As a nonresident of California, understanding the tax implications of your income earned within the state is crucial. The California Franchise Tax Board (FTB) requires nonresidents to file a tax return if they have earned income from California sources. One of the key tax forms for nonresidents is the 540NR, which is used to report income earned from California sources. In this article, we will delve into the world of the 540NR tax form, exploring its purpose, eligibility, and the steps to complete it.

What is the 540NR Tax Form?

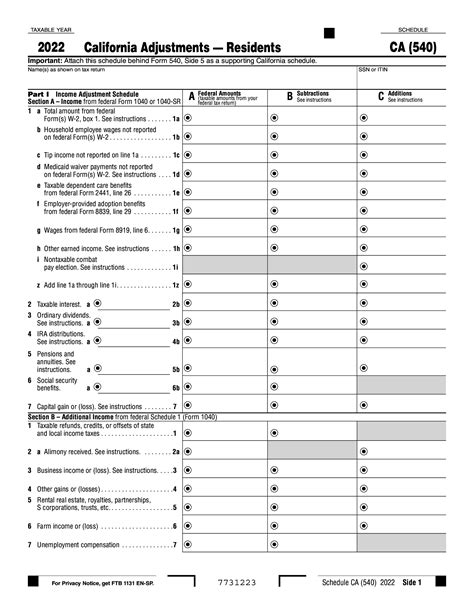

The 540NR tax form is a nonresident income tax return used by individuals who are not residents of California but have earned income from California sources. This form is used to report income earned from California sources, such as employment, self-employment, rental income, and capital gains. The 540NR tax form is similar to the 540 tax form, which is used by California residents, but it has some key differences.

Who Needs to File the 540NR Tax Form?

Nonresidents who have earned income from California sources are required to file the 540NR tax form. This includes:

- Individuals who are not residents of California but have earned income from a California source, such as employment or self-employment.

- Individuals who have sold or exchanged real estate or other property located in California.

- Individuals who have received rental income from a California property.

- Individuals who have received income from a California business or investment.

What Income is Subject to California Taxation?

As a nonresident, you are only required to pay California taxes on income earned from California sources. This includes:

- Employment income earned while working in California.

- Self-employment income earned from a business or profession conducted in California.

- Rental income earned from a California property.

- Capital gains from the sale or exchange of California real estate or other property.

- Income from a California business or investment.

How to Complete the 540NR Tax Form

Completing the 540NR tax form requires attention to detail and an understanding of California tax laws. Here are the steps to follow:

- Gather Required Documents: Before starting the tax form, gather all required documents, including:

- W-2 forms from California employers.

- 1099 forms for self-employment income or rental income.

- Schedule K-1 forms for income from partnerships or S corporations.

- Capital gains statements for the sale or exchange of California property.

- Determine Your Filing Status: Determine your filing status, which will affect the tax rates and deductions you are eligible for.

- Complete the Tax Form: Complete the 540NR tax form, reporting all income earned from California sources.

- Claim Deductions and Credits: Claim any deductions and credits you are eligible for, such as the California Earned Income Tax Credit (CalEITC).

- Calculate Your Tax Liability: Calculate your tax liability, including any penalties or interest due.

Tax Rates and Deductions

California tax rates range from 1% to 13.3%, depending on your income and filing status. As a nonresident, you are eligible for the same deductions and credits as California residents, including:

- Standard deduction: $4,852 (single) or $9,704 (joint).

- Itemized deductions: medical expenses, mortgage interest, charitable donations, and more.

- California Earned Income Tax Credit (CalEITC): a refundable credit for low-income individuals.

Penalties and Interest

Failure to file or pay California taxes can result in penalties and interest. The FTB may impose a penalty of up to 47.6% of the tax due, plus interest on the unpaid tax.

Conclusion

The 540NR tax form is a critical document for nonresidents who have earned income from California sources. By understanding the purpose, eligibility, and steps to complete the form, you can ensure compliance with California tax laws and avoid penalties and interest. If you are unsure about any aspect of the 540NR tax form, consider consulting a tax professional or seeking guidance from the California Franchise Tax Board.

Additional Resources

- California Franchise Tax Board (FTB):

- 540NR Tax Form:

- California Tax Rates:

FAQ Section:

Who is required to file the 540NR tax form?

+Nonresidents who have earned income from California sources are required to file the 540NR tax form.

What income is subject to California taxation?

+As a nonresident, you are only required to pay California taxes on income earned from California sources, including employment income, self-employment income, rental income, capital gains, and income from a California business or investment.

How do I complete the 540NR tax form?

+Complete the 540NR tax form by gathering required documents, determining your filing status, reporting income earned from California sources, claiming deductions and credits, and calculating your tax liability.