In the vast landscape of legal documents, understanding the intricacies of specific forms can be a daunting task, especially for those who are not familiar with the legal system. One such document that holds significant importance in certain jurisdictions is the Form FL-142. This form is primarily used in California, playing a crucial role in family law proceedings. Despite its importance, many individuals are unaware of its purpose, application, and legal implications. This article aims to shed light on the essential facts about Form FL-142, providing a comprehensive overview that will benefit both legal professionals and laypersons alike.

What is Form FL-142?

Definition and Purpose

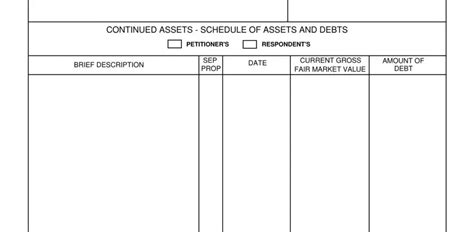

Form FL-142, also known as the "Schedule of Assets and Debts," is a legal document utilized in the Superior Court of California, specifically within the realm of family law. Its primary purpose is to provide a detailed and comprehensive list of a party's assets and debts. This form is an essential component of the financial disclosure process, mandated by the California Family Code, ensuring that both parties involved in a family law matter have a clear understanding of each other's financial situation.

Why is Form FL-142 Important?

Relevance in Family Law Proceedings

The importance of Form FL-142 cannot be overstated. It serves as a tool for transparency, facilitating a fair and equitable division of assets and debts between parties in a divorce or legal separation. By requiring each party to disclose their financial information, Form FL-142 helps to prevent financial deception and promotes honesty, thereby reducing the potential for disputes and litigations.

Moreover, this form is crucial for the accurate calculation of spousal support and child support. Without a comprehensive understanding of each party's financial situation, the court may face challenges in making informed decisions regarding support obligations.

How to Fill Out Form FL-142

Step-by-Step Guide

Filling out Form FL-142 requires meticulous attention to detail and accuracy. Here is a simplified step-by-step guide to assist you:

-

Identify Assets: List all your assets, including but not limited to real estate properties, vehicles, financial accounts, personal effects, and retirement accounts.

-

Specify Debts: Itemize all your debts, such as mortgages, credit card balances, personal loans, and any other financial obligations.

-

Include Supporting Documents: Attach supporting documents for each listed asset and debt, such as bank statements, deeds, and loan agreements.

-

Sign Under Penalty of Perjury: Ensure that you sign the form under penalty of perjury, attesting to the accuracy of the information provided.

It is advisable to seek the assistance of a family law attorney to ensure that the form is completed accurately and thoroughly.

Common Mistakes to Avoid

Best Practices for Completion

While filling out Form FL-142, there are several common mistakes that parties should avoid:

-

Incomplete Disclosure: Failing to list all assets and debts can lead to legal complications and potentially undermine the fairness of the court's decisions.

-

Inaccurate Information: Providing false or misleading information can result in severe consequences, including potential perjury charges.

-

Late Disclosure: Delaying the submission of Form FL-142 can hinder the progression of family law proceedings, leading to unnecessary delays and costs.

To avoid these pitfalls, it is essential to approach the completion of Form FL-142 with diligence and a thorough understanding of the requirements.

Conclusion and Next Steps

Form FL-142 is a critical document in California family law proceedings, serving as a cornerstone of the financial disclosure process. By understanding its purpose, importance, and the steps involved in its completion, parties can navigate family law matters more effectively. If you are involved in a divorce or legal separation in California, it is indispensable to familiarize yourself with Form FL-142 and seek professional legal advice to ensure a smooth and equitable resolution of your case.

Now that you've learned about the essential facts of Form FL-142, we invite you to share your thoughts or questions in the comments section. Have you or someone you know had to deal with Form FL-142 in a family law case? Share your experiences and help us continue the conversation on this critical topic.

What is the primary purpose of Form FL-142?

+The primary purpose of Form FL-142 is to provide a detailed list of a party's assets and debts in family law proceedings.

Is Form FL-142 mandatory in all family law cases in California?

+Yes, Form FL-142 is a mandatory disclosure document in family law cases in California, ensuring transparency and fairness.

What are the consequences of not disclosing all assets and debts on Form FL-142?

+Failure to disclose all assets and debts can lead to legal complications, including potential perjury charges and undermining the fairness of court decisions.