As an employee, receiving your W2 form is a crucial part of the tax filing process. The Paylocity W2 form is an essential document that provides details about your income and taxes withheld from your employer, Paylocity. In this article, we will delve into the world of Paylocity W2 forms, explaining what they are, how to access them, and what information they contain.

Understanding the Paylocity W2 Form

The Paylocity W2 form, also known as the Wage and Tax Statement, is a document that employers are required to provide to their employees and the Social Security Administration (SSA) each year. The form reports an employee's income, taxes withheld, and other relevant tax information. As an employee of Paylocity, you can expect to receive your W2 form by January 31st of each year, which is the deadline for employers to distribute these forms.

What Information is Included on the Paylocity W2 Form?

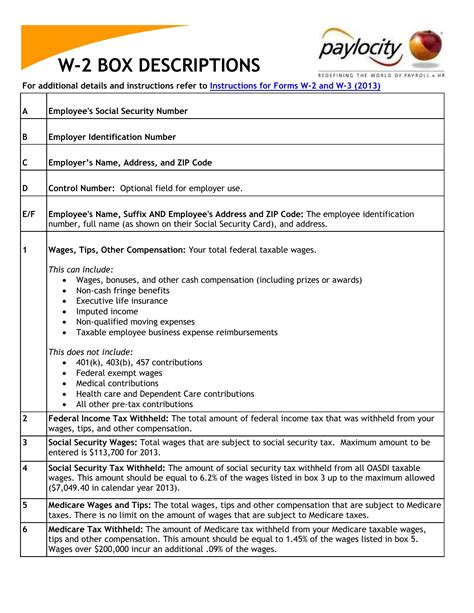

The Paylocity W2 form contains essential information that you will need to file your taxes accurately. Some of the key details included on the form are:

- Your name, address, and Social Security number

- Paylocity's employer identification number (EIN)

- Your wages, tips, and other compensation

- Federal income tax withheld

- Social Security tax withheld

- Medicare tax withheld

- State and local taxes withheld (if applicable)

How to Access Your Paylocity W2 Form

As a Paylocity employee, you can access your W2 form through the Paylocity portal or through the US Postal Service. Here are the steps to access your W2 form:

- Log in to the Paylocity portal using your username and password

- Click on the "My Pay" or "Tax Documents" tab

- Select the tax year for which you want to view your W2 form

- Click on the "View W2" button to display the form

Alternatively, if you prefer to receive a paper copy of your W2 form, you can opt-out of electronic delivery through the Paylocity portal. In this case, your W2 form will be mailed to you by January 31st of each year.

Common Issues with Paylocity W2 Forms

While Paylocity strives to provide accurate and timely W2 forms, issues can arise. Here are some common problems that employees may encounter:

- Incorrect or missing information: If you notice any errors or omissions on your W2 form, contact Paylocity's payroll department immediately.

- Late delivery: If you have not received your W2 form by February 1st, contact Paylocity's payroll department to request a replacement.

- Duplicate forms: If you receive multiple W2 forms, verify that the information is accurate and keep the most recent form for your records.

What to Do if You Have Questions or Concerns

If you have questions or concerns about your Paylocity W2 form, you can contact Paylocity's payroll department directly. Here are the steps to follow:

- Log in to the Paylocity portal and click on the "Help" or "Contact Us" tab

- Submit a request for assistance, including a detailed description of your issue

- A Paylocity representative will respond to your inquiry within 24-48 hours

Benefits of the Paylocity W2 Form

The Paylocity W2 form provides several benefits to employees, including:

- Accurate tax filing: The W2 form ensures that you have the necessary information to file your taxes accurately and on time.

- Compliance with tax laws: The W2 form helps Paylocity comply with tax laws and regulations, ensuring that employees are not liable for any errors or omissions.

- Record-keeping: The W2 form serves as a record of your income and taxes withheld, which can be useful for future reference.

Best Practices for Managing Your Paylocity W2 Form

To ensure that you manage your Paylocity W2 form effectively, follow these best practices:

- Verify the accuracy of your W2 form: Review your W2 form carefully to ensure that all information is accurate and complete.

- Keep a copy for your records: Save a copy of your W2 form for your records, in case you need to refer to it in the future.

- File your taxes promptly: Use the information on your W2 form to file your taxes promptly and avoid any penalties or fines.

Conclusion

In conclusion, the Paylocity W2 form is an essential document that provides employees with the necessary information to file their taxes accurately. By understanding what the form contains, how to access it, and how to manage it effectively, you can ensure that you comply with tax laws and regulations. If you have any questions or concerns about your Paylocity W2 form, don't hesitate to contact Paylocity's payroll department for assistance.

We hope this article has provided you with a comprehensive guide to the Paylocity W2 form. If you have any further questions or concerns, please don't hesitate to ask. Share your thoughts and comments below, and don't forget to share this article with your colleagues and friends who may find it useful.

What is the deadline for employers to distribute W2 forms?

+The deadline for employers to distribute W2 forms is January 31st of each year.

How can I access my Paylocity W2 form?

+You can access your Paylocity W2 form through the Paylocity portal or through the US Postal Service.

What information is included on the Paylocity W2 form?

+The Paylocity W2 form includes your name, address, and Social Security number, as well as your wages, taxes withheld, and other relevant tax information.