As a business owner, it's essential to understand the tax implications of selling your business property. The Internal Revenue Service (IRS) requires you to report the sale of business property on Form 4797, which can be a complex and confusing process. In this article, we'll break down the specifics of Form 4797, Part II, and provide you with a comprehensive guide to help you navigate the process.

What is Form 4797, Part II?

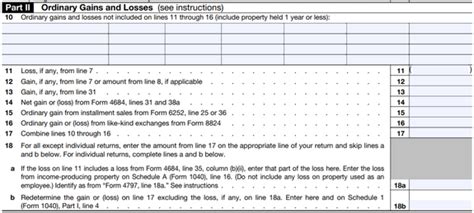

Form 4797, Part II, is used to report the sale of business property, including equipment, vehicles, and real estate. This form is used to calculate the gain or loss on the sale of business property and to determine the amount of depreciation recapture.

Who Needs to File Form 4797, Part II?

You need to file Form 4797, Part II, if you've sold business property during the tax year. This includes:

- Sole proprietors

- Partnerships

- S corporations

- C corporations

What Information Do I Need to Complete Form 4797, Part II?

To complete Form 4797, Part II, you'll need the following information:

- Description of the property sold

- Date of sale

- Sales price

- Original cost of the property

- Accumulated depreciation

- Depreciation method used

How to Complete Form 4797, Part II

Completing Form 4797, Part II, involves several steps:

- Section A: Description of Property

- Provide a detailed description of the property sold, including the type of property, location, and any other relevant information.

- Section B: Date of Sale and Sales Price

- Enter the date of sale and the sales price of the property.

- Section C: Original Cost and Accumulated Depreciation

- Enter the original cost of the property and the accumulated depreciation.

- Section D: Depreciation Method

- Enter the depreciation method used, such as straight-line or accelerated depreciation.

- Section E: Gain or Loss

- Calculate the gain or loss on the sale of the property using the information entered in the previous sections.

Calculating Gain or Loss on Form 4797, Part II

To calculate the gain or loss on Form 4797, Part II, you'll need to follow these steps:

- Calculate the Adjusted Basis

- Calculate the adjusted basis of the property by subtracting the accumulated depreciation from the original cost.

- Calculate the Gain or Loss

- Calculate the gain or loss by subtracting the adjusted basis from the sales price.

Depreciation Recapture on Form 4797, Part II

Depreciation recapture is the process of recapturing the depreciation previously claimed on a property. This is done by adding back the depreciation previously claimed to the gain on the sale of the property.

Examples of Completing Form 4797, Part II

Here are a few examples of completing Form 4797, Part II:

- Example 1: Sale of Equipment

- Sales price: $10,000

- Original cost: $15,000

- Accumulated depreciation: $5,000

- Gain or loss: $5,000 gain

- Example 2: Sale of Real Estate

- Sales price: $100,000

- Original cost: $150,000

- Accumulated depreciation: $20,000

- Gain or loss: $30,000 gain

Common Errors to Avoid on Form 4797, Part II

Here are a few common errors to avoid on Form 4797, Part II:

- Failure to report the sale of business property

- Incorrect calculation of gain or loss

- Failure to recapture depreciation

- Incorrect completion of Section A, B, C, D, or E

Tips for Completing Form 4797, Part II

Here are a few tips for completing Form 4797, Part II:

- Keep accurate records of business property sales

- Use a depreciation schedule to track accumulated depreciation

- Consult with a tax professional if you're unsure about completing the form

Additional Resources

If you're still unsure about completing Form 4797, Part II, here are some additional resources to help you:

- IRS Publication 946: How to Depreciate Property

- IRS Form 4797 Instructions

- Consult with a tax professional

FAQs

Q: What is the deadline for filing Form 4797, Part II? A: The deadline for filing Form 4797, Part II, is the same as the deadline for filing your tax return.

Q: Can I e-file Form 4797, Part II? A: Yes, you can e-file Form 4797, Part II, using tax software or through a tax professional.

Q: What is depreciation recapture? A: Depreciation recapture is the process of recapturing the depreciation previously claimed on a property.

What is the purpose of Form 4797, Part II?

+The purpose of Form 4797, Part II, is to report the sale of business property and calculate the gain or loss on the sale.

Who needs to file Form 4797, Part II?

+Business owners who have sold business property during the tax year need to file Form 4797, Part II.

What information do I need to complete Form 4797, Part II?

+You'll need to provide a description of the property sold, date of sale, sales price, original cost, accumulated depreciation, and depreciation method used.