As a business owner, you're constantly looking for ways to minimize your tax liability and maximize your profits. One often-overlooked opportunity is the Section 179 deduction, which can be claimed on Form 4562. In this article, we'll delve into the details of Form 4562 and explore how you can use Section 179 deductions to save thousands of dollars on your taxes.

.

.

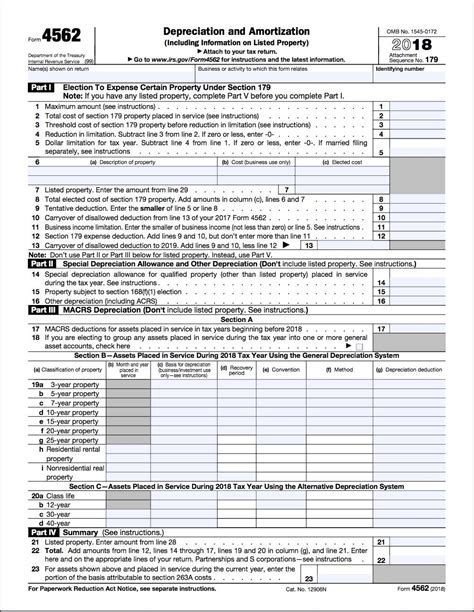

To understand the benefits of Section 179 deductions, you need to first comprehend what Form 4562 is and what it's used for. Form 4562 is the Depreciation and Amortization form, which is used to calculate the depreciation and amortization of assets purchased or acquired by a business. This includes tangible assets like equipment, vehicles, and buildings, as well as intangible assets like patents and copyrights.

What is Section 179?

Section 179 is a provision of the Internal Revenue Code that allows businesses to deduct the full purchase price of qualifying equipment and software in the first year of use. This is in contrast to traditional depreciation methods, which spread the deduction over several years. By claiming a Section 179 deduction, businesses can significantly reduce their taxable income and lower their tax liability.

.

.

To qualify for a Section 179 deduction, the equipment or software must meet certain criteria:

- It must be tangible property, such as equipment, vehicles, or buildings

- It must be used for business purposes more than 50% of the time

- It must be acquired through a purchase or lease

- It must be placed in service during the tax year

Benefits of Section 179 Deductions

The benefits of Section 179 deductions are numerous. By claiming a Section 179 deduction, businesses can:

- Reduce their taxable income and lower their tax liability

- Improve cash flow by reducing the amount of taxes owed

- Accelerate the depreciation of assets, allowing for more deductions in the first year

- Increase their bottom line by reducing the overall cost of the asset

.

.

For example, let's say a business purchases a piece of equipment for $100,000. Using traditional depreciation methods, the business might be able to deduct $20,000 in the first year, and $20,000 in each subsequent year for five years. However, by claiming a Section 179 deduction, the business can deduct the full $100,000 in the first year, significantly reducing its taxable income and tax liability.

How to Claim Section 179 Deductions on Form 4562

To claim Section 179 deductions on Form 4562, follow these steps:

- Complete Part I of Form 4562, which requires you to list the assets you're depreciating, including the date acquired, cost, and method of depreciation.

- Identify the assets that qualify for Section 179 deductions and complete Part II of Form 4562.

- Calculate the total amount of Section 179 deductions you're claiming and report it on Line 1 of Form 4562.

- Complete the rest of Form 4562, including the depreciation calculation and any other required information.

.

.

Limitations and Phase-Outs

While Section 179 deductions can be incredibly beneficial, there are limitations and phase-outs to be aware of. For example:

- The total amount of Section 179 deductions you can claim is limited to $1 million in 2022.

- The deduction begins to phase out when the total amount of qualifying property exceeds $2.5 million.

- Certain types of property, such as real estate and intangible assets, may not be eligible for Section 179 deductions.

.

.

Conclusion: Maximize Your Tax Savings with Section 179 Deductions

By understanding how to claim Section 179 deductions on Form 4562, you can significantly reduce your taxable income and lower your tax liability. Remember to identify qualifying assets, complete Form 4562 accurately, and be aware of limitations and phase-outs. With careful planning and execution, you can maximize your tax savings and improve your business's bottom line.

What is Form 4562 used for?

+Form 4562 is used to calculate the depreciation and amortization of assets purchased or acquired by a business.

What are the benefits of Section 179 deductions?

+The benefits of Section 179 deductions include reducing taxable income, improving cash flow, accelerating depreciation, and increasing the bottom line.

How do I claim Section 179 deductions on Form 4562?

+To claim Section 179 deductions on Form 4562, complete Part I and Part II of the form, identify qualifying assets, and calculate the total amount of Section 179 deductions.