As a taxpayer, one of the most crucial tasks is to file tax returns accurately and on time. For businesses and individuals with tax credits, Form 8990 is a crucial document that helps claim tax credits for qualified sick and family leave wages. However, completing this form can be overwhelming, especially for those who are new to tax filing. In this article, we will provide you with 5 tips to complete Form 8990 with ease, ensuring that you claim your tax credits without any hassle.

Understanding Form 8990

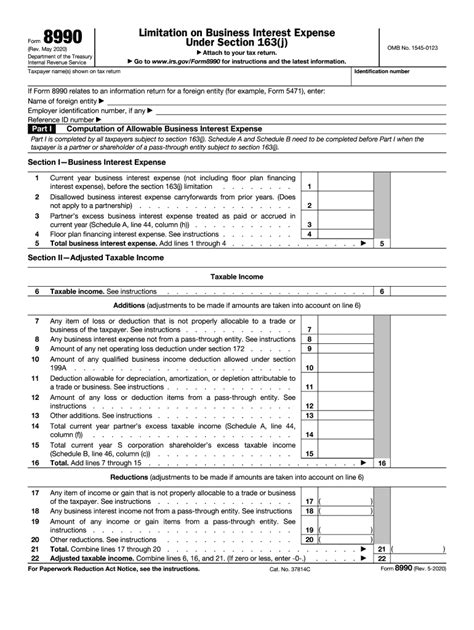

Before we dive into the tips, it's essential to understand what Form 8990 is and its purpose. Form 8990 is used to report qualified sick and family leave wages paid to employees under the Families First Coronavirus Response Act (FFCRA). The form helps businesses and individuals claim tax credits for these wages, which can be a significant relief during these challenging times.

Tips to Complete Form 8990

Now, let's move on to the 5 tips to complete Form 8990 with ease:

Tip 1: Gather All Necessary Documents

Before starting to fill out Form 8990, make sure you have all the necessary documents and information. This includes:

- Employee records, including dates of leave, number of hours taken, and wages paid

- Payroll records, including gross wages, taxes withheld, and employer contributions

- Records of qualified sick and family leave wages paid to employees

- Records of tax credits claimed in previous years (if applicable)

Having all the necessary documents will help you fill out the form accurately and avoid any errors.

Tip 2: Understand the Eligibility Criteria

To claim tax credits on Form 8990, you need to ensure that the wages you're claiming meet the eligibility criteria. The FFCRA requires that the wages be paid for qualified sick and family leave, which includes:

- Paid sick leave for employees who are unable to work due to COVID-19 symptoms or exposure

- Paid family leave for employees who need to care for a family member with COVID-19 symptoms or exposure

- Paid leave for employees who are unable to work due to school or childcare closures

Make sure you understand the eligibility criteria before claiming tax credits on Form 8990.

Tip 3: Calculate the Tax Credit Amount

The tax credit amount is calculated based on the qualified sick and family leave wages paid to employees. The credit amount is equal to 100% of the qualified wages, up to a maximum of $511 per day for qualified sick leave and $200 per day for qualified family leave.

To calculate the tax credit amount, you'll need to:

- Calculate the total qualified wages paid to employees

- Calculate the total tax credit amount based on the qualified wages

- Reduce the tax credit amount by any other tax credits claimed (if applicable)

Make sure you calculate the tax credit amount accurately to avoid any errors.

Tip 4: Report the Tax Credit on the Correct Form

The tax credit for qualified sick and family leave wages is reported on Form 8990, but it's also important to report the credit on the correct form. You'll need to:

- Report the tax credit on Form 8990, Part 1

- Report the tax credit on Form 941, Employer's Quarterly Federal Tax Return (if applicable)

- Report the tax credit on Form 944, Employer's Annual Federal Tax Return (if applicable)

Make sure you report the tax credit on the correct form to avoid any errors.

Tip 5: Consult with a Tax Professional (If Necessary)

If you're unsure about completing Form 8990 or have complex tax situations, it's always best to consult with a tax professional. A tax professional can help you:

- Understand the eligibility criteria and tax credit amount

- Calculate the tax credit amount accurately

- Report the tax credit on the correct form

- Avoid any errors or penalties

Don't hesitate to seek help if you need it.

Conclusion: Take Control of Your Tax Credits

Completing Form 8990 can be challenging, but with the right tips and guidance, you can take control of your tax credits and avoid any errors. By following these 5 tips, you'll be able to complete Form 8990 with ease and claim your tax credits without any hassle.

We encourage you to share your experiences and tips for completing Form 8990 in the comments section below. Don't forget to share this article with your friends and colleagues who may benefit from it.

What is Form 8990 used for?

+Form 8990 is used to report qualified sick and family leave wages paid to employees under the Families First Coronavirus Response Act (FFCRA). The form helps businesses and individuals claim tax credits for these wages.

Who is eligible for the tax credit?

+The tax credit is available to employers who pay qualified sick and family leave wages to employees under the FFCRA. The credit is also available to self-employed individuals who pay qualified sick and family leave wages to themselves.

How do I calculate the tax credit amount?

+The tax credit amount is calculated based on the qualified sick and family leave wages paid to employees. The credit amount is equal to 100% of the qualified wages, up to a maximum of $511 per day for qualified sick leave and $200 per day for qualified family leave.