Form 1041 Schedule I is a crucial document for estates and trusts, providing essential information about the income, deductions, and credits of these entities. As an integral part of the Form 1041, U.S. Income Tax Return for Estates and Trusts, Schedule I plays a pivotal role in ensuring accurate and compliant tax reporting. Here, we delve into five essential facts about Form 1041 Schedule I, providing insight into its purpose, structure, and significance.

What is Form 1041 Schedule I?

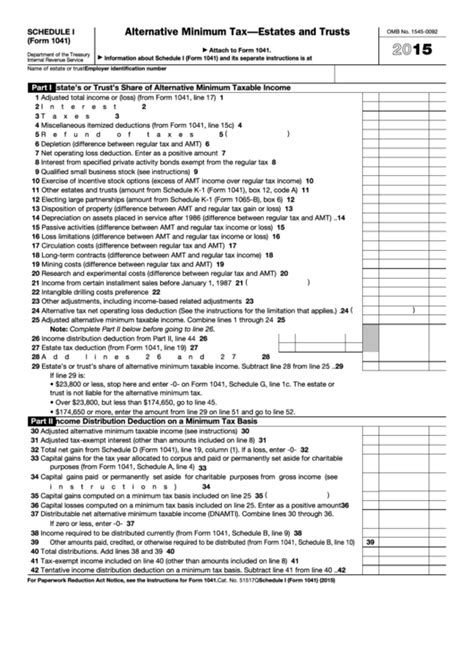

Form 1041 Schedule I is an attachment to the Form 1041, which is used by estates and trusts to report their income, deductions, and credits. Schedule I is specifically designed to report the income, deductions, and credits attributable to the estate or trust's income that is not subject to the trust-level tax. This schedule is a critical component of the Form 1041, as it helps to accurately calculate the taxable income of the estate or trust.

Purpose of Form 1041 Schedule I

The primary purpose of Form 1041 Schedule I is to report the income, deductions, and credits of the estate or trust that are not subject to the trust-level tax. This includes income earned by the estate or trust, such as interest, dividends, and capital gains, as well as deductions and credits that can be claimed against this income. By providing a detailed breakdown of this information, Schedule I helps to ensure accurate and compliant tax reporting for estates and trusts.

Structure of Form 1041 Schedule I

Form 1041 Schedule I is divided into several sections, each designed to capture specific information about the estate or trust's income, deductions, and credits. The schedule includes:

- Part I: Income

- Part II: Deductions

- Part III: Credits

Within these sections, estates and trusts must report their income, deductions, and credits, using specific lines and codes to identify the type and amount of each item.

Importance of Accurate Reporting on Form 1041 Schedule I

Accurate reporting on Form 1041 Schedule I is crucial for several reasons. Firstly, it ensures compliance with tax laws and regulations, reducing the risk of penalties and fines. Secondly, accurate reporting helps to prevent errors and discrepancies in the tax return, which can lead to delays or even audits. Finally, by providing a clear and detailed picture of the estate or trust's income, deductions, and credits, Schedule I helps to ensure that the taxable income is accurately calculated, reducing the risk of overpayment or underpayment of taxes.

Common Mistakes to Avoid on Form 1041 Schedule I

When completing Form 1041 Schedule I, estates and trusts must be mindful of common mistakes that can lead to errors, penalties, or even audits. Some common mistakes to avoid include:

- Inaccurate or incomplete reporting of income, deductions, and credits

- Failure to use the correct lines and codes to report items

- Omitting required schedules or attachments

- Failure to sign and date the schedule

By being aware of these common mistakes, estates and trusts can take steps to ensure accurate and compliant reporting on Form 1041 Schedule I.

Best Practices for Completing Form 1041 Schedule I

To ensure accurate and compliant reporting on Form 1041 Schedule I, estates and trusts should follow best practices, including:

- Carefully reviewing the instructions and guidelines for the schedule

- Using the correct lines and codes to report items

- Ensuring accurate and complete reporting of income, deductions, and credits

- Reviewing the schedule for errors and discrepancies before filing

- Seeking professional advice or guidance if needed

By following these best practices, estates and trusts can ensure that their Form 1041 Schedule I is accurate, complete, and compliant with tax laws and regulations.

Conclusion

Form 1041 Schedule I is a critical component of the Form 1041, providing essential information about the income, deductions, and credits of estates and trusts. By understanding the purpose, structure, and significance of Schedule I, estates and trusts can ensure accurate and compliant tax reporting. By avoiding common mistakes and following best practices, estates and trusts can reduce the risk of errors, penalties, and audits, and ensure that their tax return is accurate and complete.

We invite you to share your thoughts and experiences with Form 1041 Schedule I in the comments below. If you have any questions or need further guidance, please don't hesitate to ask.

What is the purpose of Form 1041 Schedule I?

+The primary purpose of Form 1041 Schedule I is to report the income, deductions, and credits of the estate or trust that are not subject to the trust-level tax.

What are the common mistakes to avoid on Form 1041 Schedule I?

+Common mistakes to avoid include inaccurate or incomplete reporting of income, deductions, and credits, failure to use the correct lines and codes to report items, omitting required schedules or attachments, and failure to sign and date the schedule.

What are the best practices for completing Form 1041 Schedule I?

+Best practices include carefully reviewing the instructions and guidelines for the schedule, using the correct lines and codes to report items, ensuring accurate and complete reporting of income, deductions, and credits, reviewing the schedule for errors and discrepancies before filing, and seeking professional advice or guidance if needed.