The Golden State of California, known for its beautiful beaches, scenic mountains, and thriving economy. As a resident of California or a business operating within the state, understanding the tax regulations is essential. One crucial aspect of California taxes is the withholding form, which can be overwhelming, especially for newcomers. In this comprehensive guide, we will break down the California withholding form, its types, how to complete it, and provide valuable tips to ensure you're on the right track.

Understanding California Withholding Forms

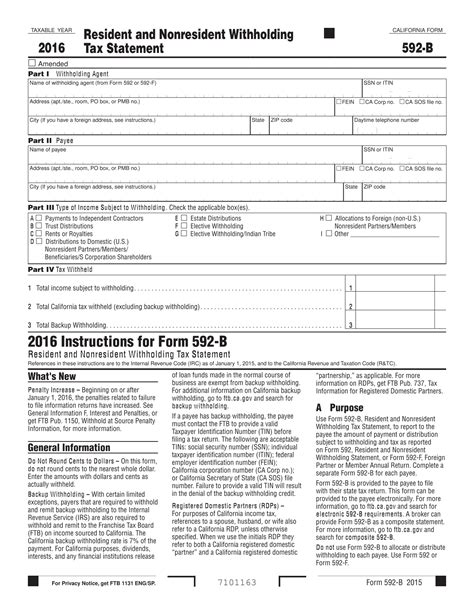

California withholding forms are used to report and pay state income taxes. These forms are crucial for employers, employees, and businesses to comply with California's tax laws. The most common types of withholding forms include:

- DE 4: California Employee's Withholding Allowance Certificate

- DE 4P: Certificate of Withholding for Periodic Payments

- DE 3BHW: Withholding Certificate for Pension or Annuity Payments

Each form serves a specific purpose and is used in different situations. For example, the DE 4 form is used by employees to claim withholding allowances, while the DE 4P form is used by employers to report periodic payments.

Types of California Withholding Forms

California has several withholding forms, each with its own unique characteristics and requirements. Some of the most common types of withholding forms include:

- DE 4: California Employee's Withholding Allowance Certificate This form is used by employees to claim withholding allowances. It helps employers determine how much state income tax to withhold from an employee's paycheck.

- DE 4P: Certificate of Withholding for Periodic Payments This form is used by employers to report periodic payments, such as pensions, annuities, or retirement accounts. It helps the state track and collect taxes on these types of income.

- DE 3BHW: Withholding Certificate for Pension or Annuity Payments This form is used to certify the withholding status of pension or annuity payments.

How to Complete a California Withholding Form

Completing a California withholding form can be a daunting task, but with the right guidance, it's easier than you think. Here's a step-by-step guide to help you complete a DE 4 form:

- Gather necessary information: Before starting, make sure you have the necessary information, including your name, address, social security number, and the number of allowances you're claiming.

- Determine your filing status: Choose your filing status, such as single, married, or head of household.

- Claim withholding allowances: Claim the number of withholding allowances you're eligible for. This will determine how much state income tax is withheld from your paycheck.

- Sign and date the form: Sign and date the form, making sure to keep a copy for your records.

California Withholding Form Tips and Reminders

Here are some valuable tips and reminders to keep in mind when dealing with California withholding forms:

- Update your withholding status: If your withholding status changes, make sure to update your DE 4 form to reflect the changes.

- Keep accurate records: Keep accurate records of your withholding forms, including the date you submitted them and the number of allowances you claimed.

- Consult a tax professional: If you're unsure about how to complete a withholding form or have complex tax situations, consider consulting a tax professional.

Frequently Asked Questions

What is the purpose of a California withholding form?

+California withholding forms are used to report and pay state income taxes. They help employers determine how much state income tax to withhold from an employee's paycheck.

What types of California withholding forms are there?

+There are several types of California withholding forms, including the DE 4, DE 4P, and DE 3BHW forms. Each form serves a specific purpose and is used in different situations.

How do I complete a California withholding form?

+To complete a California withholding form, gather necessary information, determine your filing status, claim withholding allowances, and sign and date the form.

By understanding the different types of California withholding forms and how to complete them, you'll be better equipped to navigate the state's tax regulations. Remember to keep accurate records, update your withholding status, and consult a tax professional if needed. Share your thoughts and experiences with California withholding forms in the comments below.