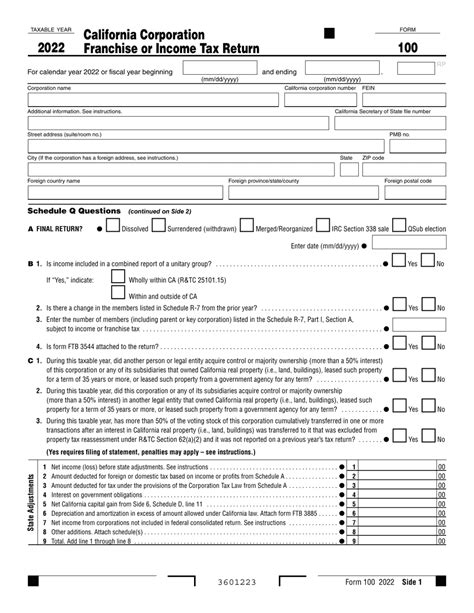

In the state of California, businesses are required to file various tax forms with the Franchise Tax Board (FTB) to report their income and pay taxes. One of the most important tax forms for corporations is the California Form 100, also known as the Corporation Franchise or Income Tax Return. This form is used to report the income, deductions, and credits of a corporation, and to calculate the amount of tax owed to the state. In this article, we will provide a comprehensive guide to California Form 100, including its purpose, who needs to file, and how to complete the form.

What is California Form 100?

California Form 100 is a tax form used by corporations to report their income, deductions, and credits to the Franchise Tax Board (FTB). The form is used to calculate the amount of tax owed by the corporation to the state of California. The form includes information about the corporation's income, expenses, and tax credits, as well as any applicable penalties or interest.

Who Needs to File California Form 100?

All corporations that are required to file a tax return with the FTB must file California Form 100. This includes:

- C corporations (also known as regular corporations)

- S corporations (also known as subchapter S corporations)

- Limited liability companies (LLCs) that are treated as corporations for tax purposes

- Foreign corporations that are doing business in California

Corporations that are exempt from filing a tax return with the FTB, such as non-profit organizations and certain government entities, do not need to file California Form 100.

How to Complete California Form 100

Completing California Form 100 can be a complex process, requiring careful attention to detail and accurate calculation of income, deductions, and credits. Here are the steps to follow:

Step 1: Gather Required Information

Before starting to complete the form, gather all required information, including:

- The corporation's name, address, and federal employer identification number (FEIN)

- The corporation's tax year-end date

- The corporation's total income, including income from all sources

- The corporation's total deductions, including business expenses and depreciation

- The corporation's tax credits, including any applicable state tax credits

Step 2: Complete the Form

The form is divided into several sections, each of which requires specific information. The sections include:

- Section 1: Corporation Information

- Section 2: Income

- Section 3: Deductions

- Section 4: Tax Credits

- Section 5: Tax Liability

Complete each section carefully, using the information gathered in Step 1.

Step 3: Calculate Tax Liability

Calculate the corporation's tax liability using the information provided in the form. This includes calculating the total tax due, as well as any applicable penalties or interest.

Tax Rates and Penalties

California corporations are subject to a franchise tax rate of 8.84% of net income. Additionally, corporations may be subject to penalties and interest for late filing or underpayment of taxes.

Penalties for Late Filing

Corporations that fail to file California Form 100 by the deadline may be subject to penalties and interest. The penalty for late filing is 5% of the tax due for each month or part of a month, up to a maximum of 25%.

Penalties for Underpayment of Taxes

Corporations that underpay their taxes may be subject to penalties and interest. The penalty for underpayment is 10% of the tax due, plus interest on the underpaid amount.

Common Mistakes to Avoid

When completing California Form 100, there are several common mistakes to avoid:

- Failing to report all income

- Failing to claim all eligible deductions and credits

- Failing to calculate tax liability accurately

- Failing to file the form by the deadline

Conclusion

Completing California Form 100 requires careful attention to detail and accurate calculation of income, deductions, and credits. By following the steps outlined in this article, corporations can ensure that they file an accurate and complete tax return. Remember to avoid common mistakes, such as failing to report all income or failing to claim all eligible deductions and credits.

If you have any questions or concerns about completing California Form 100, consult with a tax professional or contact the Franchise Tax Board (FTB) for assistance.

We hope you found this article informative and helpful. If you have any comments or questions, please don't hesitate to share them with us. We would be happy to hear from you.

What is the deadline for filing California Form 100?

+The deadline for filing California Form 100 is the 15th day of the 4th month after the close of the corporation's tax year.

Can I file California Form 100 electronically?

+What is the penalty for late filing of California Form 100?

+The penalty for late filing of California Form 100 is 5% of the tax due for each month or part of a month, up to a maximum of 25%.