form 1065 Schedule D is a supporting schedule to Form 1065, the U.S. Return of Partnership Income. It is used to report the partnership's capital gains and losses from the sale or exchange of capital assets. The schedule is divided into two parts: Part I, which reports sales and other dispositions of capital assets, and Part II, which reports gains and losses from partnerships, S corporations, and other entities.

Key Components of Form 1065 Schedule D

To accurately complete Form 1065 Schedule D, it is essential to understand the following key components:

- Capital assets: Capital assets include stocks, bonds, real estate, and other investment properties. They do not include assets used in the partnership's trade or business, such as inventory or equipment.

- Gains and losses: Gains and losses are reported separately for each type of capital asset. Gains are reported on Part I, while losses are reported on Part II.

- Holding period: The holding period determines whether a gain or loss is short-term (held for one year or less) or long-term (held for more than one year).

- Basis: The basis is the partnership's original investment in the capital asset. It is used to calculate gains and losses.

Step-by-Step Instructions for Completing Form 1065 Schedule D

To accurately complete Form 1065 Schedule D, follow these step-by-step instructions:

Step 1: Identify Capital Assets

- Review the partnership's financial records to identify all capital assets sold or exchanged during the tax year.

- Determine the type of capital asset (e.g., stocks, bonds, real estate).

Step 2: Calculate Gains and Losses

- Calculate the gain or loss for each capital asset by subtracting the basis from the sale or exchange price.

- Determine the holding period to classify the gain or loss as short-term or long-term.

Example:

- The partnership sells 100 shares of XYZ stock for $10,000.

- The basis is $5,000.

- The gain is $5,000 ($10,000 - $5,000).

- The holding period is 2 years, so the gain is classified as long-term.

Step 3: Complete Part I

- Report the sales and other dispositions of capital assets on Part I.

- List each capital asset separately, including the type, sale or exchange price, and gain or loss.

Step 4: Complete Part II

- Report the gains and losses from partnerships, S corporations, and other entities on Part II.

- List each entity separately, including the type, gain or loss, and holding period.

Example:

- The partnership has a 20% interest in ABC partnership, which reports a long-term gain of $10,000.

- The partnership reports its share of the gain on Part II.

Common Mistakes to Avoid

When completing Form 1065 Schedule D, it is essential to avoid common mistakes, including:

- Incorrect basis: Ensure the basis is accurate to calculate gains and losses correctly.

- Incorrect holding period: Ensure the holding period is accurate to classify gains and losses as short-term or long-term.

- Missing information: Ensure all required information is reported, including sales and exchange prices, gains and losses, and holding periods.

Conclusion

Accurate and timely reporting of capital gains and losses on Form 1065 Schedule D is crucial for partnerships. By understanding the key components and following the step-by-step instructions, partnerships can ensure compliance with the IRS and avoid penalties. Remember to avoid common mistakes and seek professional advice if needed.

Take Action

- Review your partnership's financial records to identify capital assets sold or exchanged during the tax year.

- Ensure accurate calculation of gains and losses.

- Complete Form 1065 Schedule D accurately and on time.

Share Your Thoughts

- Have you encountered any challenges when completing Form 1065 Schedule D?

- Do you have any tips for accurate reporting of capital gains and losses?

FAQ Section:

What is the purpose of Form 1065 Schedule D?

+Form 1065 Schedule D is used to report the partnership's capital gains and losses from the sale or exchange of capital assets.

What are the key components of Form 1065 Schedule D?

+The key components of Form 1065 Schedule D include capital assets, gains and losses, holding period, and basis.

How do I calculate gains and losses on Form 1065 Schedule D?

+Gains and losses are calculated by subtracting the basis from the sale or exchange price. The holding period determines whether a gain or loss is short-term or long-term.