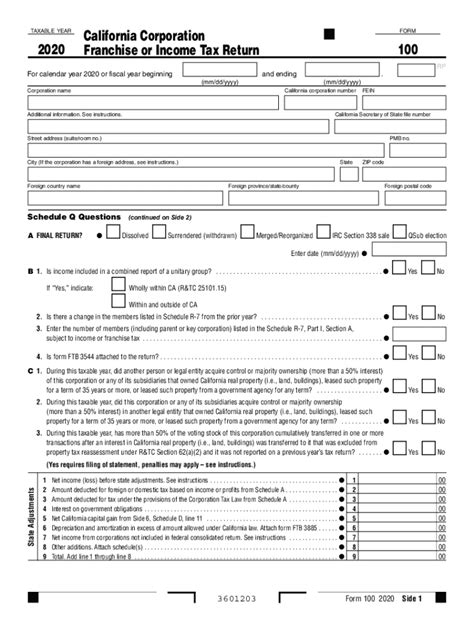

Completing California Form 100, also known as the Statement of Information, is a crucial step for businesses operating in California. This form is used to provide the California Secretary of State with information about the business entity, including its name, address, and management structure. In this article, we will guide you through the 5 steps to complete California Form 100.

Understanding the Purpose of California Form 100

Before we dive into the steps to complete California Form 100, it's essential to understand the purpose of this form. California Form 100 is a required filing for all business entities operating in California, including corporations, limited liability companies (LLCs), and limited partnerships (LPs). The form is used to update the business entity's records with the California Secretary of State and to provide public notice of the entity's existence.

Why is California Form 100 Important?

California Form 100 is important because it provides the public with access to information about the business entity, including its name, address, and management structure. This information is used by various stakeholders, including creditors, customers, and regulatory agencies.

Step 1: Gather Required Information

Before completing California Form 100, you will need to gather the required information about your business entity. This includes:

- Business entity name and address

- Name and address of the chief executive officer (CEO) or managing member

- Name and address of the secretary or assistant secretary

- Business entity's email address and phone number

- Description of the business entity's purpose and activities

Tips for Gathering Information

- Make sure to use the business entity's exact name as it appears on the records of the California Secretary of State.

- Use the business entity's current address, not a post office box.

- Provide the name and address of the CEO or managing member, not the owner or shareholder.

Step 2: Choose the Correct Form Type

California Form 100 comes in different types, depending on the business entity type. You will need to choose the correct form type for your business entity:

- Statement of Information (Form 100) for corporations

- Statement of Information (Form LLC-12) for LLCs

- Statement of Information (Form LP-1) for LPs

Tips for Choosing the Correct Form Type

- Make sure to choose the correct form type for your business entity.

- Use the form type that corresponds to your business entity's current status.

Step 3: Complete the Form

Once you have gathered the required information and chosen the correct form type, you can complete California Form 100. The form is divided into several sections, including:

- Business entity information

- CEO or managing member information

- Secretary or assistant secretary information

- Business entity's purpose and activities

Tips for Completing the Form

- Make sure to complete all sections of the form.

- Use black ink and print clearly.

- Do not leave any blank spaces.

Step 4: File the Form

Once you have completed California Form 100, you will need to file it with the California Secretary of State. You can file the form online or by mail.

Tips for Filing the Form

- Make sure to file the form on time.

- Use the correct filing fee.

- Keep a copy of the filed form for your records.

Step 5: Maintain Accurate Records

Finally, it's essential to maintain accurate records of your business entity's information. This includes updating California Form 100 whenever there are changes to the business entity's information.

Tips for Maintaining Accurate Records

- Keep a copy of the filed form for your records.

- Update the form whenever there are changes to the business entity's information.

- Use the correct form type and filing fee.

By following these 5 steps, you can ensure that your business entity is in compliance with California's requirements for filing California Form 100.

What is California Form 100?

+California Form 100 is a statement of information that provides the California Secretary of State with information about a business entity, including its name, address, and management structure.

Why is California Form 100 important?

+California Form 100 is important because it provides the public with access to information about the business entity, including its name, address, and management structure.

How often do I need to file California Form 100?

+California Form 100 needs to be filed every 2 years, or whenever there are changes to the business entity's information.

We hope this article has provided you with a comprehensive guide to completing California Form 100. If you have any further questions or concerns, please don't hesitate to comment below.