As a senior citizen in Colorado, navigating the complexities of property taxes can be overwhelming. However, the state offers a valuable benefit to help alleviate some of this burden: the Senior Property Tax Exemption. In this article, we'll delve into the details of the Colorado Senior Property Tax Exemption form, exploring its benefits, eligibility requirements, and step-by-step application process.

The importance of property tax exemptions for seniors cannot be overstated. As retirees often live on fixed incomes, property taxes can become a significant expense, potentially threatening their financial stability. By exempting a portion of their property taxes, Colorado's Senior Property Tax Exemption helps seniors maintain their independence, ensuring they can continue to live in their homes without undue financial strain.

Benefits of the Colorado Senior Property Tax Exemption

The Colorado Senior Property Tax Exemption provides a substantial reduction in property taxes for eligible seniors. Specifically, the exemption allows seniors to subtract 50% of the first $200,000 of their primary residence's actual value from their property taxes. This can result in significant savings, helping seniors allocate their resources more effectively.

To illustrate the potential benefits, consider the following example:

- A senior's primary residence has an actual value of $250,000.

- The senior's property taxes are $1,500 per year.

- With the Senior Property Tax Exemption, the senior can subtract 50% of the first $200,000 of the home's actual value, resulting in a taxable value of $150,000.

- The senior's new property taxes would be approximately $900 per year, representing a savings of $600.

Eligibility Requirements

To qualify for the Colorado Senior Property Tax Exemption, applicants must meet specific requirements:

- Be 65 years or older by January 1 of the exemption year

- Own and occupy the property as their primary residence

- Be a Colorado resident

- Not have claimed a homestead exemption in any other state

Applicants must also meet income requirements, which vary depending on the exemption year. For the 2022 exemption year, the gross income limit is $13,660 for single applicants and $20,300 for married couples.

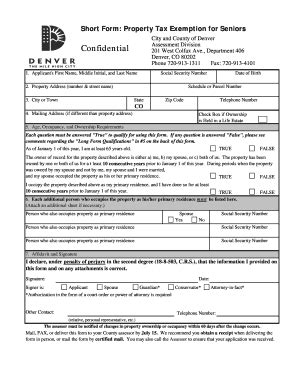

Step-by-Step Application Process

To apply for the Colorado Senior Property Tax Exemption, follow these steps:

- Gather required documents: You'll need to provide proof of age, residency, and income. Acceptable documents include a valid driver's license, birth certificate, social security statement, and income tax return.

- Complete the application form: Download and complete the Senior Property Tax Exemption application form (available on the Colorado Department of Local Affairs website).

- Submit the application: Mail the completed application to the address listed on the form.

- Wait for processing: The Colorado Department of Local Affairs will review your application and notify you of the exemption amount.

Important Deadlines and Reminders

- Application deadline: The deadline for submitting the Senior Property Tax Exemption application is July 15 of the exemption year.

- Notification: You'll receive notification of the exemption amount by October 15 of the exemption year.

- Renewal: You'll need to reapply for the exemption every two years to maintain eligibility.

Additional Resources

For more information on the Colorado Senior Property Tax Exemption, consult the following resources:

- Colorado Department of Local Affairs: Senior Property Tax Exemption

- Colorado Senior Resource Book: Property Tax Exemption

- Local county assessor's office

Conclusion

The Colorado Senior Property Tax Exemption offers a valuable benefit to eligible seniors, helping to reduce their property taxes and maintain financial stability. By understanding the eligibility requirements, application process, and deadlines, seniors can take advantage of this exemption and enjoy greater peace of mind. If you're a senior homeowner in Colorado, don't hesitate to explore this opportunity and start saving on your property taxes today.

We encourage you to share your experiences and questions about the Colorado Senior Property Tax Exemption in the comments below.

What is the deadline for submitting the Senior Property Tax Exemption application?

+The deadline for submitting the Senior Property Tax Exemption application is July 15 of the exemption year.

How often do I need to reapply for the Senior Property Tax Exemption?

+You'll need to reapply for the exemption every two years to maintain eligibility.

What is the income limit for the 2022 Senior Property Tax Exemption?

+The gross income limit for the 2022 exemption year is $13,660 for single applicants and $20,300 for married couples.