Minnesota, known as the Land of 10,000 Lakes, is a state with a strong economy and a high standard of living. For individuals and businesses operating within the state, understanding the tax landscape is crucial for compliance and financial planning. One of the key tax forms for Minnesota residents and businesses is the Form M1, which is the state's individual income tax return. Here's what you need to know about Minnesota Form M1.

What is Minnesota Form M1?

Who Needs to File Form M1?

Not everyone who earns income in Minnesota needs to file Form M1. Generally, you need to file Form M1 if you meet the minimum filing requirements, which are based on your filing status and the amount of your gross income. For example, for the tax year 2022, you would need to file Form M1 if you are single and your gross income is $12,400 or more, or if you are married filing jointly and your gross income is $24,800 or more. Additionally, even if you do not meet these minimum filing requirements, you may still need to file Form M1 if you have any Minnesota tax withheld from your income, if you made estimated tax payments, or if you are eligible for a refund.

Filing Status and Dependents

Deductions and Credits

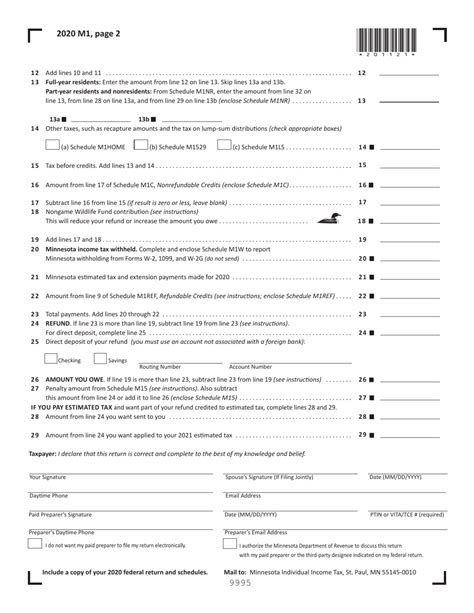

One of the key components of Form M1 is the deductions and credits section. Here, you will report any deductions you are eligible for, such as the standard deduction or itemized deductions, as well as any credits you are eligible for, such as the earned income tax credit (EITC) or the child tax credit. Minnesota also offers several state-specific credits, such as the Working Family Credit and the Student Loan Credit.

How to File Form M1

Paying and Refunding

If you owe taxes, you can pay online, by phone, or by mail. The Minnesota Department of Revenue accepts several payment methods, including credit cards, debit cards, and electronic funds transfer. If you are due a refund, you can choose to receive it by direct deposit or by paper check. Refunds are typically issued within a few weeks of filing, but the processing time can vary depending on the volume of returns.

Audit and Appeal Process

Penalties and Interest

If you fail to file Form M1 or pay your taxes on time, you may be subject to penalties and interest. The Minnesota Department of Revenue imposes a late filing penalty of 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25%. Additionally, you may be charged interest on any unpaid tax, which accrues from the original due date of the return.

Conclusion and Next Steps

Additional Resources

For more information about Form M1 and Minnesota state taxes, you can visit the Minnesota Department of Revenue's website or contact their customer service department. You can also find tax forms and instructions, as well as information about tax laws and regulations.

What is the deadline for filing Form M1?

+The deadline for filing Form M1 is typically on or around April 15th of each year, unless an extension is filed.

Who needs to file Form M1?

+You need to file Form M1 if you meet the minimum filing requirements, which are based on your filing status and the amount of your gross income.

Can I file Form M1 electronically?

+Yes, you can file Form M1 electronically using the Minnesota Department of Revenue's e-file system or a third-party tax preparation software.