Employment eligibility verification is a crucial process for employers in the United States. The Immigration and Nationality Act (INA) requires employers to verify the identity and work authorization of all new hires, including U.S. citizens and non-citizens. The most commonly used form for this purpose is the Form I-9, Employment Eligibility Verification. In this article, we will delve into the world of Form I-9 and provide a comprehensive guide to help employers navigate the complexities of employment eligibility verification.

The Importance of Form I-9

Form I-9 is a critical document that helps employers comply with federal laws and regulations. The form is used to verify the identity and work authorization of new hires, ensuring that they are eligible to work in the United States. Failure to properly complete and maintain Form I-9 can result in significant fines and penalties, making it essential for employers to understand the process.

Who Needs to Complete Form I-9?

All employers in the United States are required to complete Form I-9 for new hires, including:

- U.S. citizens

- Non-citizens

- Permanent residents

- Temporary workers

- Seasonal workers

- Interns

Employers must also complete Form I-9 for rehires, if the employee's previous Form I-9 is no longer valid or if the employee has changed their name.

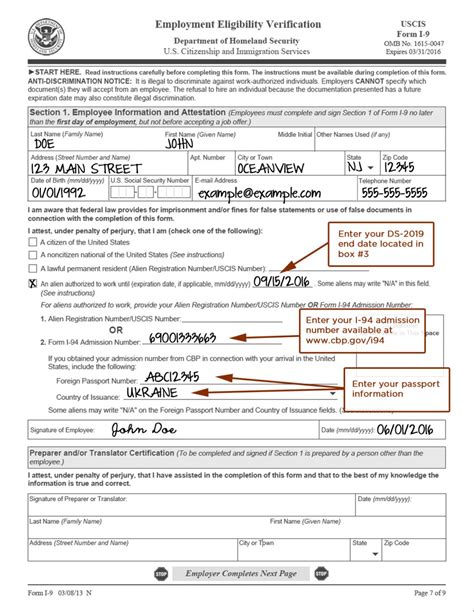

How to Complete Form I-9

Completing Form I-9 involves several steps, which are outlined below:

- Section 1: Employee Information

Employees must complete Section 1 of Form I-9 on their first day of work. This section requires employees to provide their name, address, date of birth, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Section 2: Employer or Authorized Representative Review

Employers or authorized representatives must review and verify the documents presented by the employee. This section requires employers to:

- Verify the employee's identity and work authorization

- Record the document title, issuing authority, and document number

- Sign and date the form

- Section 3: Reverification and Rehire

Section 3 is used for reverification and rehire. Employers must reverify an employee's work authorization when their previous Form I-9 is no longer valid or when the employee has changed their name.

Acceptable Documents for Form I-9

Employers must verify the identity and work authorization of new hires using acceptable documents. The following documents are acceptable for Form I-9:

- List A Documents: U.S. passport, permanent resident card, employment authorization document (EAD), and foreign passport with an I-551 stamp or a MRIV with a U.S. visa

- List B Documents: Driver's license, state ID card, school ID card, and U.S. military ID card

- List C Documents: U.S. Social Security card, birth certificate, and Form I-94/I-94A

Employers can accept one document from List A or a combination of documents from List B and List C.

Common Mistakes to Avoid

When completing Form I-9, employers should avoid the following common mistakes:

- Incomplete or inaccurate information: Ensure that all sections of the form are completed accurately and thoroughly.

- Failure to verify documents: Employers must verify the documents presented by the employee to ensure their identity and work authorization.

- Insufficient documentation: Employers must ensure that they have collected and maintained sufficient documentation to support the Form I-9.

Consequences of Non-Compliance

Failure to comply with Form I-9 regulations can result in significant fines and penalties, including:

- Civil penalties: Up to $1,100 per violation

- Criminal penalties: Up to 2 years in prison and a $4,000 fine

- Debarment: Exclusion from federal contracts and programs

Best Practices for Form I-9 Compliance

To ensure compliance with Form I-9 regulations, employers should follow these best practices:

- Develop a Form I-9 policy: Establish a policy for completing and maintaining Form I-9.

- Provide training: Train HR staff and managers on Form I-9 procedures and regulations.

- Use E-Verify: Consider using E-Verify to electronically verify the employment eligibility of new hires.

- Maintain accurate records: Ensure that all Form I-9 records are accurate, complete, and maintained in a secure location.

E-Verify: An Overview

E-Verify is an electronic employment eligibility verification system that helps employers verify the employment eligibility of new hires. E-Verify is a voluntary program that compares the information provided by the employee on Form I-9 with data from the U.S. Department of Homeland Security (DHS) and the Social Security Administration (SSA).

Benefits of E-Verify

Using E-Verify can provide several benefits, including:

- Improved accuracy: E-Verify helps reduce errors and inaccuracies in the Form I-9 process.

- Increased efficiency: E-Verify automates the employment eligibility verification process, reducing the time and effort required to complete Form I-9.

- Enhanced compliance: E-Verify helps employers comply with Form I-9 regulations and reduces the risk of non-compliance.

Conclusion

Employment eligibility verification is a critical process for employers in the United States. Form I-9 is a crucial document that helps employers comply with federal laws and regulations. By understanding the process and following best practices, employers can ensure compliance and avoid significant fines and penalties. Remember to stay informed and up-to-date on the latest Form I-9 regulations and guidelines to ensure a smooth and compliant employment eligibility verification process.

What is the purpose of Form I-9?

+Form I-9 is used to verify the identity and work authorization of new hires, ensuring that they are eligible to work in the United States.

Who needs to complete Form I-9?

+All employers in the United States are required to complete Form I-9 for new hires, including U.S. citizens, non-citizens, permanent residents, temporary workers, seasonal workers, and interns.

What are the consequences of non-compliance with Form I-9 regulations?

+Failure to comply with Form I-9 regulations can result in significant fines and penalties, including civil penalties up to $1,100 per violation, criminal penalties up to 2 years in prison and a $4,000 fine, and debarment from federal contracts and programs.