Understanding the Discover Card IRS Consent Form 4506-C

As a Discover Card holder, you may have encountered the IRS Consent Form 4506-C, also known as the IVES (Income Verification Express Service) Consent Form. This form is a crucial document that allows Discover to verify your income with the Internal Revenue Service (IRS) to process your credit card application or request for credit limit increase. In this article, we will delve into the details of the Discover Card IRS Consent Form 4506-C, its purpose, and what you need to know.

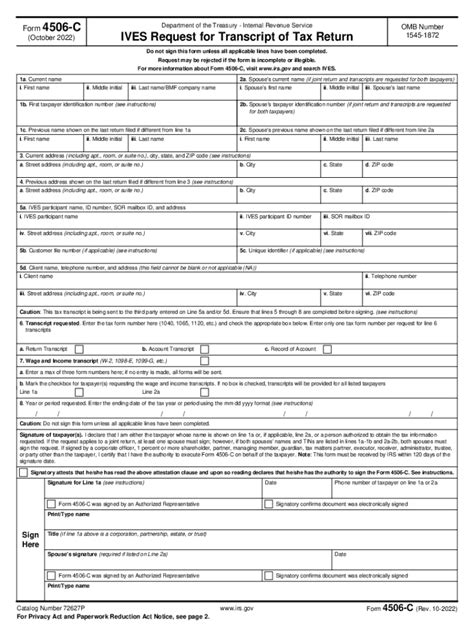

What is the IRS Consent Form 4506-C?

The IRS Consent Form 4506-C is a document that allows the IRS to disclose your tax return information to a third-party requester, in this case, Discover. The form is used to verify your income and other financial information to determine your creditworthiness. By signing the form, you are authorizing the IRS to release your tax return information to Discover for the purpose of processing your credit card application or request for credit limit increase.

Why is the IRS Consent Form 4506-C Required?

The IRS Consent Form 4506-C is required by the IRS to ensure that your tax return information is protected and only disclosed to authorized parties. The form is also required by Discover to verify your income and creditworthiness. By obtaining your consent, Discover can use your tax return information to make an informed decision about your credit card application or request for credit limit increase.

How to Complete the IRS Consent Form 4506-C

Completing the IRS Consent Form 4506-C is a straightforward process. Here are the steps to follow:

- Review the form carefully: Before signing the form, review it carefully to ensure that you understand what you are authorizing.

- Provide required information: Fill in the required information, including your name, address, and social security number.

- Sign and date the form: Sign and date the form to authorize the IRS to disclose your tax return information to Discover.

- Return the form: Return the completed form to Discover, either by mail or fax, as instructed.

Benefits of the IRS Consent Form 4506-C

The IRS Consent Form 4506-C provides several benefits to Discover Card holders. Some of the benefits include:

- Streamlined application process: By authorizing the IRS to disclose your tax return information, you can expedite the credit card application or request for credit limit increase process.

- Improved credit decisioning: The IRS Consent Form 4506-C allows Discover to make an informed decision about your creditworthiness, based on your actual income and financial information.

- Enhanced security: The form ensures that your tax return information is protected and only disclosed to authorized parties.

Common Questions and Answers

Here are some common questions and answers about the IRS Consent Form 4506-C:

Q: What is the purpose of the IRS Consent Form 4506-C? A: The form is used to authorize the IRS to disclose your tax return information to Discover for the purpose of processing your credit card application or request for credit limit increase.

Q: Is the IRS Consent Form 4506-C mandatory? A: Yes, the form is required by the IRS and Discover to verify your income and creditworthiness.

Q: How long is the IRS Consent Form 4506-C valid? A: The form is valid for a period of 120 days from the date of signing.

Best Practices for Completing the IRS Consent Form 4506-C

Here are some best practices for completing the IRS Consent Form 4506-C:

- Review the form carefully before signing

- Ensure that you understand what you are authorizing

- Provide accurate and complete information

- Sign and date the form correctly

- Return the form promptly to avoid delays in processing your credit card application or request for credit limit increase

Conclusion

In conclusion, the IRS Consent Form 4506-C is an essential document that allows Discover to verify your income and creditworthiness. By understanding the purpose and requirements of the form, you can ensure a smooth and efficient application process. Remember to review the form carefully, provide accurate and complete information, and sign and date the form correctly.

We hope this article has provided you with valuable insights into the Discover Card IRS Consent Form 4506-C. If you have any questions or comments, please feel free to share them below.

What is the purpose of the IRS Consent Form 4506-C?

+The purpose of the IRS Consent Form 4506-C is to authorize the IRS to disclose your tax return information to Discover for the purpose of processing your credit card application or request for credit limit increase.

Is the IRS Consent Form 4506-C mandatory?

+Yes, the IRS Consent Form 4506-C is mandatory for Discover to verify your income and creditworthiness.

How long is the IRS Consent Form 4506-C valid?

+The IRS Consent Form 4506-C is valid for a period of 120 days from the date of signing.