In the vast landscape of pension and retirement planning, the California Public Employees' Retirement System (CalPERS) plays a crucial role for numerous public employees and retirees. One of the less-discussed but crucial documents within the CalPERS system is the Reciprocal Self-Certification Form. This form is especially important for individuals who have worked for multiple public employers in California and are now navigating the complex waters of retirement benefits. Understanding the Reciprocal Self-Certification Form can make a significant difference in maximizing one's retirement income.

The process of filling out this form and understanding its implications can be daunting, especially for those who are not well-versed in the intricacies of CalPERS rules and regulations. This article aims to break down the complexities and provide five essential tips for navigating the CalPERS Reciprocal Self-Certification Form. By the end of this article, readers should feel more empowered and informed to tackle this crucial aspect of their retirement planning.

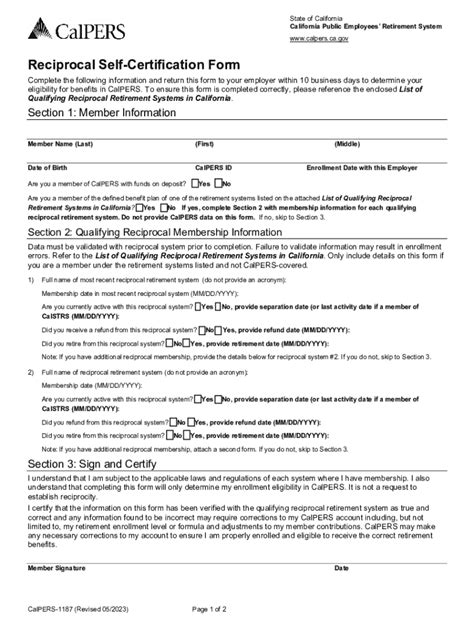

Understanding the Basics of CalPERS Reciprocity

Before diving into the tips, it's essential to grasp what reciprocity means within the CalPERS context. Reciprocity allows members who have worked for different public employers in California to combine their service credits from different retirement systems to qualify for a higher benefit tier or to retire earlier. This can be particularly beneficial for individuals who have worked in various roles across different public sectors in the state.

Why Reciprocity Matters

Reciprocity is not just about streamlining your retirement benefits; it's about maximizing your retirement income. By combining service credits, individuals can potentially qualify for higher monthly benefits, retire earlier, or achieve a combination of both, which significantly impacts their quality of life in retirement.

Tips for Navigating the CalPERS Reciprocal Self-Certification Form

Tip 1: Understand Your Eligibility

The first step in navigating the Reciprocal Self-Certification Form is understanding whether you are eligible for reciprocity. This involves checking which retirement systems you have service credits with and whether these systems have reciprocity agreements with CalPERS. Eligibility criteria can vary, so it's crucial to review your specific situation against the requirements outlined by CalPERS and other relevant retirement systems.

Tip 2: Gather All Necessary Documents

Importance of Documentation

Accurate documentation is key to completing the Reciprocal Self-Certification Form successfully. Ensure you have all necessary documents ready, including proof of employment, retirement system membership, and any relevant service credit records. It's a good idea to make copies of these documents and organize them in a way that makes them easily accessible.

Tip 3: Follow Instructions Carefully

Avoid Common Mistakes

The Reciprocal Self-Certification Form comes with detailed instructions. It's crucial to follow these instructions carefully to avoid common mistakes that could delay your application or even result in it being rejected. Take your time, and consider seeking advice if you're unsure about any part of the form.

Tip 4: Seek Professional Advice

Expert Guidance

Navigating the CalPERS system, including the Reciprocal Self-Certification Form, can be complex. Seeking advice from a financial advisor or a retirement planning expert who is familiar with CalPERS can provide valuable insights and help ensure you're making the most of your benefits.

Tip 5: Review and Double-Check

Accuracy is Key

Finally, before submitting your Reciprocal Self-Certification Form, review and double-check all the information you've provided. Accuracy is key in ensuring your application is processed smoothly and that you receive the maximum benefits you're eligible for.

Conclusion and Next Steps

Navigating the CalPERS Reciprocal Self-Certification Form requires patience, attention to detail, and a clear understanding of your eligibility and benefits. By following these five tips, you can ensure a smoother process and maximize your retirement benefits. Whether you're nearing retirement or just starting to plan, understanding the intricacies of the CalPERS system can significantly impact your future.

Engage with the Community

We invite you to share your experiences and insights regarding the CalPERS Reciprocal Self-Certification Form in the comments below. Whether you've successfully navigated the process or are facing challenges, your input can help others in similar situations. Together, we can build a more informed and supportive community for public employees and retirees in California.

What is the purpose of the CalPERS Reciprocal Self-Certification Form?

+The CalPERS Reciprocal Self-Certification Form is used to combine service credits from different public retirement systems in California for the purpose of retirement benefit calculations.

Who is eligible for CalPERS reciprocity?

+Eligibility for CalPERS reciprocity varies based on the specific retirement systems involved and the type of employment. Generally, it applies to members who have worked for different public employers in California.

What documents are needed for the CalPERS Reciprocal Self-Certification Form?

+Necessary documents include proof of employment, retirement system membership, and service credit records. It's advisable to review the form's instructions for specific documentation requirements.