The Form 5471 Schedule Q is a crucial annual reporting requirement for certain U.S. citizens and residents who have an interest in a foreign corporation. As the global economy becomes increasingly interconnected, the importance of accurate and timely reporting of foreign corporation transactions cannot be overstated. In this article, we will delve into the world of Form 5471 Schedule Q, exploring its purpose, requirements, and best practices for compliance.

What is Form 5471 Schedule Q?

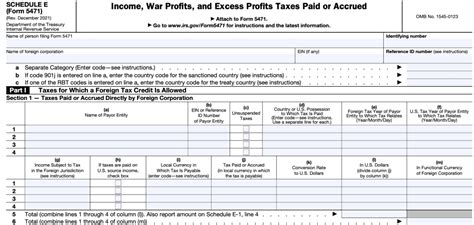

The Form 5471 is an information return required by the Internal Revenue Service (IRS) for certain U.S. persons who have an interest in a foreign corporation. Schedule Q is a specific part of the Form 5471 that requires taxpayers to provide detailed information about the foreign corporation's income, deductions, and credits. The purpose of Schedule Q is to enable the IRS to determine whether the foreign corporation has made any distributions or allocations that may be subject to U.S. taxation.

Who is required to file Form 5471 Schedule Q?

Not all U.S. citizens and residents are required to file Form 5471 Schedule Q. The following categories of individuals are typically required to file:

- U.S. shareholders of a controlled foreign corporation (CFC)

- U.S. shareholders of a foreign corporation that is not a CFC, but has made certain distributions or allocations

- U.S. citizens and residents who are officers or directors of a foreign corporation

- U.S. citizens and residents who have a 10% or greater interest in a foreign corporation

What information is required on Form 5471 Schedule Q?

Schedule Q requires taxpayers to provide detailed information about the foreign corporation's income, deductions, and credits. The following information is typically required:

- Income and deductions of the foreign corporation

- Credits and allocations of the foreign corporation

- Distributions made by the foreign corporation

- Allocations of income and deductions to U.S. shareholders

- Information about the foreign corporation's financial statements and tax returns

How to complete Form 5471 Schedule Q

Completing Form 5471 Schedule Q requires careful attention to detail and a thorough understanding of the foreign corporation's financial statements and tax returns. The following steps can help taxpayers ensure accurate and timely reporting:

- Gather necessary documents: Collect all relevant financial statements, tax returns, and other documents related to the foreign corporation.

- Review IRS instructions: Carefully review the IRS instructions for Form 5471 Schedule Q to ensure compliance with all requirements.

- Complete Schedule Q: Complete Schedule Q using the information gathered from the foreign corporation's financial statements and tax returns.

- Review and verify: Review and verify all information on Schedule Q to ensure accuracy and completeness.

Penalties for non-compliance

Failure to file Form 5471 Schedule Q or providing inaccurate or incomplete information can result in significant penalties and fines. The following penalties may apply:

- Failure to file: $10,000 per year (or $50,000 in cases of intentional disregard)

- Failure to provide complete and accurate information: $10,000 per year (or $50,000 in cases of intentional disregard)

Best practices for compliance

To ensure compliance with Form 5471 Schedule Q requirements, taxpayers should follow these best practices:

- Seek professional advice: Consult with a tax professional or attorney experienced in international taxation to ensure accurate and timely reporting.

- Maintain accurate records: Keep accurate and detailed records of the foreign corporation's financial statements and tax returns.

- Monitor IRS guidance: Stay up-to-date with IRS guidance and regulations related to Form 5471 Schedule Q.

Annual reporting requirements

Form 5471 Schedule Q is an annual reporting requirement, typically due on the 15th day of the 4th month following the close of the foreign corporation's tax year. Taxpayers should ensure that they meet this deadline to avoid penalties and fines.

Additional considerations

In addition to Form 5471 Schedule Q, taxpayers may be required to file other forms and schedules related to their interest in a foreign corporation. These may include:

- Form 5472: Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business

- Form W-8BEN: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding

- Form W-8ECI: Certificate of Foreign Person's Claim for Exemption from Withholding on Income Effectively Connected with the Conduct of a Trade or Business in the United States

Conclusion

Form 5471 Schedule Q is a critical annual reporting requirement for certain U.S. citizens and residents who have an interest in a foreign corporation. By understanding the purpose, requirements, and best practices for compliance, taxpayers can ensure accurate and timely reporting, avoiding significant penalties and fines. As the global economy continues to evolve, it is essential to stay informed about changes in international taxation and reporting requirements.

We encourage you to share your thoughts and questions about Form 5471 Schedule Q in the comments below. If you have any further questions or concerns, please don't hesitate to reach out to a tax professional or attorney experienced in international taxation.

FAQ Section

Who is required to file Form 5471 Schedule Q?

+U.S. citizens and residents who have an interest in a foreign corporation, including U.S. shareholders of a CFC, officers or directors of a foreign corporation, and U.S. citizens and residents who have a 10% or greater interest in a foreign corporation.

What information is required on Form 5471 Schedule Q?

+Schedule Q requires taxpayers to provide detailed information about the foreign corporation's income, deductions, and credits, including distributions made by the foreign corporation and allocations of income and deductions to U.S. shareholders.

What are the penalties for non-compliance with Form 5471 Schedule Q?

+Failure to file Form 5471 Schedule Q or providing inaccurate or incomplete information can result in penalties of up to $10,000 per year (or $50,000 in cases of intentional disregard).