The Lacerte tax preparation software is a powerful tool for tax professionals, offering a range of features to streamline the tax preparation process. One of the most important forms that tax professionals need to master in Lacerte is Form 5498, which reports individual retirement account (IRA) contributions, distributions, and fair market values. In this article, we will delve into the world of Form 5498 in Lacerte, providing you with 5 essential tips to help you master this critical form.

Mastering Form 5498 is crucial for tax professionals who work with clients who have IRAs. This form is used to report contributions, distributions, and fair market values of IRAs, which are essential for accurate tax reporting. By mastering Form 5498, tax professionals can ensure that their clients' IRA information is reported correctly, reducing the risk of errors and potential penalties.

So, let's dive into the 5 essential tips for mastering Form 5498 in Lacerte.

Understanding the Basics of Form 5498

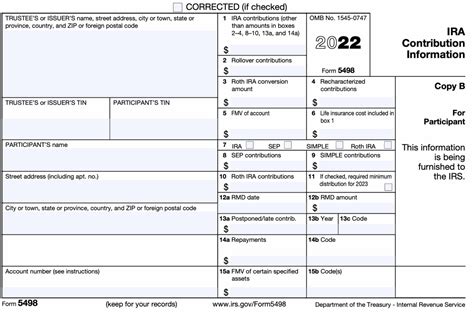

Before we dive into the tips, it's essential to understand the basics of Form 5498. This form is used to report IRA contributions, distributions, and fair market values. The form is divided into several sections, including:

- Section 1: IRA contributions

- Section 2: IRA distributions

- Section 3: Fair market value of the IRA

Tax professionals need to understand the different sections of the form and how to report the various types of IRA transactions.

Tip 1: Accurately Reporting IRA Contributions

Reporting IRA contributions accurately is crucial for ensuring that clients receive the correct tax deduction. In Lacerte, tax professionals can report IRA contributions in the "Contributions" section of Form 5498. It's essential to ensure that the contribution amount is accurate and that the correct type of contribution is reported (e.g., traditional or Roth).

To accurately report IRA contributions in Lacerte, follow these steps:

- Go to the "Contributions" section of Form 5498

- Enter the contribution amount and select the correct type of contribution

- Ensure that the contribution is reported in the correct year

Navigating the Lacerte Interface for Form 5498

To master Form 5498 in Lacerte, tax professionals need to be familiar with the software's interface. Lacerte provides a user-friendly interface for preparing Form 5498, with clear labels and easy-to-use menus.

To navigate the Lacerte interface for Form 5498, follow these steps:

- Go to the "Forms" menu and select "5498"

- Select the correct year and client

- Review the form sections and enter the required information

Tip 2: Correctly Reporting IRA Distributions

Reporting IRA distributions correctly is critical for ensuring that clients are taxed correctly on their distributions. In Lacerte, tax professionals can report IRA distributions in the "Distributions" section of Form 5498. It's essential to ensure that the distribution amount is accurate and that the correct type of distribution is reported (e.g., normal or premature).

To correctly report IRA distributions in Lacerte, follow these steps:

- Go to the "Distributions" section of Form 5498

- Enter the distribution amount and select the correct type of distribution

- Ensure that the distribution is reported in the correct year

Troubleshooting Common Issues with Form 5498

Even with the best preparation, issues can arise when working with Form 5498 in Lacerte. Common issues include errors in reporting contributions or distributions, incorrect fair market values, and missing or incomplete information.

To troubleshoot common issues with Form 5498 in Lacerte, follow these steps:

- Review the form for errors or inconsistencies

- Verify that all required information is complete and accurate

- Use Lacerte's built-in diagnostic tools to identify and resolve issues

Tip 3: Accurately Reporting Fair Market Value

Reporting the fair market value of an IRA accurately is essential for ensuring that clients are taxed correctly on their distributions. In Lacerte, tax professionals can report the fair market value of an IRA in the "Fair Market Value" section of Form 5498.

To accurately report the fair market value of an IRA in Lacerte, follow these steps:

- Go to the "Fair Market Value" section of Form 5498

- Enter the fair market value of the IRA

- Ensure that the fair market value is reported in the correct year

Best Practices for Preparing Form 5498 in Lacerte

To ensure accurate and efficient preparation of Form 5498 in Lacerte, tax professionals should follow best practices. These include:

- Verifying client information and IRA transactions

- Reviewing the form for errors or inconsistencies

- Using Lacerte's built-in diagnostic tools to identify and resolve issues

By following these best practices, tax professionals can ensure that Form 5498 is prepared accurately and efficiently, reducing the risk of errors and potential penalties.

Tip 4: Using Lacerte's Built-in Diagnostic Tools

Lacerte provides built-in diagnostic tools to help tax professionals identify and resolve issues with Form 5498. These tools include error checking and validation, which can help ensure that the form is prepared accurately and efficiently.

To use Lacerte's built-in diagnostic tools for Form 5498, follow these steps:

- Go to the "Diagnostics" menu and select "Form 5498"

- Review the diagnostic results for errors or inconsistencies

- Use the diagnostic tools to identify and resolve issues

Common Mistakes to Avoid When Preparing Form 5498 in Lacerte

When preparing Form 5498 in Lacerte, tax professionals should be aware of common mistakes to avoid. These include:

- Errors in reporting contributions or distributions

- Incorrect fair market values

- Missing or incomplete information

By being aware of these common mistakes, tax professionals can take steps to avoid them, ensuring that Form 5498 is prepared accurately and efficiently.

Tip 5: Reviewing and Verifying Client Information

Reviewing and verifying client information is critical for ensuring that Form 5498 is prepared accurately and efficiently. Tax professionals should review client information and IRA transactions to ensure that they are accurate and complete.

To review and verify client information for Form 5498 in Lacerte, follow these steps:

- Go to the "Client Information" section of the form

- Review the client's IRA transactions and contributions

- Verify that the client's information is accurate and complete

By following these 5 essential tips, tax professionals can master Form 5498 in Lacerte, ensuring that their clients' IRA information is reported correctly and reducing the risk of errors and potential penalties.

We hope you found this article helpful in mastering Form 5498 in Lacerte. Do you have any questions or comments about preparing Form 5498 in Lacerte? Share them with us in the comments section below. If you found this article helpful, please share it with your colleagues and friends.

What is Form 5498 used for?

+Form 5498 is used to report individual retirement account (IRA) contributions, distributions, and fair market values.

What are the common mistakes to avoid when preparing Form 5498 in Lacerte?

+Common mistakes to avoid when preparing Form 5498 in Lacerte include errors in reporting contributions or distributions, incorrect fair market values, and missing or incomplete information.

How can I troubleshoot common issues with Form 5498 in Lacerte?

+To troubleshoot common issues with Form 5498 in Lacerte, review the form for errors or inconsistencies, verify that all required information is complete and accurate, and use Lacerte's built-in diagnostic tools to identify and resolve issues.