The world of international trade and customs can be complex and overwhelming, especially for those who are new to the industry. One crucial aspect of this world is the CBP Form 7507, also known as the Certificate of Origin. In this article, we will delve into the essential facts about this form, its significance, and its role in facilitating smooth international trade.

As the global economy continues to grow, international trade has become an integral part of many businesses. However, with the increasing complexity of global trade comes the need for accurate and compliant documentation. The CBP Form 7507 is one such document that plays a critical role in ensuring that goods are properly declared and valued. In this article, we will explore five essential facts about the CBP Form 7507, its importance, and its implications for businesses involved in international trade.

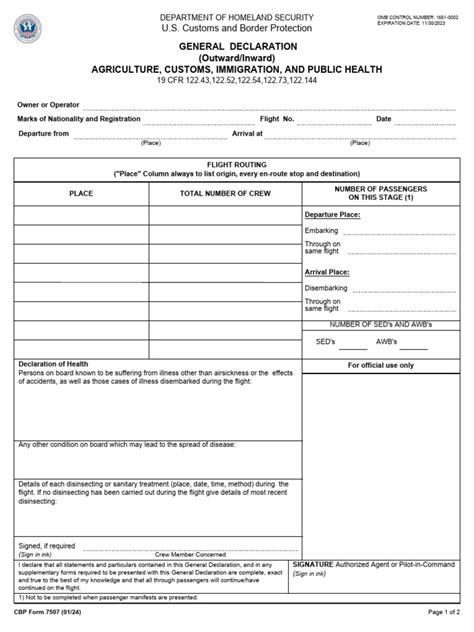

What is CBP Form 7507?

The CBP Form 7507, also known as the Certificate of Origin, is a document used by U.S. Customs and Border Protection (CBP) to determine the country of origin of imported goods. This form is required for all goods valued at over $2,500 and is used to assess tariffs, taxes, and other trade restrictions. The form provides essential information about the goods being imported, including their country of origin, value, and classification.

Why is CBP Form 7507 Important?

The CBP Form 7507 is crucial in ensuring that goods are properly declared and valued. This form helps to:

- Determine the country of origin of imported goods

- Assess tariffs, taxes, and other trade restrictions

- Ensure compliance with U.S. trade laws and regulations

- Prevent fraud and smuggling

- Facilitate smooth international trade

Who Needs to File CBP Form 7507?

The CBP Form 7507 is required for all importers of goods valued at over $2,500. This includes:

- U.S. importers of record

- Foreign exporters

- Customs brokers

- Freight forwarders

What Information is Required on CBP Form 7507?

The CBP Form 7507 requires the following information:

- Country of origin of the goods

- Description of the goods

- Value of the goods

- Classification of the goods (HTSUS)

- Bill of lading or airway bill number

- Country of export

- Date of export

Consequences of Non-Compliance

Failure to comply with CBP Form 7507 requirements can result in severe consequences, including:

- Fines and penalties

- Delays in customs clearance

- Loss of privileges

- Reputation damage

- Potential legal action

Best Practices for Filing CBP Form 7507

To ensure compliance and avoid delays, it's essential to follow best practices when filing CBP Form 7507. These include:

- Accurate and complete information

- Timely filing

- Proper documentation

- Regular audits and reviews

- Training and education for staff

Conclusion

In conclusion, the CBP Form 7507 is a critical document in the world of international trade. Its importance cannot be overstated, and non-compliance can result in severe consequences. By understanding the essential facts about this form, businesses can ensure compliance and facilitate smooth international trade. We encourage readers to share their experiences and insights about CBP Form 7507 in the comments section below.

What is the purpose of CBP Form 7507?

+The purpose of CBP Form 7507 is to determine the country of origin of imported goods and to assess tariffs, taxes, and other trade restrictions.

Who needs to file CBP Form 7507?

+U.S. importers of record, foreign exporters, customs brokers, and freight forwarders need to file CBP Form 7507.

What information is required on CBP Form 7507?

+The CBP Form 7507 requires information such as country of origin, description of goods, value of goods, classification of goods (HTSUS), bill of lading or airway bill number, country of export, and date of export.