Filing with the Texas Secretary of State (SOS) is an essential step for businesses and organizations looking to establish or maintain their presence in the Lone Star State. Among the various forms required for different purposes, Form 205 is a critical document for many entities. In this article, we will delve into the world of Form 205, explaining what it is, who needs to file it, and providing a step-by-step guide on how to file it with the SOS Texas.

Understanding Form 205

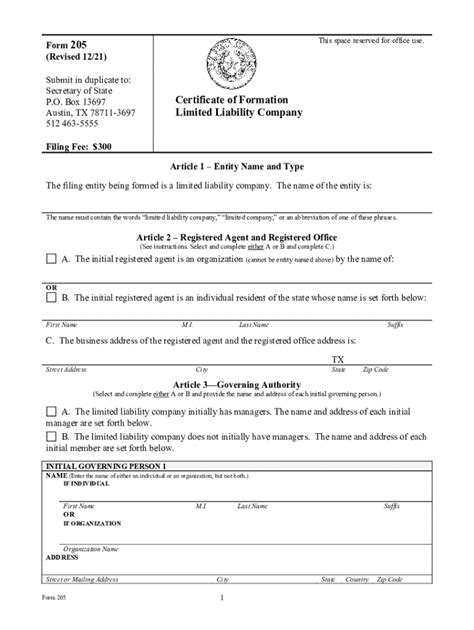

Form 205, also known as the "Certificate of Formation" or "Certificate of Registration," is a document filed with the Texas Secretary of State's office to establish or register a business entity, such as a corporation, limited liability company (LLC), limited partnership (LP), or limited liability partnership (LLP). This form serves as a declaration of the entity's existence, purpose, and structure, providing essential information about the business.

Who Needs to File Form 205?

Form 205 is required for various types of business entities, including:

- Corporations (for-profit and non-profit)

- Limited Liability Companies (LLCs)

- Limited Partnerships (LPs)

- Limited Liability Partnerships (LLPs)

If you are forming a new business entity or registering an existing one in Texas, you will likely need to file Form 205.

Step-by-Step Guide to Filing Form 205 with SOS Texas

Filing Form 205 with the Texas Secretary of State's office involves several steps, which we will outline below. Before you begin, make sure you have all the necessary information and documents ready.

Step 1: Gather Required Information and Documents

To file Form 205, you will need to provide the following information:

- Entity name and type

- Business purpose and description

- Registered agent information (name and address)

- Principal place of business (address)

- Management structure (e.g., board of directors, managers, or general partners)

- Authorized shares (for corporations)

- Organizer or incorporator information

You may also need to attach additional documents, such as:

- Articles of Incorporation (for corporations)

- Certificate of Name Reservation (if you reserved a business name)

- Consent to Use of Similar Name (if your business name is similar to an existing entity)

Step 2: Choose Your Filing Method

You can file Form 205 with the Texas Secretary of State's office online, by mail, or in person.

- Online filing: You can file electronically through the SOSDirect website.

- Mail filing: You can mail the completed form and supporting documents to the SOS office.

- In-person filing: You can deliver the documents in person to the SOS office in Austin.

Step 3: Complete Form 205

Fill out Form 205 carefully, making sure to provide all required information. You can download the form from the SOS website or use the online filing system to complete it electronically.

Step 4: Sign and Date the Form

The form must be signed and dated by the authorized individual, such as the organizer, incorporator, or registered agent.

Step 5: Submit the Form and Supporting Documents

Submit the completed Form 205 and supporting documents to the SOS office using your chosen filing method.

Step 6: Pay the Filing Fee

The filing fee for Form 205 varies depending on the type of entity and filing method. You can find the current filing fees on the SOS website.

Step 7: Receive Your Certificate of Filing

Once the SOS office processes your filing, you will receive a Certificate of Filing, which confirms the formation or registration of your business entity.

Tips and Reminders

- Make sure to file Form 205 within the required timeframe, usually within 30 days of forming your business entity.

- Use the correct form and filing method for your entity type.

- Ensure all information is accurate and complete to avoid delays or rejections.

- Keep a copy of your filed documents and Certificate of Filing for your records.

By following these steps and tips, you can successfully file Form 205 with the Texas Secretary of State's office and establish your business entity in the Lone Star State.

Encourage Engagement

We hope this step-by-step guide has been helpful in navigating the process of filing Form 205 with SOS Texas. If you have any questions or need further assistance, please don't hesitate to comment below or reach out to us. Share this article with others who may benefit from this information, and don't forget to subscribe to our blog for more helpful content on business and entrepreneurship.

FAQ Section

What is Form 205, and why do I need to file it?

+Form 205 is a document filed with the Texas Secretary of State's office to establish or register a business entity, such as a corporation, LLC, LP, or LLP. You need to file Form 205 to provide essential information about your business and obtain a Certificate of Filing, which confirms the formation or registration of your entity.

How much is the filing fee for Form 205?

+The filing fee for Form 205 varies depending on the type of entity and filing method. You can find the current filing fees on the SOS website.