Managing employee payroll can be a daunting task, especially when it comes to ensuring timely and accurate payments. One way to simplify this process is by using QuickBooks, a popular accounting software, and its direct deposit feature. In this article, we will walk you through the process of setting up QuickBooks direct deposit for your employees, making payroll management a breeze.

The importance of direct deposit cannot be overstated. It's a convenient and efficient way to pay employees, reducing the need for paper checks and minimizing the risk of lost or delayed payments. With QuickBooks direct deposit, you can ensure that your employees receive their pay on time, every time.

Benefits of Using QuickBooks Direct Deposit

Before we dive into the setup process, let's take a look at some of the benefits of using QuickBooks direct deposit:

- Convenience: Direct deposit eliminates the need for paper checks, making it a convenient option for both employers and employees.

- Efficiency: With direct deposit, you can process payroll quickly and accurately, reducing the risk of errors and delays.

- Security: Direct deposit is a secure way to pay employees, reducing the risk of lost or stolen checks.

- Cost-effective: Direct deposit can help reduce payroll costs by minimizing the need for paper checks and postage.

How to Set Up QuickBooks Direct Deposit

Now that we've covered the benefits of using QuickBooks direct deposit, let's move on to the setup process. Here's a step-by-step guide to help you get started:

- Verify your bank account: Before you can set up direct deposit, you need to verify your bank account in QuickBooks. To do this, go to the "Banking" tab and select "Verify Bank Account."

- Set up your direct deposit account: Once your bank account is verified, you can set up your direct deposit account. Go to the "Payroll" tab and select "Direct Deposit."

- Enter your bank account information: Enter your bank account information, including the routing number and account number.

- Add employees: Add your employees to the direct deposit system by going to the "Payroll" tab and selecting "Employees."

- Enter employee bank account information: Enter each employee's bank account information, including the routing number and account number.

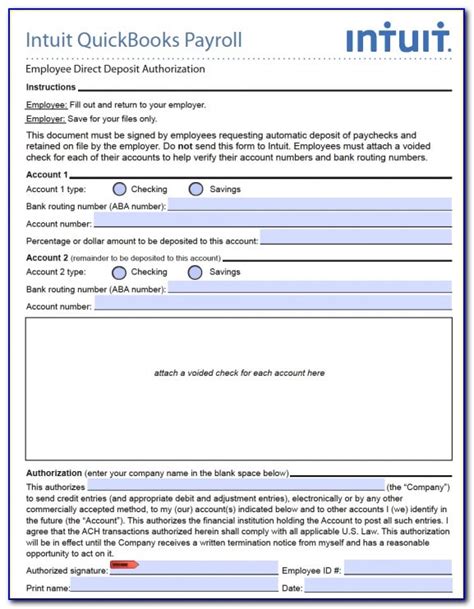

QuickBooks Direct Deposit Form

To set up direct deposit in QuickBooks, you'll need to complete a direct deposit form for each employee. Here's what you need to know:

- Employee information: The form will require you to enter each employee's name, address, and social security number.

- Bank account information: You'll need to enter each employee's bank account information, including the routing number and account number.

- Deposit amount: You'll need to specify the deposit amount for each employee.

Common Issues with QuickBooks Direct Deposit

While QuickBooks direct deposit is a convenient and efficient way to pay employees, there are some common issues that can arise. Here are a few things to watch out for:

- Incorrect bank account information: Make sure you enter each employee's bank account information correctly to avoid delays or errors.

- Insufficient funds: Make sure you have sufficient funds in your bank account to cover payroll costs.

- Technical issues: Technical issues can arise, such as connectivity problems or software glitches. Make sure you have a backup plan in place in case of technical issues.

Best Practices for Using QuickBooks Direct Deposit

To get the most out of QuickBooks direct deposit, here are some best practices to follow:

- Regularly review payroll: Regularly review payroll to ensure accuracy and completeness.

- Verify bank account information: Verify bank account information for each employee to ensure accuracy.

- Keep records: Keep records of payroll and direct deposit transactions for future reference.

Conclusion

Setting up QuickBooks direct deposit is a straightforward process that can save you time and money. By following the steps outlined in this article, you can ensure that your employees receive their pay on time, every time. Remember to regularly review payroll, verify bank account information, and keep records to get the most out of QuickBooks direct deposit.

We hope this article has been helpful in guiding you through the process of setting up QuickBooks direct deposit. If you have any questions or comments, please feel free to share them below.

What is QuickBooks direct deposit?

+QuickBooks direct deposit is a feature that allows you to pay employees electronically, eliminating the need for paper checks.

How do I set up QuickBooks direct deposit?

+To set up QuickBooks direct deposit, you'll need to verify your bank account, set up your direct deposit account, and enter employee bank account information.

What are the benefits of using QuickBooks direct deposit?

+The benefits of using QuickBooks direct deposit include convenience, efficiency, security, and cost-effectiveness.