Obtaining tax-exempt status in Florida can be a significant advantage for non-profit organizations, charitable institutions, and other qualified entities. One crucial step in this process is filing the DR-14 form, also known as the "Application for Certificate of Exemption." In this comprehensive guide, we will walk you through the process of getting Florida tax exempt with the DR-14 form, highlighting the key requirements, benefits, and common mistakes to avoid.

Understanding the Benefits of Tax-Exempt Status in Florida

Tax-exempt status in Florida offers numerous benefits, including exemption from state sales and use taxes, as well as exemption from federal income taxes. This can result in significant cost savings for qualified organizations, allowing them to allocate more resources towards their mission and goals.

Who is Eligible for Tax-Exempt Status in Florida?

To be eligible for tax-exempt status in Florida, an organization must meet specific requirements. These include:

- Being a non-profit organization, as defined by the Internal Revenue Code (IRC)

- Being organized and operated exclusively for one or more exempt purposes, such as charitable, educational, or scientific purposes

- Not being a private foundation, as defined by the IRC

- Not having any part of its net earnings inuring to the benefit of any private shareholder or individual

The DR-14 Form: A Step-by-Step Guide

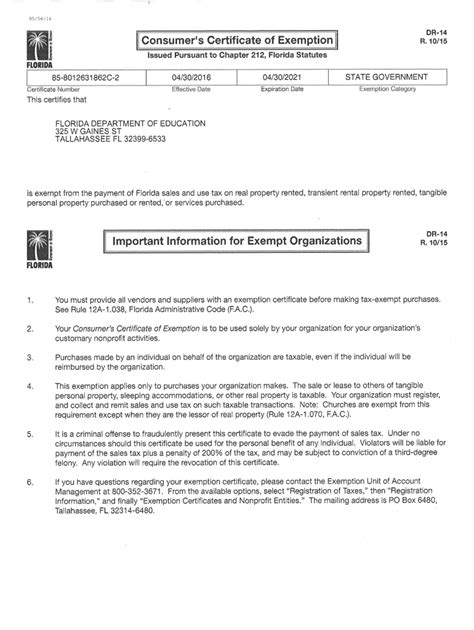

The DR-14 form is a crucial document required for tax-exempt status in Florida. Here's a step-by-step guide to help you navigate the form:

- Download the DR-14 form: You can download the form from the Florida Department of Revenue website or obtain it from your local tax office.

- Complete the application: Fill out the form accurately and completely, providing all required information, including your organization's name, address, and federal tax identification number.

- Attach supporting documents: Attach any required supporting documents, such as your organization's articles of incorporation, bylaws, and federal tax exemption letter.

- Submit the application: Submit the completed application and supporting documents to the Florida Department of Revenue.

Common Mistakes to Avoid When Filing the DR-14 Form

When filing the DR-14 form, it's essential to avoid common mistakes that can delay or even reject your application. These include:

- Incomplete or inaccurate information

- Failure to attach required supporting documents

- Not signing the application

- Not paying the required filing fee

Additional Requirements for Tax-Exempt Status in Florida

In addition to filing the DR-14 form, there are other requirements for tax-exempt status in Florida. These include:

- Annual reporting: Tax-exempt organizations must file an annual report with the Florida Department of State.

- Federal tax exemption: Tax-exempt organizations must also obtain federal tax exemption from the Internal Revenue Service (IRS).

- Compliance with Florida laws and regulations: Tax-exempt organizations must comply with all applicable Florida laws and regulations.

Conclusion

Obtaining tax-exempt status in Florida can be a complex process, but with the right guidance, it can be achieved. By following this guide and avoiding common mistakes, you can successfully file the DR-14 form and obtain tax-exempt status for your organization. Remember to also comply with additional requirements, such as annual reporting and federal tax exemption.

We encourage you to share your experiences or ask questions about the DR-14 form and tax-exempt status in Florida. Your feedback will help us improve this guide and provide more accurate information to our readers.

What is the purpose of the DR-14 form?

+The DR-14 form is used to apply for tax-exempt status in Florida. It is required for non-profit organizations, charitable institutions, and other qualified entities seeking exemption from state sales and use taxes.

Who is eligible for tax-exempt status in Florida?

+To be eligible for tax-exempt status in Florida, an organization must be a non-profit organization, as defined by the Internal Revenue Code (IRC), and meet specific requirements, such as being organized and operated exclusively for one or more exempt purposes.

What are the benefits of tax-exempt status in Florida?

+Tax-exempt status in Florida offers numerous benefits, including exemption from state sales and use taxes, as well as exemption from federal income taxes. This can result in significant cost savings for qualified organizations.