Understanding and navigating the complexities of tax forms can be a daunting task for many individuals and businesses. One such form that requires attention to detail and careful preparation is the CHP 73C form. In this article, we will delve into the world of CHP 73C form requirements, exploring its purpose, benefits, and steps to ensure accurate filing.

The CHP 73C form is a crucial document for businesses and individuals who need to report specific financial transactions to the relevant authorities. Its primary purpose is to facilitate transparency and compliance with tax regulations, enabling authorities to track and monitor financial activities effectively.

Benefits of Filing CHP 73C Form

Filing the CHP 73C form is not only a mandatory requirement but also offers several benefits to businesses and individuals. Some of the key advantages include:

• Improved Compliance: By filing the CHP 73C form, businesses and individuals demonstrate their commitment to compliance with tax regulations, reducing the risk of penalties and fines.

• Enhanced Transparency: The form provides a clear and detailed record of financial transactions, promoting transparency and accountability.

• Simplified Audits: Accurate and complete filing of the CHP 73C form can simplify the audit process, reducing the likelihood of errors and discrepancies.

Requirements for Filing CHP 73C Form

To ensure accurate and timely filing of the CHP 73C form, it is essential to understand the specific requirements and guidelines. Some of the key requirements include:

• Eligibility: The CHP 73C form is required for businesses and individuals who engage in specific financial transactions, such as sales, purchases, or rentals.

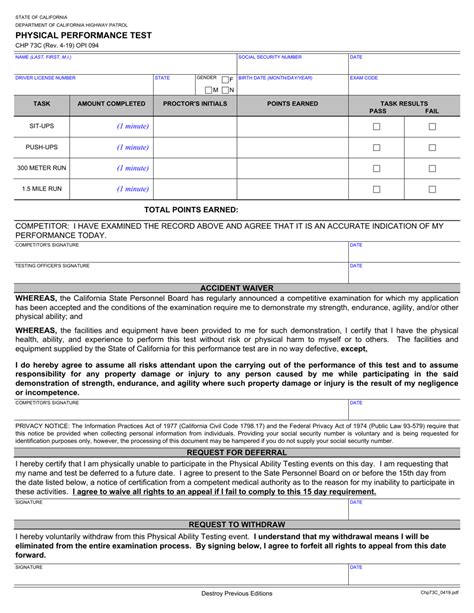

• Form Structure: The form consists of multiple sections, each requiring detailed information about the financial transactions, including dates, amounts, and descriptions.

• Supporting Documents: Businesses and individuals must maintain accurate and detailed records of financial transactions, including invoices, receipts, and bank statements.

Steps to File CHP 73C Form

To ensure accurate and timely filing of the CHP 73C form, follow these steps:

-

Gather Required Documents: Collect all necessary supporting documents, including invoices, receipts, and bank statements.

-

Complete Form Sections: Carefully complete each section of the form, ensuring accuracy and attention to detail.

-

Review and Verify: Review the completed form for errors and discrepancies, verifying the information against supporting documents.

-

Submit the Form: Submit the completed form to the relevant authorities, either electronically or by mail, depending on the specified filing method.

Common Mistakes to Avoid

When filing the CHP 73C form, it is essential to avoid common mistakes that can lead to errors, penalties, and fines. Some of the most common mistakes include:

• Inaccurate or Incomplete Information: Failing to provide accurate and complete information can lead to errors and discrepancies.

• Late Filing: Failing to file the form on time can result in penalties and fines.

• Insufficient Supporting Documents: Failing to maintain accurate and detailed records of financial transactions can lead to errors and discrepancies.

Best Practices for Filing CHP 73C Form

To ensure accurate and timely filing of the CHP 73C form, follow these best practices:

• Seek Professional Guidance: Consult with a tax professional or accountant to ensure accurate and complete filing.

• Maintain Accurate Records: Maintain accurate and detailed records of financial transactions, including invoices, receipts, and bank statements.

• Review and Verify: Review the completed form for errors and discrepancies, verifying the information against supporting documents.

Benefits of Timely Filing

Timely filing of the CHP 73C form offers several benefits, including:

• Reduced Penalties: Filing the form on time can reduce the risk of penalties and fines.

• Improved Compliance: Timely filing demonstrates compliance with tax regulations, promoting transparency and accountability.

• Simplified Audits: Accurate and complete filing of the CHP 73C form can simplify the audit process, reducing the likelihood of errors and discrepancies.

Common Challenges and Solutions

Filing the CHP 73C form can be challenging, especially for businesses and individuals who are new to the process. Some common challenges and solutions include:

• Complexity: The form can be complex and time-consuming to complete. Solution: Seek professional guidance from a tax professional or accountant.

• Time Constraints: Filing the form can be time-consuming, especially for businesses with multiple transactions. Solution: Maintain accurate and detailed records of financial transactions, and allocate sufficient time for filing.

• Technical Issues: Technical issues can arise during the filing process. Solution: Ensure that the necessary software and hardware are up-to-date, and seek technical support when needed.

Conclusion and Next Steps

Filing the CHP 73C form is a critical requirement for businesses and individuals who engage in specific financial transactions. By understanding the form's purpose, benefits, and requirements, individuals can ensure accurate and timely filing. To simplify the process, it is essential to maintain accurate and detailed records of financial transactions, seek professional guidance when needed, and allocate sufficient time for filing.

By following the guidelines and best practices outlined in this article, businesses and individuals can ensure accurate and timely filing of the CHP 73C form, promoting transparency, compliance, and accountability.

We encourage you to share your thoughts and experiences with filing the CHP 73C form. Have you encountered any challenges or successes? Share your comments below!

What is the purpose of the CHP 73C form?

+The CHP 73C form is used to report specific financial transactions to the relevant authorities, promoting transparency and compliance with tax regulations.

Who is required to file the CHP 73C form?

+Businesses and individuals who engage in specific financial transactions, such as sales, purchases, or rentals, are required to file the CHP 73C form.

What are the benefits of timely filing?

+Timely filing of the CHP 73C form can reduce penalties and fines, promote compliance with tax regulations, and simplify the audit process.