Donating a vehicle to a charitable organization can be a great way to give back to the community while also receiving a tax deduction. However, the process of reporting and claiming this deduction can be complex. This is where the IRS Form 1098-C comes in. In this article, we will delve into the world of vehicle donations, the importance of Form 1098-C, and provide a comprehensive guide on how to complete and utilize this form.

Understanding Vehicle Donations and Form 1098-C

When you donate a vehicle to a qualified charitable organization, you are eligible to claim a tax deduction based on the vehicle's fair market value (FMV). The FMV is the price that a willing buyer would pay for the vehicle in its current condition. To claim this deduction, you will need to obtain a written acknowledgment from the charitable organization, which is typically provided on Form 1098-C.

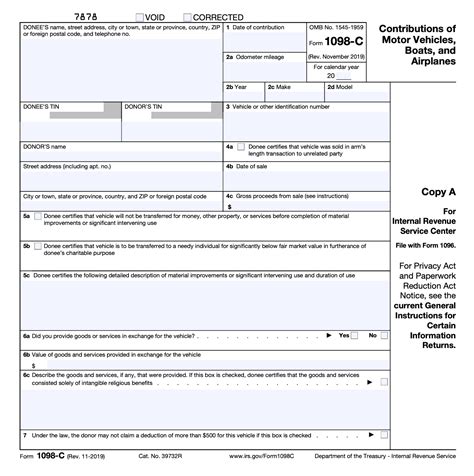

Form 1098-C is a document that charitable organizations use to acknowledge the receipt of a donated vehicle and provide the donor with the necessary information to claim a tax deduction. The form includes details such as the vehicle's make, model, year, and VIN, as well as the date of the donation and the FMV of the vehicle.

The Importance of Form 1098-C

Form 1098-C is a crucial document for both the donor and the charitable organization. For the donor, it provides the necessary information to claim a tax deduction, which can result in significant tax savings. For the charitable organization, it serves as proof of the donation and helps to ensure compliance with IRS regulations.

In addition to its practical uses, Form 1098-C also plays a role in maintaining transparency and accountability in the vehicle donation process. By providing a standardized form for reporting vehicle donations, the IRS can track and monitor donations, reducing the risk of abuse and ensuring that charitable organizations are using donations for their intended purpose.

Benefits of Form 1098-C

The benefits of Form 1098-C are numerous:

• Provides necessary information for tax deduction • Serves as proof of donation • Helps maintain transparency and accountability • Reduces risk of abuse • Ensures compliance with IRS regulations

How to Complete Form 1098-C

Completing Form 1098-C is a relatively straightforward process. Here's a step-by-step guide:

- Obtain the form: The charitable organization should provide you with a completed Form 1098-C within 30 days of the donation.

- Review the form: Verify that the form includes all necessary information, such as the vehicle's make, model, year, and VIN, as well as the date of the donation and the FMV of the vehicle.

- Check for errors: Ensure that the form is accurate and complete. If you find any errors, contact the charitable organization to request corrections.

- Attach to tax return: Attach the completed Form 1098-C to your tax return (Form 1040) to claim your tax deduction.

Common Mistakes to Avoid

When completing Form 1098-C, be aware of the following common mistakes:

• Inaccurate or incomplete information • Failure to attach the form to the tax return • Incorrect valuation of the vehicle • Failure to obtain a written acknowledgment from the charitable organization

Vehicle Donation Process

The vehicle donation process typically involves the following steps:

- Choose a charitable organization: Select a qualified charitable organization that accepts vehicle donations.

- Gather necessary documents: Collect the vehicle's title, registration, and any other required documents.

- Donate the vehicle: Transfer ownership of the vehicle to the charitable organization.

- Obtain a written acknowledgment: Receive a written acknowledgment from the charitable organization, which should include Form 1098-C.

- Claim your tax deduction: Attach Form 1098-C to your tax return and claim your tax deduction.

Vehicle Donation Tips

Here are some valuable tips to keep in mind when donating a vehicle:

• Research the charitable organization • Ensure the organization is qualified • Gather all necessary documents • Obtain a written acknowledgment • Claim your tax deduction

Printable Form 1098-C

If you need to obtain a printable Form 1098-C, you can download it from the IRS website or request a copy from the charitable organization.

IRS Form 1098-C Download

You can download Form 1098-C from the IRS website by following these steps:

- Visit the IRS website (irs.gov)

- Search for "Form 1098-C"

- Click on the "Download" button

- Save the form to your computer

Conclusion

Donating a vehicle to a charitable organization can be a rewarding experience, and Form 1098-C plays a crucial role in the process. By understanding the importance of this form and how to complete it, you can ensure a smooth and successful donation experience. Remember to research the charitable organization, gather all necessary documents, and obtain a written acknowledgment to claim your tax deduction.

What is Form 1098-C?

+Form 1098-C is a document that charitable organizations use to acknowledge the receipt of a donated vehicle and provide the donor with the necessary information to claim a tax deduction.

How do I obtain Form 1098-C?

+The charitable organization should provide you with a completed Form 1098-C within 30 days of the donation. You can also download the form from the IRS website.

What information is included on Form 1098-C?

+Form 1098-C includes the vehicle's make, model, year, and VIN, as well as the date of the donation and the FMV of the vehicle.