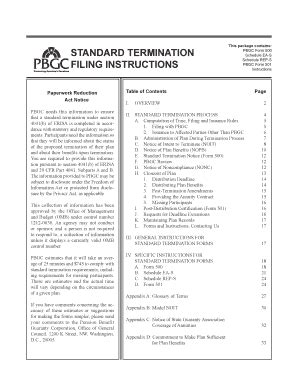

Completing the PBGC Form 500 can be a daunting task, but with the right guidance, it can be done with ease. The Pension Benefit Guaranty Corporation (PBGC) requires this form to be filed by certain pension plans, and it's essential to get it right to avoid any penalties or delays. In this article, we'll break down the process into 7 manageable steps, making it easier for you to complete the PBGC Form 500.

Understanding the PBGC Form 500

Before we dive into the steps, let's quickly understand what the PBGC Form 500 is and why it's required. The PBGC Form 500 is a report that certain pension plans must file with the PBGC to provide information about their plan's financial condition, participant data, and other relevant details. This form is typically filed by single-employer defined benefit pension plans that are subject to the Employee Retirement Income Security Act of 1974 (ERISA).

Step 1: Determine If You Need to File

The first step is to determine if your pension plan is required to file the PBGC Form 500. Check the PBGC's website or consult with your plan's administrator to see if your plan meets the filing requirements. Typically, plans with 100 or more participants are required to file this form.

Step 2: Gather Required Information

Gathering Information for PBGC Form 500

Once you've determined that your plan needs to file the PBGC Form 500, it's time to gather all the required information. This includes:

- Plan name and number

- Employer's name and address

- Plan administrator's name and address

- Number of participants and beneficiaries

- Total assets and liabilities

- Funding information, including the plan's funded ratio and any funding deficiencies

Make sure to have all the necessary documents and records readily available to avoid any delays.

Step 3: Choose Your Filing Method

Filing Methods for PBGC Form 500

You can file the PBGC Form 500 either electronically or by mail. The PBGC recommends electronic filing, as it's faster and more convenient. You can use the PBGC's online filing system, My Plan Administration Account (MPAA), to submit your form. If you prefer to file by mail, make sure to use the correct address and follow the PBGC's instructions.

Step 4: Complete the Form

Completing the PBGC Form 500

Now it's time to complete the PBGC Form 500. The form is divided into several sections, including:

- Plan information

- Participant data

- Financial information

- Funding information

- Certification

Make sure to carefully review each section and provide accurate information. You can use the PBGC's instructions and examples to help guide you through the process.

Step 5: Review and Edit

Reviewing and Editing the PBGC Form 500

Once you've completed the form, review it carefully to ensure accuracy and completeness. Check for any errors or omissions, and make any necessary edits. It's also a good idea to have someone else review the form to catch any mistakes.

Step 6: Submit the Form

Submitting the PBGC Form 500

After reviewing and editing the form, it's time to submit it to the PBGC. If you're filing electronically, simply click the "submit" button in the MPAA system. If you're filing by mail, make sure to use the correct address and follow the PBGC's instructions.

Step 7: Receive Confirmation

Receiving Confirmation for PBGC Form 500

Once you've submitted the PBGC Form 500, you'll receive confirmation from the PBGC. This confirmation will include a filing ID and a date stamp. Keep this confirmation for your records, as you may need to refer to it later.

Additional Tips and Reminders

- Make sure to file the PBGC Form 500 on time to avoid any penalties or delays.

- Use the PBGC's instructions and examples to help guide you through the process.

- Keep accurate records of your filing, including the confirmation and any supporting documentation.

- If you have any questions or concerns, contact the PBGC or your plan's administrator for assistance.

By following these 7 steps, you can complete the PBGC Form 500 with ease and confidence. Remember to take your time, review the form carefully, and seek help if you need it.

We'd love to hear from you!

Have you completed the PBGC Form 500 before? Share your experiences and tips in the comments below. If you have any questions or need further assistance, don't hesitate to ask.

FAQ Section:

Who needs to file the PBGC Form 500?

+Single-employer defined benefit pension plans with 100 or more participants are required to file the PBGC Form 500.

What is the deadline for filing the PBGC Form 500?

+The deadline for filing the PBGC Form 500 varies depending on the plan's fiscal year-end. Typically, the form is due 15 months after the plan's fiscal year-end.