If you're a resident of Illinois, you may be familiar with the RUT-25 tax form, also known as the "Certification for Exemption from Withholding for Illinois Income Tax". This form is used to claim exemption from Illinois state income tax withholding on certain types of income. However, filling out this form can be a bit tricky, and that's where this article comes in. We'll provide you with 5 ways to complete the RUT-25 tax form Illinois, making it easier for you to navigate the process.

Understanding the Purpose of the RUT-25 Form

Before we dive into the ways to complete the RUT-25 form, let's first understand its purpose. The RUT-25 form is used to certify that you're exempt from Illinois state income tax withholding on certain types of income, such as:

- Retirement income

- Social Security benefits

- Disability income

- Unemployment compensation

- Other types of exempt income

Why Do You Need to Complete the RUT-25 Form?

Completing the RUT-25 form is essential if you want to avoid having Illinois state income tax withheld from your exempt income. By completing this form, you're certifying that you're eligible for exemption, and your employer or payer will not withhold state income tax from your payments.

5 Ways to Complete the RUT-25 Tax Form Illinois

Now that we've covered the basics, let's move on to the 5 ways to complete the RUT-25 tax form Illinois:

1. Online Filing

You can complete the RUT-25 form online through the Illinois Department of Revenue's website. This is the fastest and most convenient way to file the form. You'll need to create an account and provide your identification information, social security number, and other required details.

2. Paper Filing

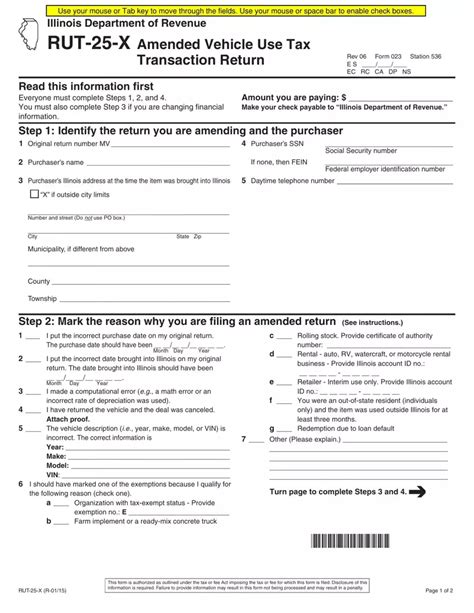

If you prefer to file the RUT-25 form by mail, you can download the form from the Illinois Department of Revenue's website or pick one up from your local library or tax office. Fill out the form carefully and accurately, making sure to sign and date it. Then, mail it to the address listed on the form.

3. E-Filing Through a Tax Professional

If you're not comfortable filing the RUT-25 form yourself, you can hire a tax professional to do it for you. Many tax professionals offer e-filing services, which can save you time and ensure accuracy.

4. Phone Filing

You can also complete the RUT-25 form by phone by calling the Illinois Department of Revenue's customer service number. A representative will guide you through the process and help you complete the form over the phone.

5. In-Person Filing

If you prefer to file the RUT-25 form in person, you can visit your local Illinois Department of Revenue office. A representative will assist you in completing the form and answer any questions you may have.

What to Expect After Filing the RUT-25 Form

After you've completed and filed the RUT-25 form, you can expect the following:

- Your employer or payer will stop withholding Illinois state income tax from your exempt income.

- You may need to provide additional documentation or information to support your exemption claim.

- The Illinois Department of Revenue may review your exemption claim and verify your eligibility.

Tips and Reminders

Here are some tips and reminders to keep in mind when completing the RUT-25 form:

- Make sure to carefully review the form instructions and requirements.

- Provide accurate and complete information to avoid delays or rejection.

- Keep a copy of your completed form for your records.

- If you're unsure about any part of the process, consider consulting a tax professional or contacting the Illinois Department of Revenue for assistance.

Conclusion

Completing the RUT-25 tax form Illinois is a straightforward process that can help you avoid unnecessary state income tax withholding on your exempt income. By following the 5 ways outlined in this article, you can ensure a smooth and hassle-free experience. Remember to carefully review the form instructions, provide accurate information, and seek assistance if needed.What is the purpose of the RUT-25 form?

+The RUT-25 form is used to certify that you're exempt from Illinois state income tax withholding on certain types of income.

Can I file the RUT-25 form online?

+Yes, you can file the RUT-25 form online through the Illinois Department of Revenue's website.

What happens after I file the RUT-25 form?

+After you file the RUT-25 form, your employer or payer will stop withholding Illinois state income tax from your exempt income.