Filing California Tax Extension Form 3519 Easily Online

As the tax filing deadline approaches, many Californians find themselves struggling to meet the requirements. Whether it's due to unforeseen circumstances or the complexity of the tax filing process, requesting an extension can be a viable solution. The California Franchise Tax Board (FTB) provides an option to request an automatic six-month extension of time to file by submitting Form 3519. In this article, we will guide you through the process of filing California Tax Extension Form 3519 easily online.

Why File an Extension?

Requesting an extension can provide several benefits, including:- Avoiding late-filing penalties and interest

- Gaining extra time to gather necessary documentation

- Reducing stress and anxiety associated with meeting the deadline

- Allowing for more accurate and thorough tax preparation

Who Can File an Extension?

The FTB allows individuals, businesses, and estates to request an extension. This includes:- Personal income tax filers (Form 540)

- Business entities (Form 100, 100S, 100W, 565, and 568)

- Estates and trusts (Form 541)

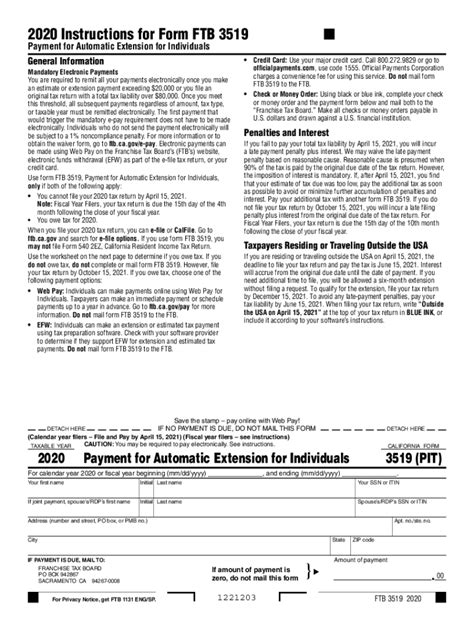

How to File California Tax Extension Form 3519 Online

Filing Form 3519 online is a straightforward process that can be completed in a few steps:

- Create an account: Visit the FTB website and create an account if you don't already have one. This will give you access to the online extension filing system.

- Gather required information: You will need your:

- California tax account number

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Business entity's California tax account number (if applicable)

- Complete Form 3519: Fill out the online Form 3519, providing the required information and selecting the correct extension period.

- Submit and pay: Submit your extension request and pay any estimated tax due. You can pay by electronic funds withdrawal (EFW) or credit card.

What to Expect After Filing an Extension

After submitting your extension request:

- You will receive an acknowledgement from the FTB, confirming receipt of your request.

- You will have an additional six months to file your tax return (October 15th for personal income tax filers).

- You must still pay any estimated tax due by the original deadline to avoid penalties and interest.

Tips and Reminders

- The extension only applies to the filing deadline, not the payment deadline.

- You should estimate and pay any tax due to avoid penalties and interest.

- If you're unable to pay the estimated tax, you can make a payment plan with the FTB.

Common FAQs

- Q: What is the deadline for filing Form 3519? A: The deadline for filing Form 3519 is the original tax filing deadline (April 15th for personal income tax filers).

- Q: Can I file an extension if I owe taxes? A: Yes, you can still file an extension even if you owe taxes. However, you should estimate and pay any tax due to avoid penalties and interest.

- Q: How long does it take to process an extension request? A: The FTB typically processes extension requests within 24-48 hours.

What is the penalty for not filing an extension?

+The penalty for not filing an extension can include a late-filing penalty of 5% per month or part of a month, up to a maximum of 25%, and a late-payment penalty of 0.5% per month or part of a month, up to a maximum of 25%.

Can I file an extension if I'm due a refund?

+Yes, you can still file an extension even if you're due a refund. However, keep in mind that filing an extension will delay your refund.

How do I check the status of my extension request?

+You can check the status of your extension request by logging into your FTB account or calling the FTB's automated phone service at (916) 845-6600.

We hope this guide has helped you understand the process of filing California Tax Extension Form 3519 easily online. Remember to file your extension request before the deadline and pay any estimated tax due to avoid penalties and interest. If you have any further questions or concerns, don't hesitate to reach out to the FTB or a tax professional for assistance.