Filling out a tax form can be a daunting task, especially if you're not familiar with the process. In Georgia, the ST-5 form is used to report and pay sales and use tax, and it's essential to fill it out accurately to avoid any penalties or delays. In this article, we'll guide you through five ways to fill out the ST-5 form in Georgia, making the process smoother and less intimidating.

What is the ST-5 Form?

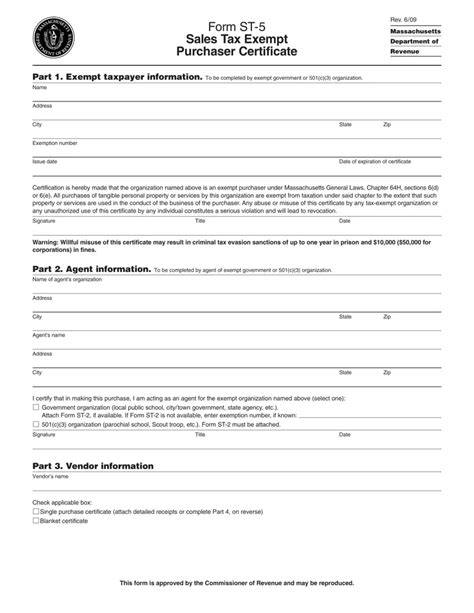

The ST-5 form is a sales and use tax return form used by the state of Georgia to collect taxes on sales and use of tangible personal property. Businesses and individuals who make taxable sales or purchases are required to file this form on a monthly or quarterly basis, depending on their tax liability.

5 Ways to Fill Out the ST-5 Form in Georgia

1. Online Filing through the Georgia Tax Center

One of the most convenient ways to fill out the ST-5 form is through the Georgia Tax Center (GTC) website. The GTC is a secure online platform that allows taxpayers to file and pay their taxes electronically.

To file online, you'll need to create an account on the GTC website and follow these steps:

- Log in to your account and select the "File a Return" option

- Choose the ST-5 form and select the filing period

- Enter your tax information, including sales and use tax liability

- Pay your tax liability online using a credit card or e-check

- Submit your return and print or save a copy for your records

2. Manual Filing by Mail

If you prefer to file your ST-5 form manually, you can do so by mail. You'll need to download and complete the form from the Georgia Department of Revenue website, then mail it to the address listed on the form.

Here's how to file manually:

- Download the ST-5 form from the Georgia Department of Revenue website

- Complete the form accurately, including your tax information and liability

- Sign and date the form

- Mail the form to the address listed on the form, along with payment for your tax liability

- Keep a copy of the form and payment for your records

3. Using Tax Preparation Software

Tax preparation software, such as TurboTax or QuickBooks, can make filling out the ST-5 form easier and less time-consuming. These programs guide you through the filing process, ensuring you complete the form accurately and take advantage of any deductions or credits you're eligible for.

Here's how to use tax preparation software:

- Choose a tax preparation software that supports the ST-5 form

- Follow the software's instructions to complete the form

- Enter your tax information, including sales and use tax liability

- Review and submit your return electronically or by mail

- Pay your tax liability using the software's payment options

4. Hiring a Tax Professional

If you're not comfortable filling out the ST-5 form yourself, you can hire a tax professional to do it for you. Tax professionals, such as accountants or tax attorneys, have the expertise and knowledge to ensure your return is accurate and complete.

Here's how to hire a tax professional:

- Research and choose a reputable tax professional

- Provide your tax information, including sales and use tax liability

- Review and approve the completed form

- Ensure the tax professional submits your return and pays your tax liability on your behalf

5. Using a Tax Filing Service

Tax filing services, such as TaxAct or Credit Karma Tax, offer a convenient and affordable way to fill out and file your ST-5 form. These services provide step-by-step guidance and support to ensure your return is accurate and complete.

Here's how to use a tax filing service:

- Choose a tax filing service that supports the ST-5 form

- Follow the service's instructions to complete the form

- Enter your tax information, including sales and use tax liability

- Review and submit your return electronically or by mail

- Pay your tax liability using the service's payment options

FAQs

What is the deadline for filing the ST-5 form in Georgia?

+The deadline for filing the ST-5 form in Georgia is the 20th day of the month following the end of the filing period.

Can I file the ST-5 form electronically?

+Yes, you can file the ST-5 form electronically through the Georgia Tax Center website or using tax preparation software.

What is the penalty for late filing of the ST-5 form?

+The penalty for late filing of the ST-5 form is 5% of the tax due for each month or part of a month, up to a maximum of 25%.

Conclusion

Filling out the ST-5 form in Georgia doesn't have to be a daunting task. By following these five ways to fill out the form, you can ensure your return is accurate and complete, and avoid any penalties or delays. Whether you choose to file online, by mail, or with the help of a tax professional, remember to take your time and review your return carefully before submitting it.