As an employer, filing taxes is an essential part of running a business. One of the most critical tax forms you'll need to file is the IRS Form 941, also known as the Employer's Quarterly Federal Tax Return. This form is used to report employment taxes, including income taxes withheld from employees, Social Security taxes, and Medicare taxes. However, filling out a blank 941 form can be a daunting task, especially if you're new to filing taxes. In this article, we'll guide you through the process of filling out a blank 941 form, providing you with the necessary information to ensure accuracy and compliance.

Understanding the 941 Form

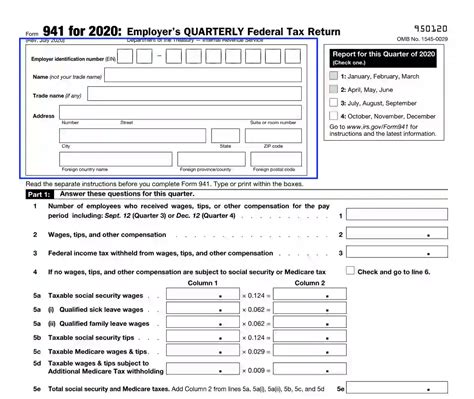

Before we dive into the instructions, it's essential to understand the purpose of the 941 form and the information it requires. The 941 form is used to report employment taxes on a quarterly basis. The form consists of several sections, including:

- Employer identification information

- Total wages, tips, and other compensation

- Federal income tax withheld

- Social Security taxes

- Medicare taxes

Gathering Necessary Information

To fill out the 941 form accurately, you'll need to gather the following information:

- Employer Identification Number (EIN)

- Business name and address

- Total wages, tips, and other compensation paid to employees

- Federal income tax withheld from employees

- Social Security taxes paid

- Medicare taxes paid

5 Ways to Fill Out a Blank 941 Form

Now that you have the necessary information, let's move on to the step-by-step guide on filling out a blank 941 form.

Method 1: Filing Electronically

The IRS encourages employers to file their 941 forms electronically. This method is not only faster but also more accurate. To file electronically, you'll need to:

- Create an account on the IRS Electronic Federal Tax Payment System (EFTPS) website

- Log in to your account and select the "Employer" option

- Choose the "941" form and follow the prompts to complete the form

- Submit the form and pay any required taxes electronically

Method 2: Using IRS Free File

The IRS offers a free filing option for employers who meet certain requirements. To use IRS Free File, you'll need to:

- Visit the IRS website and select the "Free File" option

- Choose the "941" form and follow the prompts to complete the form

- Submit the form and pay any required taxes electronically

Method 3: Filing by Mail

If you prefer to file your 941 form by mail, you'll need to:

- Download and print the 941 form from the IRS website

- Complete the form accurately and attach any required supporting documents

- Mail the form to the IRS address listed in the instructions

Method 4: Using Tax Software

Tax software can help simplify the process of filling out a blank 941 form. To use tax software, you'll need to:

- Choose a reputable tax software provider

- Download and install the software

- Follow the prompts to complete the 941 form

- Submit the form and pay any required taxes electronically

Method 5: Hiring a Tax Professional

If you're not comfortable filling out the 941 form yourself, you can hire a tax professional to do it for you. To hire a tax professional, you'll need to:

- Research and choose a reputable tax professional

- Provide the necessary information and documentation

- Let the tax professional complete and submit the form on your behalf

Common Mistakes to Avoid

When filling out a blank 941 form, it's essential to avoid common mistakes that can lead to penalties and fines. Some common mistakes to avoid include:

- Inaccurate employer identification information

- Incorrect calculation of employment taxes

- Failure to report all wages and tips

- Not paying required taxes on time

Conclusion

Filling out a blank 941 form can be a daunting task, but with the right guidance, you can ensure accuracy and compliance. Remember to gather the necessary information, choose the best filing method for your business, and avoid common mistakes. If you're unsure about any part of the process, consider hiring a tax professional to help. By following these steps, you'll be able to fill out a blank 941 form with confidence.

What is the deadline for filing the 941 form?

+The deadline for filing the 941 form is the last day of the month following the end of the quarter. For example, the deadline for the first quarter (January 1 - March 31) is April 30th.

Do I need to file the 941 form if I have no employees?

+No, you do not need to file the 941 form if you have no employees. However, you may still need to file other tax forms, such as the 940 form, if you have other tax liabilities.

Can I file the 941 form electronically?

+Yes, you can file the 941 form electronically using the IRS Electronic Federal Tax Payment System (EFTPS) website or through a tax software provider.