As a Michigan resident, you take pride in the Great Lakes State's natural beauty and thriving economy. However, dealing with taxes can be a daunting task, especially when it comes to claiming a refund. If you're eligible for a refund on your Michigan taxes, you'll need to file Form MI-1040CR-7, Claim for Farmland Preservation Tax Credits, Homestead Property Tax Credits, and/or Farmland Tax Credits. In this article, we'll guide you through the process of claiming a refund on your Michigan taxes using Form MI-1040CR-7.

Understanding the Purpose of Form MI-1040CR-7

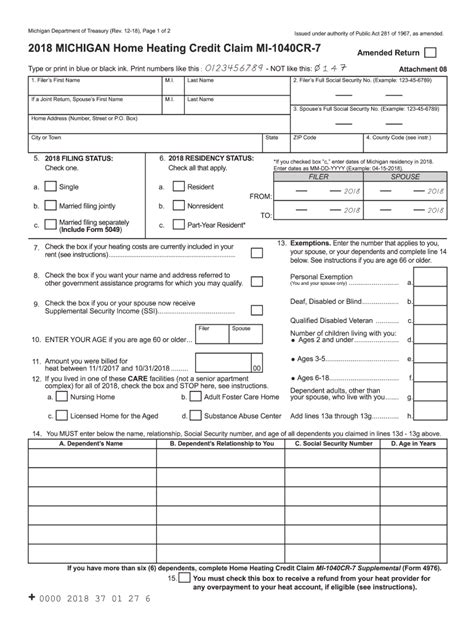

Form MI-1040CR-7 is a vital document for Michigan residents who want to claim a refund on their taxes. The form allows you to claim tax credits for farmland preservation, homestead property tax, and farmland tax. These tax credits can significantly reduce your tax liability, and in some cases, even result in a refund. The Michigan Department of Treasury uses Form MI-1040CR-7 to process these tax credits and issue refunds to eligible residents.

Who Can Claim a Refund Using Form MI-1040CR-7?

To claim a refund using Form MI-1040CR-7, you must meet specific eligibility criteria. You can claim a refund if you:

- Owned and occupied a homestead in Michigan for at least six months of the tax year

- Paid property taxes on your homestead

- Have a taxable income of $60,000 or less

- Are a Michigan resident

Additionally, if you're claiming farmland preservation tax credits or farmland tax credits, you must meet specific requirements related to your farmland property.

How to Claim a Refund Using Form MI-1040CR-7

Claiming a refund using Form MI-1040CR-7 involves several steps:

- Gather Required Documents: Before filling out Form MI-1040CR-7, make sure you have all the necessary documents, including:

- Your property tax statement

- Your Michigan income tax return (Form MI-1040)

- Proof of residency (e.g., driver's license, utility bills)

- Fill Out Form MI-1040CR-7: Complete Form MI-1040CR-7, ensuring you accurately report your property taxes, income, and other relevant information.

- Calculate Your Tax Credits: Use the form to calculate your eligible tax credits for farmland preservation, homestead property tax, and farmland tax.

- Submit Your Form: Mail or e-file your completed Form MI-1040CR-7 to the Michigan Department of Treasury.

What to Expect After Submitting Form MI-1040CR-7

After submitting Form MI-1040CR-7, the Michigan Department of Treasury will review your application and determine your eligibility for a refund. If approved, you can expect to receive your refund within 6-8 weeks. If you're owed a refund, you'll receive a check or direct deposit.

Tips and Reminders

- File on Time: Make sure to file Form MI-1040CR-7 by the designated deadline to avoid missing out on your refund.

- Double-Check Your Math: Ensure you accurately calculate your tax credits to avoid errors or delays.

- Keep Records: Keep a copy of your Form MI-1040CR-7 and supporting documents in case of an audit or questions from the Michigan Department of Treasury.

Common Questions and Answers

What is the deadline for filing Form MI-1040CR-7?

The deadline for filing Form MI-1040CR-7 is typically April 15th of each year. However, if you're filing an amended return, you have three years from the original filing date or two years from the date of payment, whichever is later.

Can I claim a refund if I don't owe taxes?

Yes, even if you don't owe taxes, you can still claim a refund using Form MI-1040CR-7 if you're eligible for tax credits.

How long does it take to receive my refund?

Refunds are typically processed within 6-8 weeks after submitting Form MI-1040CR-7.

What if I made a mistake on my Form MI-1040CR-7?

+If you made a mistake on your Form MI-1040CR-7, you can file an amended return using Form MI-1040CR-7X. You'll need to correct the error and refile the form.

Can I claim a refund for prior tax years?

+No, you can only claim a refund for the current tax year. However, if you're eligible for a refund for a prior tax year, you can file an amended return using Form MI-1040CR-7X.

How do I check the status of my refund?

+You can check the status of your refund by calling the Michigan Department of Treasury's refund hotline or checking the status online through the Michigan Treasury Online website.

By following the steps outlined in this article and using Form MI-1040CR-7, you can successfully claim a refund on your Michigan taxes. Remember to double-check your math, keep records, and file on time to avoid any delays or errors. If you have any further questions or concerns, don't hesitate to reach out to the Michigan Department of Treasury or a tax professional for guidance.