Managing taxes and financial obligations can be overwhelming, especially when dealing with complex forms and paperwork. One crucial form that often requires attention is the W-4V form, used for Voluntary Withholding Request. If you're looking to download and print the W-4V form easily, you're in the right place. In this article, we'll guide you through the process, explain the purpose of the form, and provide valuable insights to make tax management more accessible.

What is the W-4V Form?

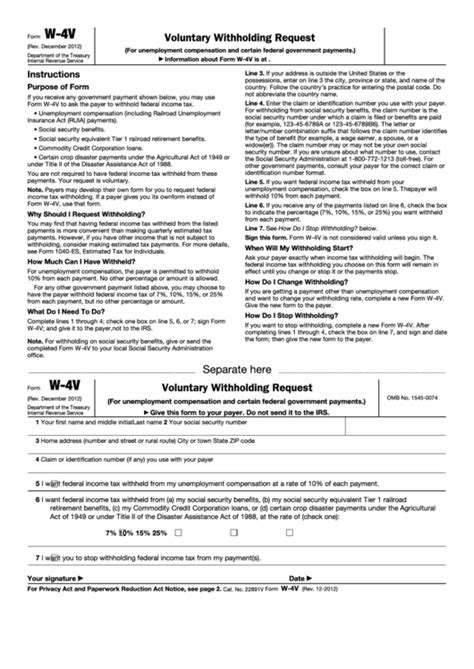

The W-4V form, also known as the Voluntary Withholding Request, is a document used by the United States Internal Revenue Service (IRS). It allows individuals to request that a payor withhold federal income tax from certain government payments. This form is particularly useful for those who need to manage their tax obligations more effectively or avoid a large tax bill at the end of the year.

Who Needs to Use the W-4V Form?

You might need to use the W-4V form if you're receiving any of the following types of payments:

- Social Security benefits

- Supplemental Security Income (SSI) benefits

- Unemployment compensation

- Certain government pensions

These payments are not subject to automatic tax withholding, but using the W-4V form allows you to voluntarily request withholding. This can be beneficial for managing your tax obligations and avoiding potential penalties.

Benefits of Using the W-4V Form

There are several benefits to using the W-4V form:

- Better tax management: By having taxes withheld from your government payments, you can avoid a large tax bill at the end of the year.

- Reduced penalties: Voluntary withholding can help you avoid penalties for underpayment of taxes.

- Simplified tax filing: With taxes withheld throughout the year, you may have a simpler tax filing process.

How to Download and Print the W-4V Form

Downloading and printing the W-4V form is a straightforward process:

- Visit the IRS website: Go to the official IRS website (irs.gov) and navigate to the "Forms and Publications" section.

- Search for the W-4V form: Use the search function to find the W-4V form. You can also browse through the list of forms to find it.

- Download the form: Once you've found the W-4V form, click on the "Download" button to save it to your computer.

- Print the form: Open the downloaded form and print it on standard 8.5 x 11-inch paper.

Filling Out the W-4V Form

To fill out the W-4V form, you'll need to provide some basic information:

- Name and address: Provide your name and address as it appears on your tax return.

- Social Security number or ITIN: Enter your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Type of payment: Specify the type of payment you're receiving (e.g., Social Security benefits).

- Withholding amount: Choose the amount you want to have withheld from your payments.

Common Questions and Answers

Here are some common questions and answers about the W-4V form:

- Q: Can I change my withholding amount? A: Yes, you can change your withholding amount by filing a new W-4V form.

- Q: Do I need to file the W-4V form every year? A: No, you only need to file the W-4V form once, unless you want to change your withholding amount or stop voluntary withholding.

- Q: Can I use the W-4V form for other types of payments? A: No, the W-4V form is specifically designed for certain government payments. For other types of payments, you may need to use a different form.

Conclusion

Managing your tax obligations can be complex, but using the W-4V form can help simplify the process. By downloading and printing the form, you can take control of your taxes and avoid potential penalties. Remember to fill out the form carefully and accurately, and don't hesitate to reach out to the IRS if you have any questions or concerns.

What is the purpose of the W-4V form?

+The W-4V form is used to request voluntary withholding of federal income tax from certain government payments.

Who needs to use the W-4V form?

+Individuals receiving Social Security benefits, Supplemental Security Income (SSI) benefits, unemployment compensation, or certain government pensions may need to use the W-4V form.

How do I download and print the W-4V form?

+Visit the IRS website, search for the W-4V form, download it, and print it on standard 8.5 x 11-inch paper.

We hope this article has provided you with valuable insights and guidance on using the W-4V form. If you have any further questions or concerns, please don't hesitate to reach out.