Filling out forms can be a daunting task, especially when it comes to tax-related documents like Form 943. The Employer's Annual Federal Tax Return is a crucial form that employers must submit to the IRS to report their annual federal tax liability. However, with the right guidance, completing a fillable Form 943 can be a breeze. In this article, we will explore five ways to complete a fillable Form 943 easily.

Understanding Form 943

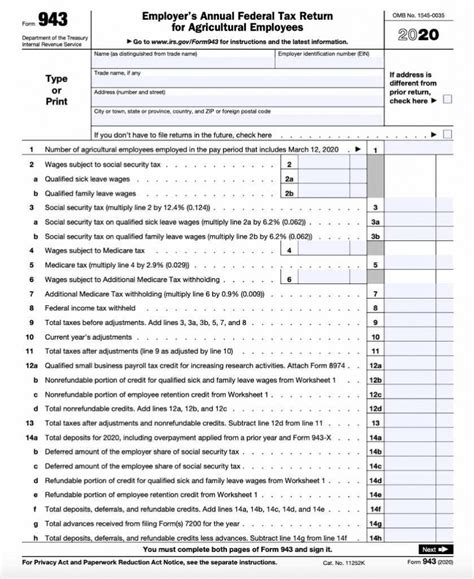

Before we dive into the ways to complete a fillable Form 943, it's essential to understand the purpose of this form. Form 943 is used by employers to report their annual federal tax liability, including income tax withholding, Social Security tax, and Medicare tax. The form is typically filed annually, and the deadline is usually January 31st of each year.

Who Needs to File Form 943?

Not all employers need to file Form 943. Typically, employers who have paid wages to employees and have withheld federal income tax, Social Security tax, or Medicare tax must file this form. This includes:

- Agricultural employers who have paid wages to employees and have withheld federal income tax, Social Security tax, or Medicare tax

- Household employers who have paid wages to employees and have withheld federal income tax, Social Security tax, or Medicare tax

- Government agencies that have paid wages to employees and have withheld federal income tax, Social Security tax, or Medicare tax

5 Ways to Complete a Fillable Form 943 Easily

Now that we have a better understanding of Form 943, let's explore five ways to complete a fillable Form 943 easily.

1. Use the IRS Website

The IRS website (irs.gov) offers a fillable Form 943 that can be downloaded and completed electronically. The form is available in PDF format, and you can use Adobe Acrobat Reader to fill it out. The IRS website also provides instructions and guidance on how to complete the form.

2. Use Tax Software

Tax software like TurboTax, H&R Block, or TaxAct can help you complete a fillable Form 943 easily. These software programs guide you through the process, ensuring that you complete the form accurately and efficiently. They also offer error-checking features to minimize mistakes.

Benefits of Using Tax Software

- Guides you through the process

- Error-checking features

- Saves time and effort

- Accurate calculations

3. Hire a Tax Professional

If you're not comfortable completing a fillable Form 943 yourself, you can hire a tax professional to do it for you. Tax professionals have the expertise and knowledge to complete the form accurately and efficiently. They can also help you with any questions or concerns you may have.

4. Use a Fillable Form 943 Template

You can also use a fillable Form 943 template to complete the form easily. These templates are available online and can be downloaded and completed electronically. They often include instructions and guidance on how to complete the form.

Benefits of Using a Fillable Form 943 Template

- Easy to use

- Saves time and effort

- Accurate calculations

- Reduces errors

5. Consult the IRS Instructions

Finally, you can consult the IRS instructions for Form 943 to complete the form easily. The instructions provide guidance on how to complete each section of the form, including the schedules and attachments.

Conclusion

Completing a fillable Form 943 can be a challenging task, but with the right guidance, it can be done easily. By using the IRS website, tax software, hiring a tax professional, using a fillable Form 943 template, or consulting the IRS instructions, you can complete the form accurately and efficiently. Remember to always double-check your work and seek help if you need it.

We hope this article has been helpful in guiding you through the process of completing a fillable Form 943. If you have any questions or concerns, please don't hesitate to reach out. Share your experiences and tips with us in the comments section below.

What is Form 943?

+Form 943 is the Employer's Annual Federal Tax Return, which is used by employers to report their annual federal tax liability, including income tax withholding, Social Security tax, and Medicare tax.

Who needs to file Form 943?

+Typically, employers who have paid wages to employees and have withheld federal income tax, Social Security tax, or Medicare tax must file Form 943. This includes agricultural employers, household employers, and government agencies.

What is the deadline for filing Form 943?

+The deadline for filing Form 943 is usually January 31st of each year.