The process of verifying a bank account can be a daunting task, especially when it comes to filling out Form 1239. However, with the right guidance, you can navigate this process with ease. In this article, we will explore the importance of Form 1239 bank account verification, its benefits, and provide 5 valuable tips to help you complete the process successfully.

Bank account verification is a critical step in various financial transactions, including tax refunds, direct deposits, and online payments. Form 1239 is a document used by the Internal Revenue Service (IRS) to verify an individual's or business's bank account information. The form is used to ensure that the account holder's name and account number match the information on file with the IRS. This verification process helps prevent errors, reduces the risk of identity theft, and ensures that funds are deposited into the correct account.

The benefits of verifying a bank account through Form 1239 are numerous. For one, it ensures that tax refunds and other payments are deposited into the correct account, eliminating the risk of errors or delays. Additionally, verifying a bank account helps prevent identity theft by ensuring that only authorized individuals or businesses have access to the account. Furthermore, verified bank accounts can help streamline financial transactions, making it easier to manage your finances.

Tip 1: Understand the Purpose of Form 1239

Before starting the verification process, it's essential to understand the purpose of Form 1239. The form is used to verify an individual's or business's bank account information, ensuring that the account holder's name and account number match the information on file with the IRS. This understanding will help you navigate the process with ease.

What Information is Required on Form 1239?

To complete Form 1239, you will need to provide the following information:

- Your name and address

- Your bank account number and routing number

- Your bank's name and address

- Your tax identification number (Social Security number or Employer Identification Number)

Tip 2: Gather Required Documents and Information

Before starting the verification process, ensure you have all the required documents and information. This includes:

- A voided check or a bank statement that shows your account number and routing number

- Your tax identification number (Social Security number or Employer Identification Number)

- Your bank's name and address

Having all the required documents and information readily available will help you complete the process quickly and efficiently.

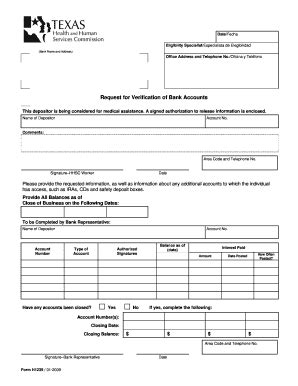

How to Complete Form 1239

To complete Form 1239, follow these steps:

- Download and print Form 1239 from the IRS website or obtain a copy from your bank

- Fill out the form with the required information, ensuring accuracy and completeness

- Sign and date the form

- Attach the required documents, such as a voided check or bank statement

- Submit the form to your bank or the IRS, depending on the specific requirements

Tip 3: Ensure Accuracy and Completeness

Accuracy and completeness are crucial when filling out Form 1239. Ensure that all information is correct, including your name, address, bank account number, and routing number. Incomplete or inaccurate information can lead to delays or errors in the verification process.

Common Mistakes to Avoid

When filling out Form 1239, avoid the following common mistakes:

- Incomplete or inaccurate information

- Missing or incorrect signatures

- Failure to attach required documents

- Incorrect or outdated bank account information

Tip 4: Submit the Form Correctly

Once you've completed Form 1239, ensure that you submit it correctly. Depending on the specific requirements, you may need to submit the form to your bank or the IRS. Follow the instructions carefully to avoid delays or errors.

What Happens After Submitting Form 1239?

After submitting Form 1239, the verification process typically takes a few days to complete. Once the verification is successful, your bank account will be updated, and you can start receiving tax refunds and other payments directly into your account.

Tip 5: Follow Up and Verify

Finally, it's essential to follow up and verify that your bank account has been successfully verified. You can do this by contacting your bank or checking your account online. This will ensure that your account is updated and ready to receive payments.

By following these 5 tips, you can ensure a smooth and successful Form 1239 bank account verification process. Remember to understand the purpose of the form, gather required documents and information, ensure accuracy and completeness, submit the form correctly, and follow up and verify the verification process.

We hope this article has provided you with valuable insights and tips on how to complete Form 1239 successfully. If you have any questions or concerns, please feel free to comment below. Don't forget to share this article with others who may benefit from this information.

What is Form 1239 used for?

+Form 1239 is used to verify an individual's or business's bank account information with the IRS.

What information is required on Form 1239?

+The form requires your name and address, bank account number and routing number, bank's name and address, and tax identification number (Social Security number or Employer Identification Number).

How long does the verification process take?

+The verification process typically takes a few days to complete.