Maintaining health insurance coverage is crucial for individuals and families to ensure they can afford medical care when needed. However, life circumstances can sometimes lead to a lapse in coverage. If you're a CareFirst member who has experienced a coverage lapse, you may be eligible for reinstatement. In this article, we'll provide a comprehensive guide on the CareFirst reinstatement form, including the process, requirements, and benefits of reinstating your coverage.

Reinstatement is a valuable option for those who have experienced a coverage lapse due to non-payment or other reasons. It allows you to reactivate your previous coverage without having to reapply or go through the underwriting process again. However, the reinstatement process can be complex, and understanding the requirements and steps involved is essential to ensure a smooth transition.

Understanding the CareFirst Reinstatement Form

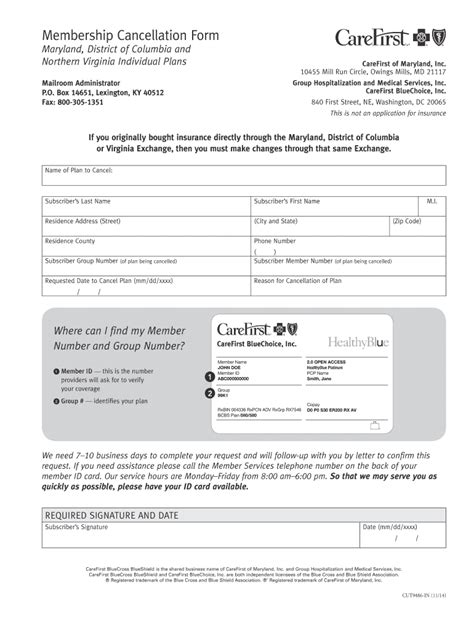

The CareFirst reinstatement form is a document that you'll need to complete and submit to reactivate your lapsed coverage. The form typically includes personal and coverage information, as well as a statement explaining the reason for the coverage lapse. It's essential to ensure that you provide accurate and complete information to avoid delays or rejection of your reinstatement request.

Eligibility Requirements

To be eligible for reinstatement, you must meet certain requirements. These typically include:

- You must have had a previous CareFirst policy that lapsed due to non-payment or other reasons.

- You must not have had a break in coverage exceeding 63 days.

- You must not have any outstanding premiums or debts owed to CareFirst.

- You must not have made any material misrepresentations on your original application.

Step-by-Step Guide to Completing the CareFirst Reinstatement Form

Completing the CareFirst reinstatement form requires careful attention to detail and accurate information. Here's a step-by-step guide to help you through the process:

- Gather required documents: Before starting the form, ensure you have all the necessary documents, including your previous policy information, identification, and proof of income (if applicable).

- Download or request the form: You can download the CareFirst reinstatement form from the company's website or request a copy by mail or phone.

- Complete the form accurately: Fill out the form carefully, ensuring that you provide accurate and complete information. Make sure to sign and date the form.

- Attach required documentation: Attach all required documents, including proof of income, identification, and previous policy information.

- Submit the form: Submit the completed form and supporting documentation to CareFirst via mail, fax, or email.

Processing Time and Approval

Once you've submitted the CareFirst reinstatement form, it will be reviewed and processed. The processing time typically takes 7-10 business days, but this may vary depending on the complexity of your case. If your reinstatement is approved, you'll receive a notification with details on your new coverage effective date and any outstanding premiums or debts.

Benefits of Reinstating Your CareFirst Coverage

Reinstating your CareFirst coverage offers several benefits, including:

- Continuous coverage: Reinstatement ensures that you maintain continuous coverage, avoiding any gaps in protection.

- No reapplication required: You don't need to reapply for coverage, saving you time and effort.

- No underwriting required: You won't need to go through the underwriting process again, which can be complex and time-consuming.

- Same coverage terms: Your reinstated coverage will have the same terms and conditions as your previous policy.

Common Mistakes to Avoid

When completing the CareFirst reinstatement form, avoid common mistakes that can delay or reject your reinstatement request. These include:

- Inaccurate or incomplete information: Ensure that you provide accurate and complete information to avoid delays or rejection.

- Missing documentation: Attach all required documents to avoid delays or rejection.

- Late submission: Submit the form and supporting documentation on time to avoid delays or rejection.

Conclusion

Reinstating your CareFirst coverage can be a complex process, but understanding the requirements and steps involved can make it easier. By following this step-by-step guide and avoiding common mistakes, you can ensure a smooth transition and maintain continuous coverage. If you have any questions or concerns, don't hesitate to contact CareFirst or a licensed insurance professional for guidance.

We encourage you to share your experiences or ask questions about the CareFirst reinstatement form in the comments section below. Your feedback and insights can help others navigating the reinstatement process.

What is the CareFirst reinstatement form?

+The CareFirst reinstatement form is a document that you need to complete and submit to reactivate your lapsed coverage.

How long does the reinstatement process take?

+The processing time typically takes 7-10 business days, but this may vary depending on the complexity of your case.

What are the benefits of reinstating my CareFirst coverage?

+Reinstating your CareFirst coverage offers several benefits, including continuous coverage, no reapplication required, no underwriting required, and same coverage terms.