Connecticut residents who are beneficiaries of an estate or trust are likely familiar with the CT Form 1041. This form is a crucial part of the state's tax system, and understanding its intricacies can help individuals navigate the complexities of estate and trust taxation. In this article, we will delve into the essential facts about CT Form 1041, exploring its purpose, requirements, and implications for beneficiaries.

What is CT Form 1041?

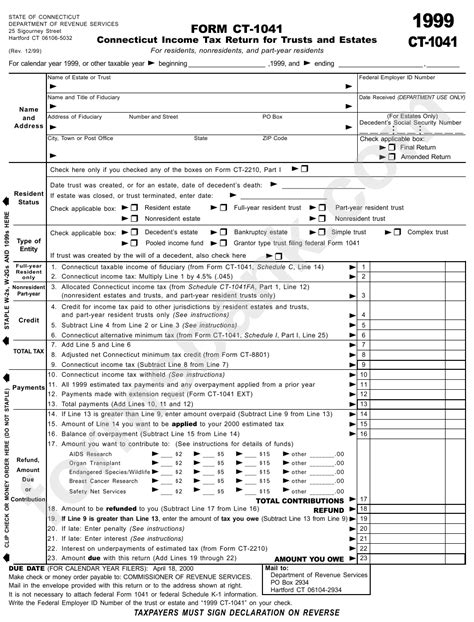

CT Form 1041 is the Connecticut fiduciary income tax return form. It is used by the fiduciary of an estate or trust to report the income, deductions, and credits of the estate or trust for a given tax year. The form is typically filed by the executor or trustee of the estate or trust, and it is used to calculate the tax liability of the estate or trust.

Who Needs to File CT Form 1041?

Not all estates and trusts are required to file CT Form 1041. Generally, the following types of estates and trusts must file the form:

- Estates: Estates that have a gross income of $600 or more during the tax year, or that have a tax liability.

- Trusts: Trusts that have a gross income of $100 or more during the tax year, or that have a tax liability.

What Information is Required on CT Form 1041?

CT Form 1041 requires a range of information, including:

- The name, address, and federal identification number of the estate or trust

- The name, address, and telephone number of the fiduciary

- The income of the estate or trust, including interest, dividends, and capital gains

- The deductions and credits of the estate or trust

- The tax liability of the estate or trust

How to Calculate Tax Liability on CT Form 1041

Calculating the tax liability on CT Form 1041 can be complex, as it involves applying the Connecticut tax rates to the taxable income of the estate or trust. The tax rates range from 3% to 7%, depending on the level of taxable income. Beneficiaries may be able to claim a credit against their Connecticut income tax liability for taxes paid by the estate or trust.

What are the Benefits of Filing CT Form 1041?

Filing CT Form 1041 provides several benefits to beneficiaries, including:

- Compliance with Connecticut tax law: Filing the form ensures that the estate or trust is in compliance with Connecticut tax law, avoiding potential penalties and fines.

- Accurate calculation of tax liability: The form helps to accurately calculate the tax liability of the estate or trust, ensuring that beneficiaries are not over- or under-paying taxes.

- Claiming credits: Beneficiaries may be able to claim a credit against their Connecticut income tax liability for taxes paid by the estate or trust.

Common Mistakes to Avoid When Filing CT Form 1041

When filing CT Form 1041, beneficiaries should avoid common mistakes, such as:

- Failing to report all income: Ensure that all income, including interest, dividends, and capital gains, is reported on the form.

- Miscalculating tax liability: Accurately calculate the tax liability of the estate or trust to avoid over- or under-paying taxes.

- Missing deadlines: File the form on time to avoid penalties and fines.

How to Get Help with CT Form 1041

Beneficiaries who need help with CT Form 1041 can:

- Consult a tax professional: A tax professional can provide guidance on completing the form and ensuring compliance with Connecticut tax law.

- Contact the Connecticut Department of Revenue Services: The department can provide information and assistance with filing the form.

- Use online resources: Online resources, such as tax preparation software, can provide guidance and support with completing the form.

In conclusion, CT Form 1041 is an essential part of the Connecticut tax system, and understanding its intricacies can help beneficiaries navigate the complexities of estate and trust taxation. By following the tips and guidelines outlined in this article, beneficiaries can ensure compliance with Connecticut tax law, accurately calculate tax liability, and claim credits. If you have any further questions or concerns, don't hesitate to ask in the comments below.

What is the deadline for filing CT Form 1041?

+The deadline for filing CT Form 1041 is the 15th day of the fourth month following the end of the tax year.

Can I file CT Form 1041 electronically?

+Yes, CT Form 1041 can be filed electronically through the Connecticut Department of Revenue Services' website.

What is the penalty for not filing CT Form 1041?

+The penalty for not filing CT Form 1041 can range from $50 to $100, depending on the circumstances.