In the ever-changing landscape of tax laws and regulations, it's easy to get lost in the complexities of tax forms and instructions. One such form that has gained attention in recent years is Form 8915-F, used for Qualified Disaster Retirement Plan Distributions and Repayments. This form is crucial for individuals who have taken distributions from qualified retirement plans due to a qualified disaster. The goal is to report these distributions and repayments accurately to avoid any potential penalties or misunderstandings with the IRS. In this article, we'll delve into the details of how to complete Form 8915-F correctly, ensuring you navigate the process with confidence.

Understanding Form 8915-F

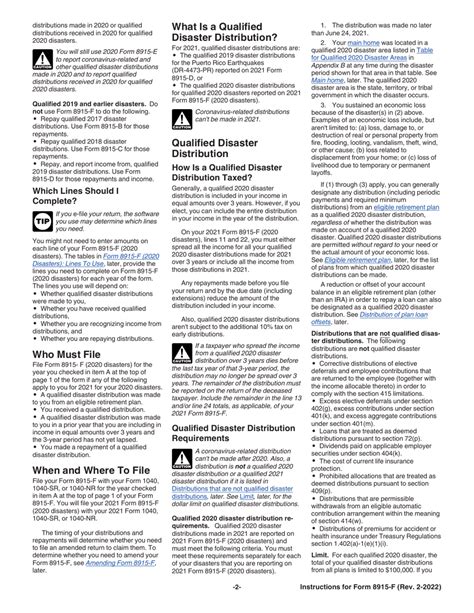

Before we dive into the steps to complete Form 8915-F, it's essential to understand its purpose and the qualifications for using it. Form 8915-F is designed for taxpayers who have received qualified disaster distributions from eligible retirement plans, such as 401(k), 403(b), or traditional IRA accounts, due to a qualified disaster declared by the President and determined by the Federal Emergency Management Agency (FEMA). This form allows you to report these distributions and any repayments you've made to the original plan.

Who Should Use Form 8915-F?

- Eligibility: You're eligible to use Form 8915-F if you're a victim of a qualified disaster and have received a qualified disaster distribution from an eligible retirement plan.

- Qualified Disaster: The disaster must be declared by the President and recognized by FEMA. A list of qualified disasters and their respective incident periods can be found on the FEMA website.

- Eligible Retirement Plans: These include qualified employer plans under Section 401(a), Section 403(a) annuity plans, Section 403(b) annuity contracts, and traditional IRAs.

Step 1: Gather Necessary Documents

Before starting the form, ensure you have the following documents ready:

- 1099-R Forms: For each qualified disaster distribution you received from an eligible retirement plan.

- Proof of Repayment: If you've repaid any part of the qualified disaster distribution, have documentation of these repayments.

- FEMA Documentation: Proof that you are a victim of a qualified disaster as declared by the President and recognized by FEMA.

Understanding the FEMA Documentation

FEMA documentation is crucial as it validates your eligibility for filing Form 8915-F. Ensure you have the correct FEMA documentation for the qualified disaster you're claiming.

Step 2: Fill Out the Form 8915-F

Form 8915-F consists of several parts that you'll need to fill out accurately. Here's a brief overview of each part:

- Part I: Qualified Disaster Distributions

- Report each qualified disaster distribution you received. You'll need the date, amount, and type of distribution.

- Part II: Repayments of Qualified Disaster Distributions

- If you've repaid any part of the distributions, report the repayment amounts and dates.

- Part III: Determining the Amount of the Qualified Disaster Distribution to be Included in Income

- Calculate the amount of the qualified disaster distribution that must be included in your income. This involves considering the three-year ratable inclusion unless you repay the distribution.

- Part IV: Summary

- A summary of your qualified disaster distributions and repayments.

Tips for Filling Out the Form

- Accuracy is Key: Ensure all information is accurate and matches your documentation.

- Keep a Copy: Keep a copy of the completed form and supporting documents for your records.

Step 3: Submit the Form

Once you've completed the form, review it carefully for accuracy. You'll need to submit Form 8915-F with your tax return (Form 1040). The form itself does not need to be submitted separately unless you're filing it after the original tax return has been submitted, in which case, you'll need to file an amended return (Form 1040-X).

Amended Returns

If you've already filed your tax return and realize you need to report qualified disaster distributions or repayments, you can file an amended return. Include Form 8915-F with the amended return.

Conclusion

Completing Form 8915-F requires attention to detail and an understanding of the qualified disaster distributions and repayments you're reporting. By following these steps and ensuring you have all necessary documentation, you can confidently navigate the process. Remember, accuracy is key, and keeping detailed records of your distributions and repayments will make the process smoother.

Stay Informed

Tax laws and regulations can change, so it's essential to stay informed about any updates or changes to Form 8915-F and the rules surrounding qualified disaster distributions.

What is Form 8915-F used for?

+Form 8915-F is used to report qualified disaster distributions from eligible retirement plans and any repayments made to the original plan.

How do I know if I'm eligible to use Form 8915-F?

+You're eligible if you're a victim of a qualified disaster declared by the President and recognized by FEMA, and you've received a qualified disaster distribution from an eligible retirement plan.

Do I need to file Form 8915-F separately or with my tax return?

+Generally, you submit Form 8915-F with your tax return (Form 1040). However, if you're filing an amended return to report qualified disaster distributions or repayments, you'll need to file Form 1040-X.