Filling out tax forms can be a daunting task, especially when it comes to complex forms like Form 40N. The Form 40N, also known as the Individual Income Tax Return, is a critical document for residents of Alabama to report their income and claim their tax refunds. In this article, we will guide you through the process of filling out Form 40N, highlighting five essential steps to ensure accuracy and efficiency.

Understanding Form 40N

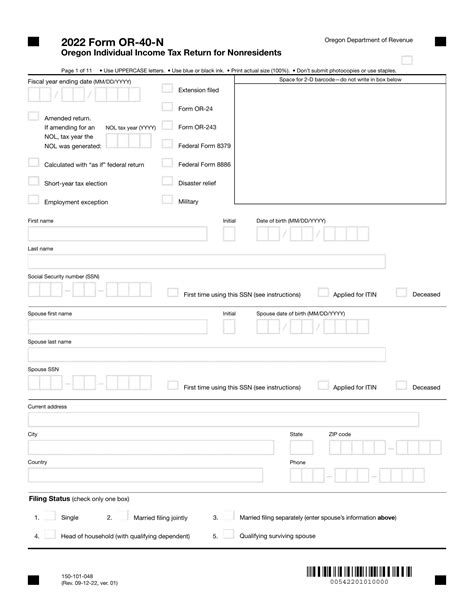

Before we dive into the steps, it's essential to understand the purpose of Form 40N. This form is used by individuals to report their income, deductions, and credits to the Alabama Department of Revenue. The form consists of multiple sections, including personal information, income, deductions, credits, and tax liability.

Step 1: Gather Required Documents

To fill out Form 40N accurately, you'll need to gather all required documents, including:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- W-2 forms from all employers

- 1099 forms for freelance work or self-employment

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

Step 2: Complete Personal Information

The first section of Form 40N requires your personal information, including:

- Name and address

- Social Security number or ITIN

- Spouse's name and Social Security number or ITIN (if filing jointly)

- Filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er))

Make sure to double-check your personal information to avoid errors.

Step 3: Report Income

The next section requires you to report all your income, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividend income

- Capital gains and losses

- Other income (such as alimony or prizes)

Use your W-2 and 1099 forms to accurately report your income.

Step 4: Claim Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Common deductions include:

- Standard deduction or itemized deductions

- Mortgage interest and property taxes

- Charitable donations

- Medical expenses

Common credits include:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

Make sure to review the instructions carefully to claim all eligible deductions and credits.

Step 5: Calculate Tax Liability

The final section requires you to calculate your tax liability. You'll need to:

- Calculate your total income

- Subtract deductions and exemptions

- Apply tax rates to your taxable income

- Calculate any credits or penalties

Use the tax tables or tax calculator to ensure accuracy.

By following these five steps, you'll be able to accurately fill out Form 40N and claim your tax refund. Remember to review the instructions carefully and seek professional help if needed.

Final Tips and Reminders

- File your tax return electronically to avoid errors and delays.

- Keep accurate records and supporting documents.

- Review your return carefully before submitting.

- Consider consulting a tax professional if you're unsure about any part of the process.

By following these tips and steps, you'll be able to fill out Form 40N with confidence and accuracy.

Wrapping Up

Filling out Form 40N may seem daunting, but by following these five essential steps, you'll be able to navigate the process with ease. Remember to gather all required documents, complete personal information, report income, claim deductions and credits, and calculate tax liability. By doing so, you'll ensure accuracy and efficiency in your tax filing process.

We hope this article has been informative and helpful. If you have any questions or need further guidance, please don't hesitate to comment below. Share this article with your friends and family to help them navigate the tax filing process.

What is Form 40N?

+Form 40N is the Individual Income Tax Return form used by residents of Alabama to report their income and claim their tax refunds.

What documents do I need to fill out Form 40N?

+You'll need to gather your Social Security number or ITIN, W-2 forms, 1099 forms, interest statements, dividend statements, charitable donation receipts, and medical expense receipts.

How do I calculate my tax liability?

+You'll need to calculate your total income, subtract deductions and exemptions, apply tax rates to your taxable income, and calculate any credits or penalties. Use the tax tables or tax calculator to ensure accuracy.