Taking control of your retirement savings is a significant step towards securing your financial future. For individuals who have contributed to an ADP 401(k) plan, understanding the withdrawal process is essential. In this article, we will delve into the world of ADP 401k withdrawal forms, providing a comprehensive, step-by-step guide to help you navigate this process with ease.

The Importance of Understanding ADP 401k Withdrawal Forms

Having a clear understanding of the ADP 401k withdrawal form is crucial for several reasons. Firstly, it ensures that you comply with the rules and regulations governing 401(k) plans, avoiding any potential penalties or taxes. Secondly, it helps you make informed decisions about your retirement savings, allowing you to plan for your financial future with confidence.

Lastly, understanding the withdrawal process can provide peace of mind, knowing that you have control over your hard-earned savings. In this article, we will break down the ADP 401k withdrawal form into manageable sections, providing you with a clear roadmap for success.

What is an ADP 401k Withdrawal Form?

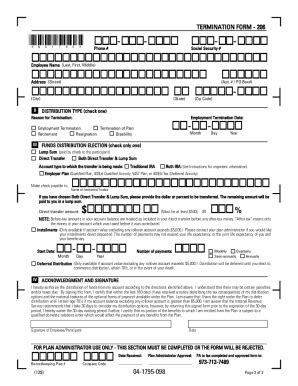

An ADP 401k withdrawal form is a document that allows you to request a withdrawal from your 401(k) plan. This form is typically used when you need to access your retirement savings for a specific reason, such as a financial emergency or retirement.

The form will require you to provide personal and account information, as well as specify the reason for the withdrawal. It's essential to note that 401(k) plans have rules and regulations governing withdrawals, and not all requests may be approved.

Eligibility for ADP 401k Withdrawal

To be eligible for an ADP 401k withdrawal, you must meet specific criteria. These may include:

- Age: You must be at least 59 ½ years old to withdraw from your 401(k) plan without incurring a 10% penalty.

- Separation from service: You must have separated from your employer or be currently employed by a company that offers an ADP 401(k) plan.

- Financial hardship: You may be eligible for a withdrawal if you are experiencing financial hardship, such as a medical emergency or foreclosure.

It's essential to review your plan documents or consult with your HR representative to determine the specific eligibility criteria for your ADP 401k plan.

Step-by-Step Guide to ADP 401k Withdrawal Form

Here is a step-by-step guide to completing the ADP 401k withdrawal form:

- Gather required documents: You will need to provide identification, such as a driver's license or passport, and proof of address.

- Log in to your ADP account: Access your ADP account online or through the mobile app to initiate the withdrawal process.

- Select the withdrawal reason: Choose the reason for your withdrawal, such as retirement or financial hardship.

- Specify the withdrawal amount: Enter the amount you wish to withdraw, ensuring it meets the plan's minimum and maximum withdrawal limits.

- Review and confirm: Carefully review your withdrawal request and confirm that all information is accurate.

- Submit the request: Submit your withdrawal request to ADP for processing.

Taxes and Penalties on ADP 401k Withdrawals

It's essential to understand the tax implications and potential penalties associated with ADP 401k withdrawals. These may include:

- Income taxes: Withdrawals are subject to income tax, which may be withheld by ADP.

- 10% penalty: If you withdraw before age 59 ½, you may be subject to a 10% penalty, unless you qualify for an exception.

- Early withdrawal fees: Some plans may charge early withdrawal fees, which can range from 1% to 5% of the withdrawal amount.

Alternatives to ADP 401k Withdrawal

Before withdrawing from your ADP 401k plan, consider alternative options:

- Loan provision: Check if your plan offers a loan provision, allowing you to borrow from your account without incurring penalties.

- Hardship withdrawal: If you're experiencing financial hardship, you may be eligible for a hardship withdrawal, which may have more favorable terms.

- Consolidation: Consider consolidating your 401(k) accounts into a single plan, reducing fees and simplifying management.

Conclusion

Withdrawing from your ADP 401k plan can be a complex process, but understanding the rules and regulations can help you make informed decisions. By following the step-by-step guide outlined in this article, you'll be well on your way to successfully navigating the ADP 401k withdrawal form.

Remember to carefully review your plan documents, consider alternative options, and seek professional advice if needed. Take control of your retirement savings today and secure your financial future.

We hope you found this article informative and helpful. If you have any questions or comments, please feel free to share them below.

What is the minimum age for ADP 401k withdrawal?

+The minimum age for ADP 401k withdrawal is 59 ½ years old.

Can I withdraw from my ADP 401k plan for any reason?

+No, you must meet specific eligibility criteria, such as age or financial hardship, to withdraw from your ADP 401k plan.