Estate planning and taxation can be complex and overwhelming, especially for those who have recently lost a loved one. In California, one of the crucial steps in the estate settlement process is filing the California Form 541, also known as the Estate Tax Return. This form is used to report the estate's income, deductions, and credits, as well as to calculate the estate's tax liability. In this article, we will provide a comprehensive guide on how to file the California Form 541, including the requirements, steps, and deadlines.

Understanding the California Form 541

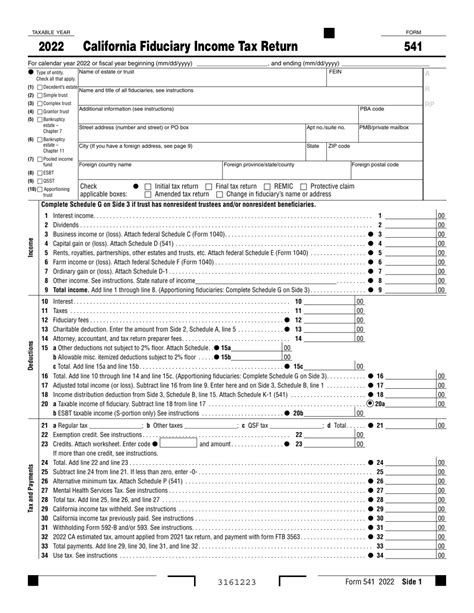

The California Form 541 is a tax return form used to report the income, deductions, and credits of a deceased person's estate. The form is used to calculate the estate's tax liability, which is typically paid by the executor or personal representative of the estate. The form is also used to claim any refund due to the estate.

Who Needs to File the California Form 541?

Not all estates are required to file the California Form 541. The form is typically required for estates that have a gross income of $600 or more, or if the estate has a tax liability. However, even if the estate does not meet these requirements, it may still be necessary to file the form if the estate has any tax credits or deductions to claim.

Requirements for Filing the California Form 541

To file the California Form 541, the following requirements must be met:

- The estate must have a gross income of $600 or more

- The estate must have a tax liability

- The estate must have any tax credits or deductions to claim

- The estate must have a valid tax identification number (TIN)

- The estate must have a valid address and phone number

Steps to File the California Form 541

Filing the California Form 541 can be a complex process, but the following steps can help guide you through it:

- Gather all necessary documents and information, including:

- The deceased person's Social Security number or TIN

- The estate's tax identification number (TIN)

- The estate's address and phone number

- All income statements, including W-2s and 1099s

- All deduction and credit documents, including receipts and invoices

- Complete the California Form 541, including:

- The estate's income, deductions, and credits

- The estate's tax liability

- Any refund due to the estate

- Attach all necessary schedules and forms, including:

- Schedule A: Itemized Deductions

- Schedule B: Interest and Dividend Income

- Schedule C: Business Income and Expenses

- Schedule D: Capital Gains and Losses

- Sign and date the form

- File the form with the California Franchise Tax Board (FTB) by the deadline

Deadlines for Filing the California Form 541

The deadline for filing the California Form 541 is typically the 15th day of the 4th month following the end of the estate's tax year. However, if the estate's tax year ends on December 31, the deadline is typically April 15.

Penalties for Late Filing

If the California Form 541 is filed late, the estate may be subject to penalties and interest. The penalty for late filing is typically 5% of the unpaid tax liability for each month or part of a month that the return is late, up to a maximum of 25%.

Conclusion and Next Steps

Filing the California Form 541 can be a complex and time-consuming process, but it is a crucial step in the estate settlement process. By following the steps and requirements outlined in this guide, you can ensure that the estate's tax liability is accurately calculated and reported to the California Franchise Tax Board.

If you have any questions or concerns about filing the California Form 541, it is recommended that you consult with a qualified tax professional or attorney. They can provide guidance and support throughout the process and help ensure that the estate's tax liability is minimized.

We hope this guide has been helpful in providing a comprehensive overview of the California Form 541 and the filing process. If you have any further questions or would like to share your experiences with filing the California Form 541, please comment below.

Who needs to file the California Form 541?

+The California Form 541 is typically required for estates that have a gross income of $600 or more, or if the estate has a tax liability.

What is the deadline for filing the California Form 541?

+The deadline for filing the California Form 541 is typically the 15th day of the 4th month following the end of the estate's tax year.

What are the penalties for late filing?

+The penalty for late filing is typically 5% of the unpaid tax liability for each month or part of a month that the return is late, up to a maximum of 25%.