Filing taxes can be a daunting task, especially when it comes to navigating the intricacies of state-specific tax forms. For residents of Virginia, understanding how to properly file Form 760ES is crucial for avoiding penalties and ensuring compliance with state tax regulations. In this article, we will delve into the world of Virginia Form 760ES, providing six essential tips to help you navigate the process with ease.

Understanding Virginia Form 760ES

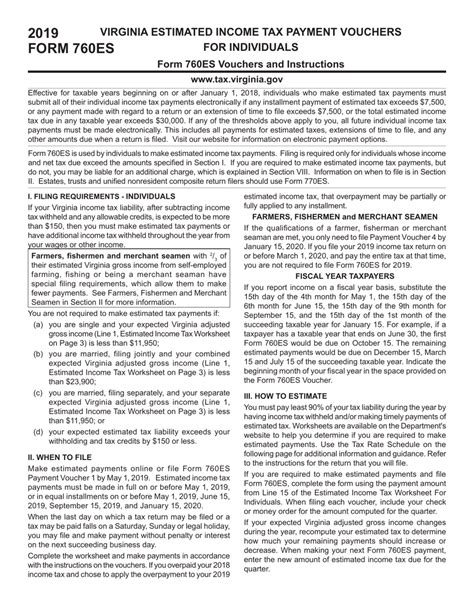

Before we dive into the tips, it's essential to understand what Form 760ES is and why it's necessary. Form 760ES is the Virginia Estimated Income Tax Payment Voucher, which is used by individuals and businesses to make estimated tax payments to the Commonwealth of Virginia. This form is typically filed on a quarterly basis, and it's used to report and pay estimated taxes on income that is not subject to withholding, such as self-employment income, interest, dividends, and capital gains.

Tip 1: Determine if You Need to File Form 760ES

The first step in filing Form 760ES is to determine if you need to file it in the first place. You are required to file Form 760ES if you expect to owe more than $1,000 in taxes for the year, and you do not have Virginia income tax withheld from your income. This includes individuals who are self-employed, receive income from rental properties, or have investments that generate income. If you're unsure whether you need to file Form 760ES, consult with a tax professional or contact the Virginia Department of Taxation.

Tip 2: Gather Required Information

To file Form 760ES, you will need to gather specific information, including:

- Your name and Social Security number

- Your Virginia tax account number (if you have one)

- Your estimated tax liability for the year

- The amount of tax you have already paid or withheld

- The amount of tax you are paying with the voucher

Make sure to have all this information readily available before starting the filing process.

Tip 3: Choose the Right Filing Status

Choose the Right Filing Status

When filing Form 760ES, you will need to choose the correct filing status. This includes:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Your filing status will affect your tax liability, so it's essential to choose the correct status.

Tip 4: Calculate Your Estimated Tax Liability

Calculate Your Estimated Tax Liability

To file Form 760ES, you will need to calculate your estimated tax liability for the year. You can use Form 760ES to estimate your tax liability based on your income and deductions. You can also use tax software or consult with a tax professional to help with the calculation.

Tip 5: File on Time

Form 760ES is typically filed on a quarterly basis, with deadlines as follows:

- April 15th for the first quarter (January 1 - March 31)

- June 15th for the second quarter (April 1 - May 31)

- September 15th for the third quarter (June 1 - August 31)

- January 15th of the following year for the fourth quarter (September 1 - December 31)

Make sure to file on time to avoid penalties and interest.

Tip 6: Pay Electronically

Pay Electronically

To make the filing process easier and more efficient, consider paying electronically. The Virginia Department of Taxation offers several electronic payment options, including:

- e-Check

- Credit card

- Debit card

Paying electronically can help reduce the risk of errors and ensure timely payment.

Get Help When You Need It

Filing Form 760ES can be a complex process, especially for those who are new to Virginia state taxes. If you're unsure about any aspect of the filing process, don't hesitate to seek help. The Virginia Department of Taxation offers resources and guidance to help you navigate the process.

Share Your Thoughts

We hope these tips have helped you understand the process of filing Virginia Form 760ES. If you have any questions or comments, please share them with us. Your feedback is invaluable in helping us provide the best possible guidance.

What is the deadline for filing Form 760ES?

+Form 760ES is typically filed on a quarterly basis, with deadlines as follows: April 15th for the first quarter, June 15th for the second quarter, September 15th for the third quarter, and January 15th of the following year for the fourth quarter.

Do I need to file Form 760ES if I'm self-employed?

+Yes, if you're self-employed and expect to owe more than $1,000 in taxes for the year, you will need to file Form 760ES.

Can I pay my estimated taxes electronically?

+Yes, the Virginia Department of Taxation offers several electronic payment options, including e-Check, credit card, and debit card.